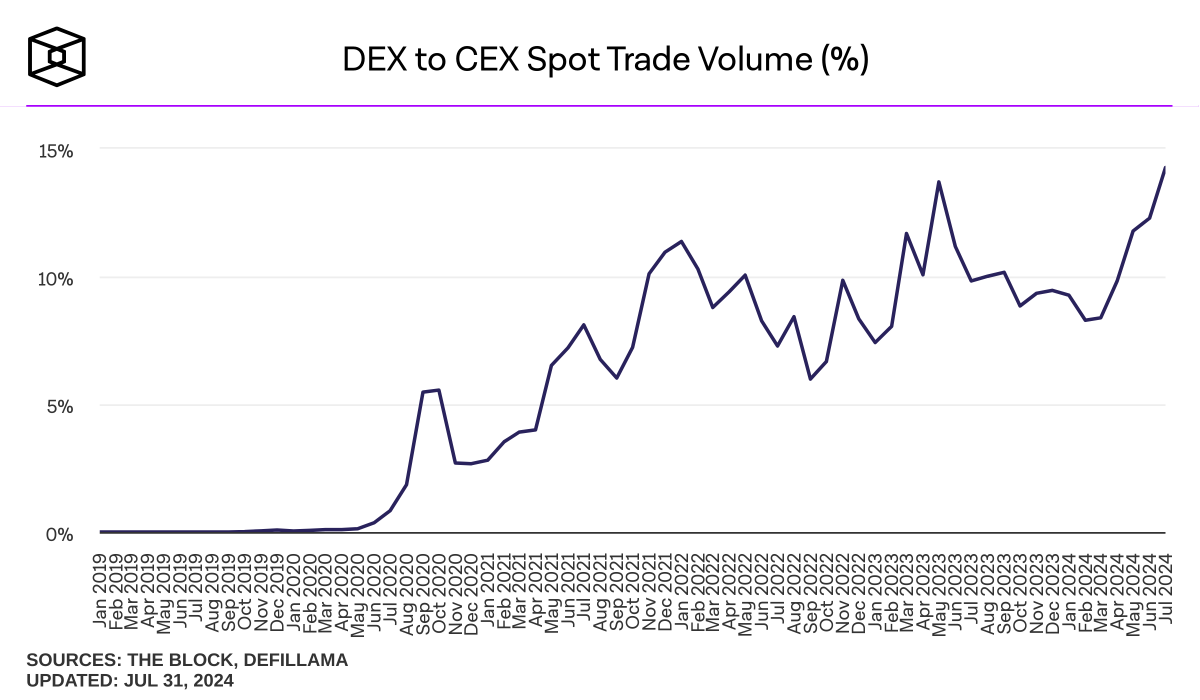

Regardless of the short-term uncertain market sentiment, one indicator that allows us to be optimistic about the long-term future of blockchain or on-chain ecosystems is the recent activity shown by DEXs. Currently, DEXs are processing more trades than ever before since the inception of blockchain. According to The Block, as of August 2024, DEX spot trading volume is about 14% compared to CEX, and based onDeFilama, approximately $7B in trades were executed through DEXs in the last 24 hours.

As seen in the past when the FTX incident increased the custodial risk among market participants, leading to increased DEX usage, it's common to find cases where short-term events temporarily increase DEX usage. However, unlike temporary increases, the current increase in DEX usage we're witnessing shows a consistent trend. This steady upward trend in DEX usage compared to CEX can be interpreted as a result of DEXs continuously improving various issues in terms of usability and making significant progress.

Source: DEX to CEX Spot Trade Volume (%)

Among these developments, the component of DEX that I want to highlight today is the liquidity provision (LPing) mechanism of AMM, especially the CPMM (Constant Product Market Maker) where trades are executed through xy=k, which most DEXs have adopted. Abundant liquidity helps provide a smooth trading environment by minimizing slippage, so aligning incentives between the protocol and Liquidity Providers (LPs) to maintain a continuous state of increased LPing is considered the core of DEX. In other words, DEXs must ensure sufficient profitability for LPs.

However, a recent problem emerging in AMM DEXs is that "LPs are losing more money than expected." And the entity causing losses to LPs is none other than external parties such as arbitrageurs. As value generated in the protocol is continuously extracted by external entities, the value that goes to participants contributing to the protocol's operation decreases. Consequently, risks of liquidity provision such as LVR (Loss Versus Rebalancing) have emerged as important topics, and DEXs that eliminate such risks and quickly adopt newly developed technologies are being re-highlighted. From here on, we'll examine various attempts by these DEXs and illuminate their significance in recent DeFi protocol trends.

