*This is the third part of a four-part series that examines the current solutions that are expanding the Bitcoin ecosystem.

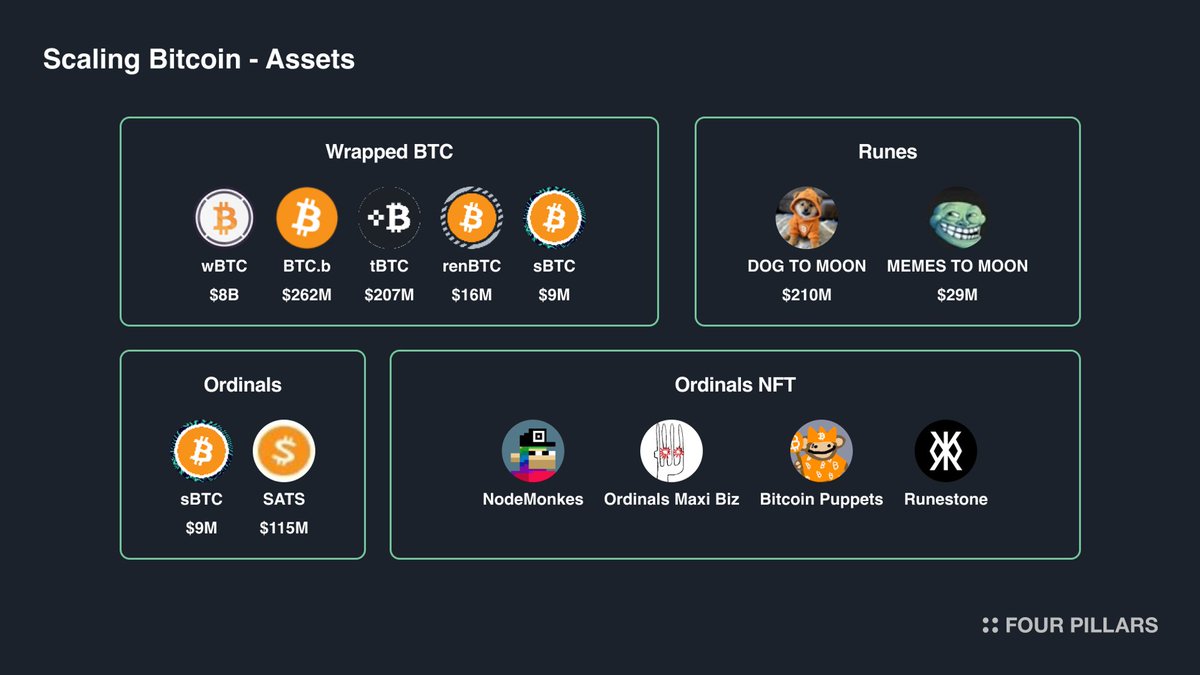

In terms of the overall cryptocurrency market, Bitcoin holds the most valuable brand and assets, and its asset class is not just limited to its native BTC. From having its BTC wrapped and sent to other blockchains to be utilized, it also has bitcoin-inscribed assets, which include Ordinals and and Rune protocol. Additionally, it has an expanding NFT marketplace with NFTs issued with Ordinals Protocol.

In this opinion article, let's look into what asset classes are in the Bitcoin ecosystem and how each asset class is performing.

As of 2024, Bitcoin remains the largest cryptocurrency by market capitalization, with a total value exceeding $1.3 trillion, which accounts for 53% of the total crypto market. However, since Bitcoin does not have many use cases in its native ecosystem, it has been bridged to other smart-contract based blockchains as Bridged BTC. Bridged BTC refers to Bitcoin that has been wrapped or tokenized in 1:1 ratio to be used in DeFi in other blockchain networks.

Examples of bridge BTC include wBTC, tBTC, and BTC.b.

Wrapped Bitcoin (wBTC): Wrapped Bitcoin is an ERC-20 token on the Ethereum blockchain that represents Bitcoin. Each wBTC is backed 1:1 by Bitcoin held in reserve, now operated by BitGlobal.

tBTC: It operates through a system of smart contracts and a network of decentralized signers who manage the minting and redemption processes. Users deposit Bitcoin into a multi-signature wallet, and in return, they receive an equivalent amount of tBTC on Ethereum.