1.1 COW Protocol - MEV Capturing AMM

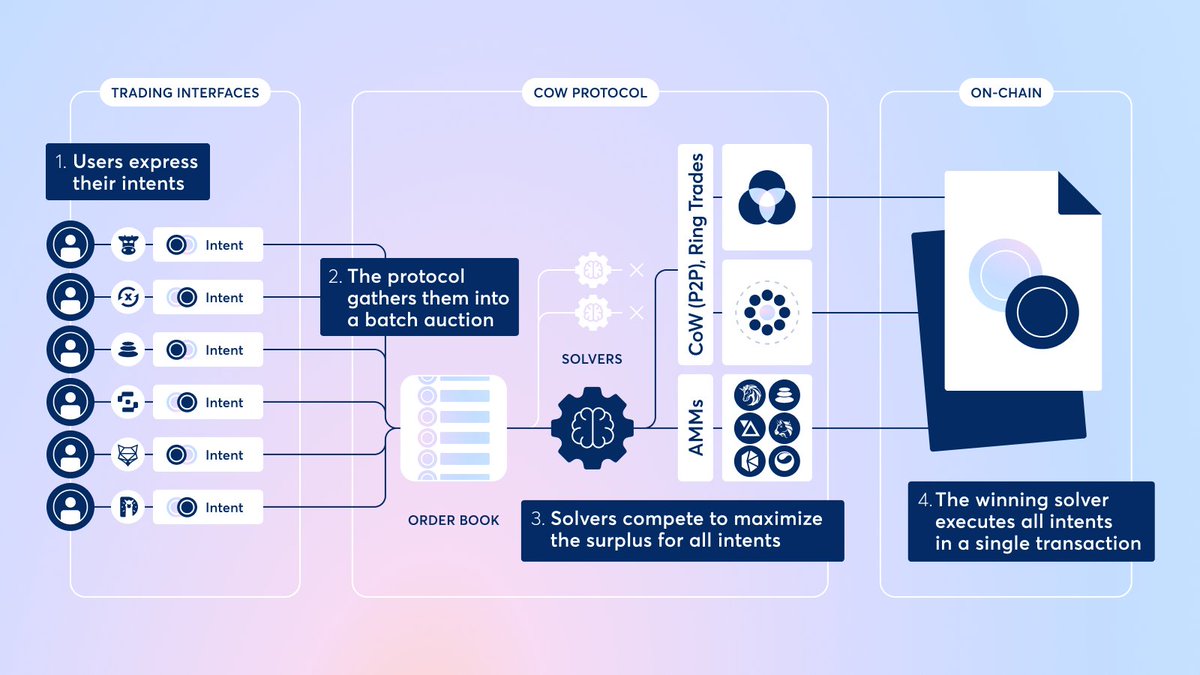

Source: CoW Protocol Docs

CoW Swap provides a swap service that protects traders from MEV attacks such as front-running, back-running, or sandwich attacks through an off-chain batch auction system. In CoW Swap, instead of traders directly settling trades on-chain, they submit transactions to trade tokens as intents to the protocol. When these traders' transactions are bundled into a single off-chain batch, a third-party entity called a Solver finds the optimal trading route from AMMs (e.g., Uniswap, Balancer), DEX aggregators (e.g., 1inch), and so on. This allows traders to be protected from MEV and trade at optimal prices.

Source: CoW Protocol Docs

This CoW Swap specializes in preventing value extraction from external traders through batch auction-based trading with Solver intervention. Based on this mechanism, CoW Swap has introduced CoW AMM as the next step to protect not only traders' transactions from MEV but also LPs. CoW AMM has been proposed as an MEV-Capturing AMM that eliminates LVR arising from arbitrageurs.

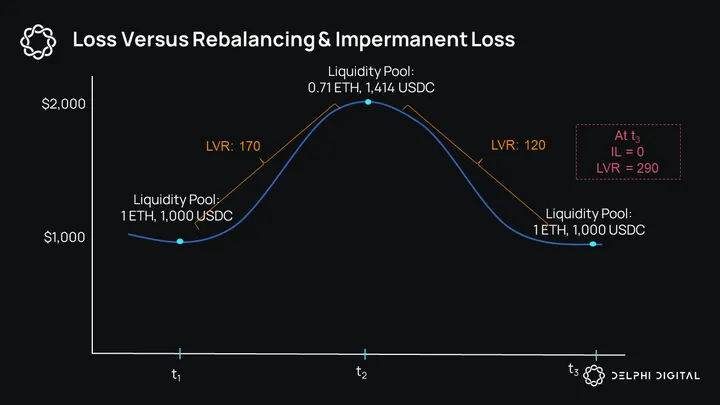

Source: Delphi Digital

Here,LVR (Loss Versus Rebalancing) is a risk management indicator that quantifies the loss incurred by LPs due to arbitrage opportunities arising from differences between asset prices within the AMM and external market prices caused by asset price volatility while in a LPing state. In other words, while Impermanent Loss, another risk of liquidity provision, only considers the opportunity cost that LPs may experience due to asset price volatility based on the start and end points of the LP position, LVR represents the ongoing cost of LPs bearing the role of counterparty to arbitrageurs throughout the entire period of LPing. A more detailed explanation is needed regarding this, but the essential problem to highlight here is that liquidity providers are exposed to unfavorable trading conditions by external arbitrageurs.

To address this issue, CoW AMM is designed to protect LPs from external arbitrageurs and capture MEV internally. In CoW AMM, Solvers competitively bid for the authority to rebalance the CoW AMM pool whenever there's an arbitrage opportunity. The process is as follows:

LPs deposit liquidity into the CoW AMM pool.

When there's an arbitrage opportunity, Solvers bid to rebalance the CoW AMM pool.

The Solver that leaves the most Surplus in the pool gains the authority to rebalance the pool. Here, Surplus refers to the quantified result of the extent to which the AMM curve is shifted upward, simply put, the excess funds left in the liquidity pool by providing the most favorable optimal trading conditions for LPs. Reference

fora detailed explanation of Surplus-capturing AMM.

Through this, CoW AMM internally captures the value of arbitrage that MEV bots extract in existing CPMMs, eliminating the LVR risk that LPs are exposed to, while LPs receive Surplus as an incentive for providing liquidity. In other words, unlike existing CPMMs, it can secure MEV as a revenue source instead of trading fees.

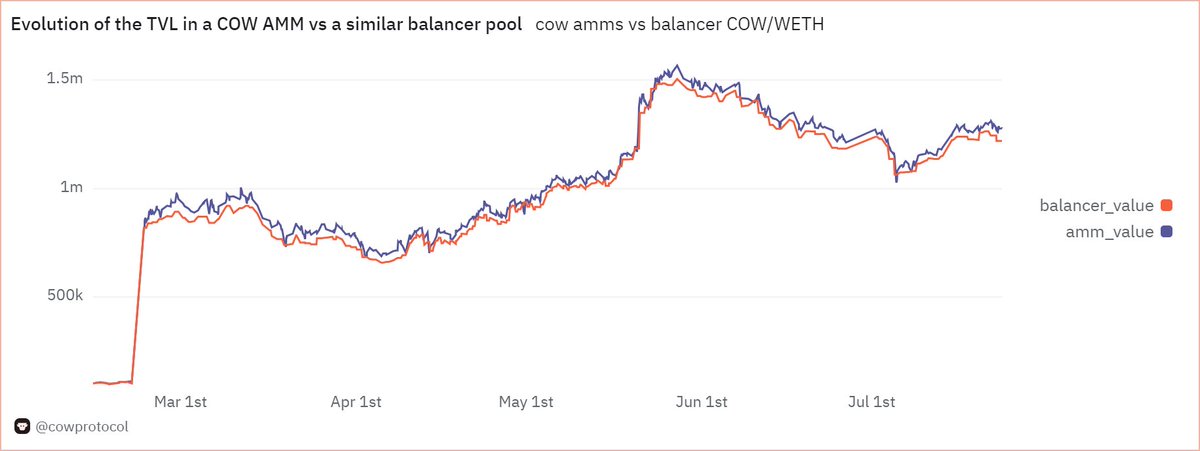

Source: Dune(@cowprotocol)

This CoW AMM, like CoW Swap, applies a single price to buy and sell transactions for tokens within a specific batch, and ultimately adopts a method where one batch forms a block. As a result, it can fundamentally block MEV based on price differences, such as arbitrage, and minimize LPs' LVR by not providing stale AMM prices that do not reflect price volatility to external arbitrageurs.

Bunni V2 utilizes Uniswap v4's Out-Of-Range Hooks as another method to improve LP profitability. Hooks here is one of the architecture upgrades of the upcoming Uniswap V4, allowing customization of Uniswap's liquidity pool contracts as modules according to various usage methods (Dynamic Fee, TWAMM, Out-of-Range, etc.).

Bunni V1 was originally an LPD (Liquidity Provider Derivatives) protocol that improved the limitations of concentrated liquidity proposed by Uniswap V3, along with Gamma and Arrakis Finance. However, with the launch of V2, it builds its own DEX by incorporating various Hook utilization functions, including Out-Of-Range Hooks. Here, concentrated liquidity refers to a liquidity provision method that allows LPs to directly determine an arbitrary price range for LPing to increase capital efficiency of liquidity provision positions. While this concentrated liquidity increased capital efficiency, it had the limitation that LPs had to continuously readjust the range of liquidity provision to match changing market prices, so Bunni has been providing a solution that automatically manages the range of liquidity provision when LPs entrust their funds.

Source: X(@bunni_xyz)

Out-Of-Range Hooks is a new attempt to increase capital efficiency by interoperating idle liquidity with external protocols, rather than readjusting the range of liquidity provision when idle liquidity occurs outside the current market price range. By depositing idle liquidity into lending protocols and vaults that can generate interest income, such as Aave, Yearn, Gearbox, Morpho, etc., it provides LPs with not only trading fees from LPing but also additional returns. Of course, as Bunni's attempt is in the testing phase, it will be necessary to closely observe the trade-offs that may occur in the future, such as increased contract risks due to liquidity interoperability or depletion of liquidity needed for AMM swaps, at the cost of capital efficiency.

As we conclude and return to the current status of DEX market share compared to CEX mentioned in the introduction, an important question arises. So why should we use DEX instead of CEX? From an objective perspective, considering only the convenience and abundant liquidity of CEX, it's not easy to find a compelling reason why DEX must be used. Even if DEX usage has maintained an upward trend, a 14% usage compared to CEX is, frankly speaking, not a very large scale.

The FTX bankruptcy reminded market participants of the risks of custodial exchanges, stimulating DEX usage in the short term, but this merely serves as a temporary substitute. Therefore, as one method to gradually expand DEX market share, attempts to create native value propositions unique to DEX, which cannot be experienced in CEX, should continue.

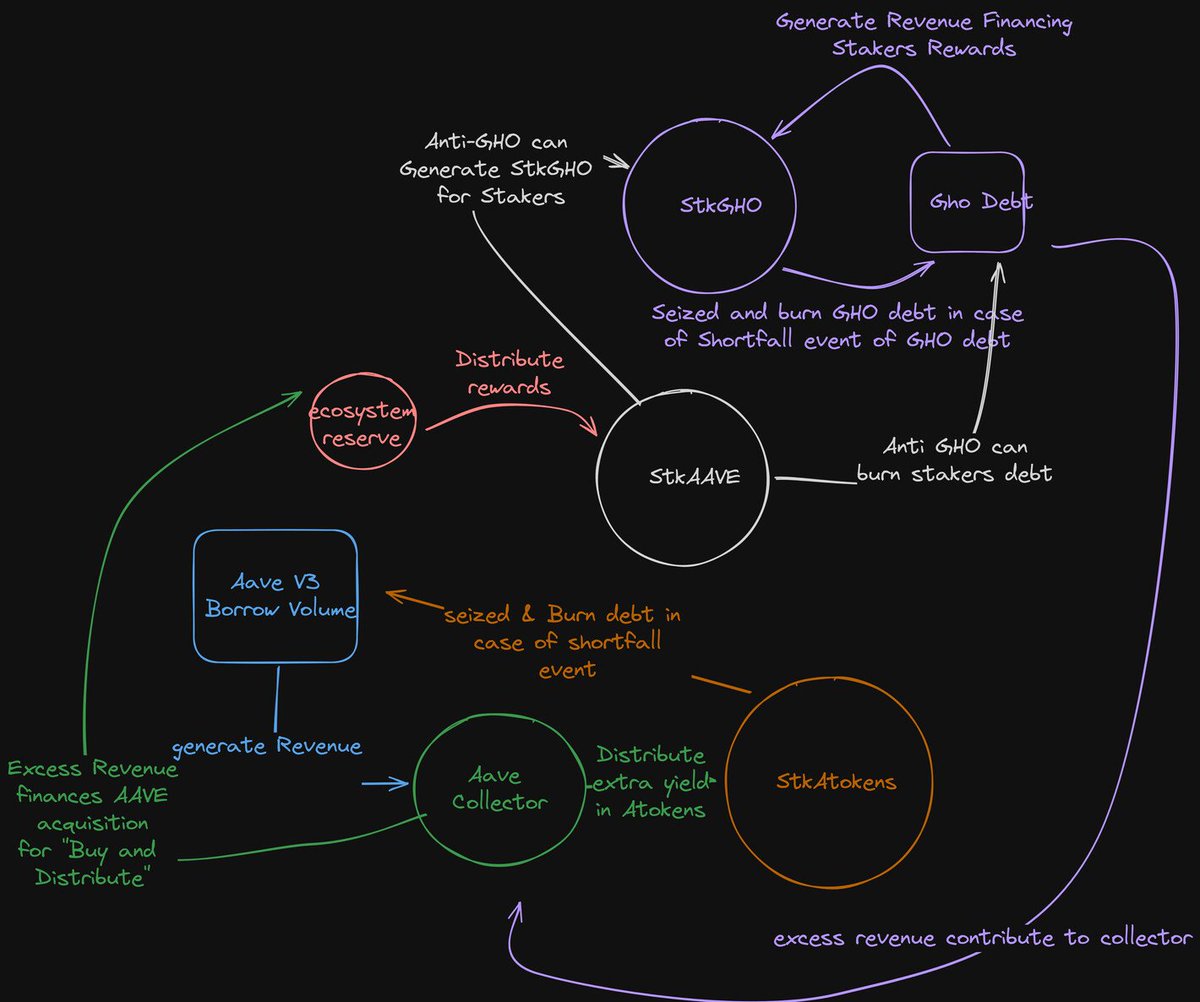

Source: AAVEnomics update

In this regard, liquidity provision (LPing) and profit redistribution mechanisms are very significant as values that only DEX can propose. LPing is not only an essential condition for providing a smooth trading environment, but the passive interest generation path provided by LPing can also serve as a funnel for CEX liquidity to flow on-chain by providing another motivation for market participants to approach DEX. Meanwhile, the profit redistribution mechanism could be the starting point for a self-sustaining economic system, or token economy, where participants contribute and receive rewards according to token incentives on a decentralized protocol, potentially the most ideal method to maximize the utility of blockchain and crypto.

When the unique value that DEX can propose lies in liquidity provision and profit redistribution mechanisms, internalizing value that was previously extracted from external entities (arbitrageurs or various types of MEV including them) becomes even more important. The functions of DEXs examined in the main text are also aimed at solving this. CoW AMM captures MEV internally to eliminate LP risk, while Bunni V2's Out-Of-Range interoperates liquidity within AMM pools to maximize LP profitability. And although not mentioned in the main text, recent DeFi protocols receiving price feeds based on oracles are exploring attempts to internalize OEV (Oracle Extractable Value) profits.

Moreover, the importance of this is further highlighted as mechanisms to redistribute the value gained by protocols to participants in the protocol are being re-emphasized recently. In fact, Aave Protocol has proposed new AAVEnomics that buys back $AAVE with protocol revenue and distributes it to $AAVE stakers. Also, Uniswap's Fee Switch has recently been reignited, and even Aevo has announced that it will buy back $AEVO.

As DeFi protocols try to introduce mechanisms to redistribute value, the protocol's sustainable revenue model and value accumulated internally within the protocol become even more important. For instance, if a proposal to distribute trading fees to $UNI token holders passes for Uniswap, it would have to share a portion of the trading fees that were previously entirely taken by LPs with $UNI token holders. In such a case, more value needs to be accumulated internally within the protocol to redistribute value to participants in the protocol than before, and along with this, the importance of internalizing value that was previously extracted from external entities is highlighted.

In this sense, protocols that propose differentiated methods of liquidity provision like CoW AMM and Bunni V2 that we examined today, or develop mechanisms to return the value gained by the protocol to ecosystem participants, are attempts that should be closely watched. Not only these, but various protocols are developing attempts to improve LPing, such as Osmosis's Protorev which prevents back-running, or Smilee Finance's 'Impermanent Gain' proposed as a method to hedge the risk of impermanent loss. The process of DeFi protocols creating their unique value through such attempts, which cannot be provided by CEX or CeFi, will continue to be an important point to watch in gradually increasing DEX activity in the future.

This analysis overlooks the incentives offered by DeFi protocols, which can boost the profitability of being a liquidity provider (LP). While impermanent loss may occur when the value of assets in a liquidity pool changes, leading to temporary losses compared to holding the assets independently, these losses can be offset by the fees and incentives earned through providing liquidity.

In the DeFi ecosystem, LPs supply liquidity to DEXs and earn incentives in return. These often include transaction fees and additional rewards like governance tokens. For example, platforms like Uniswap and SushiSwap issue LPs with LP tokens, representing their share in the liquidity pool. These tokens can be used for various purposes, such as staking in yield farming protocols to earn more rewards.

This mix of incentives and opportunities makes liquidity provision in DeFi potentially profitable, despite the risks.

Four Pillars -

a16z -

Ethereum Research -

CoW Swap -

CoW Protocol -

Bunni -

Uniswap -

Dive into 'Narratives' that will be important in the next year