BTC.b: This is another wrapped Bitcoin in avalanche as an omnichain token standard by LayerZero.

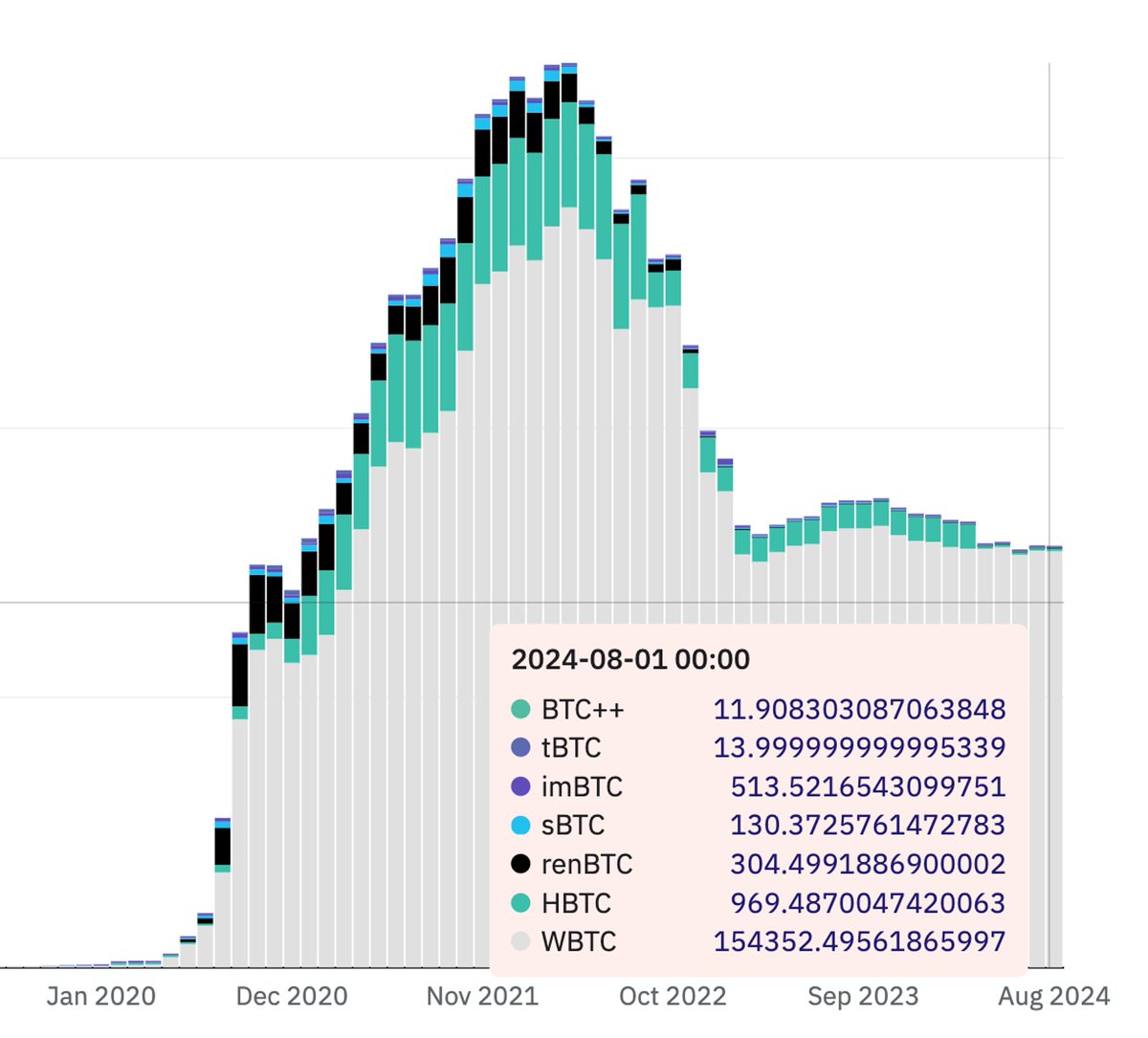

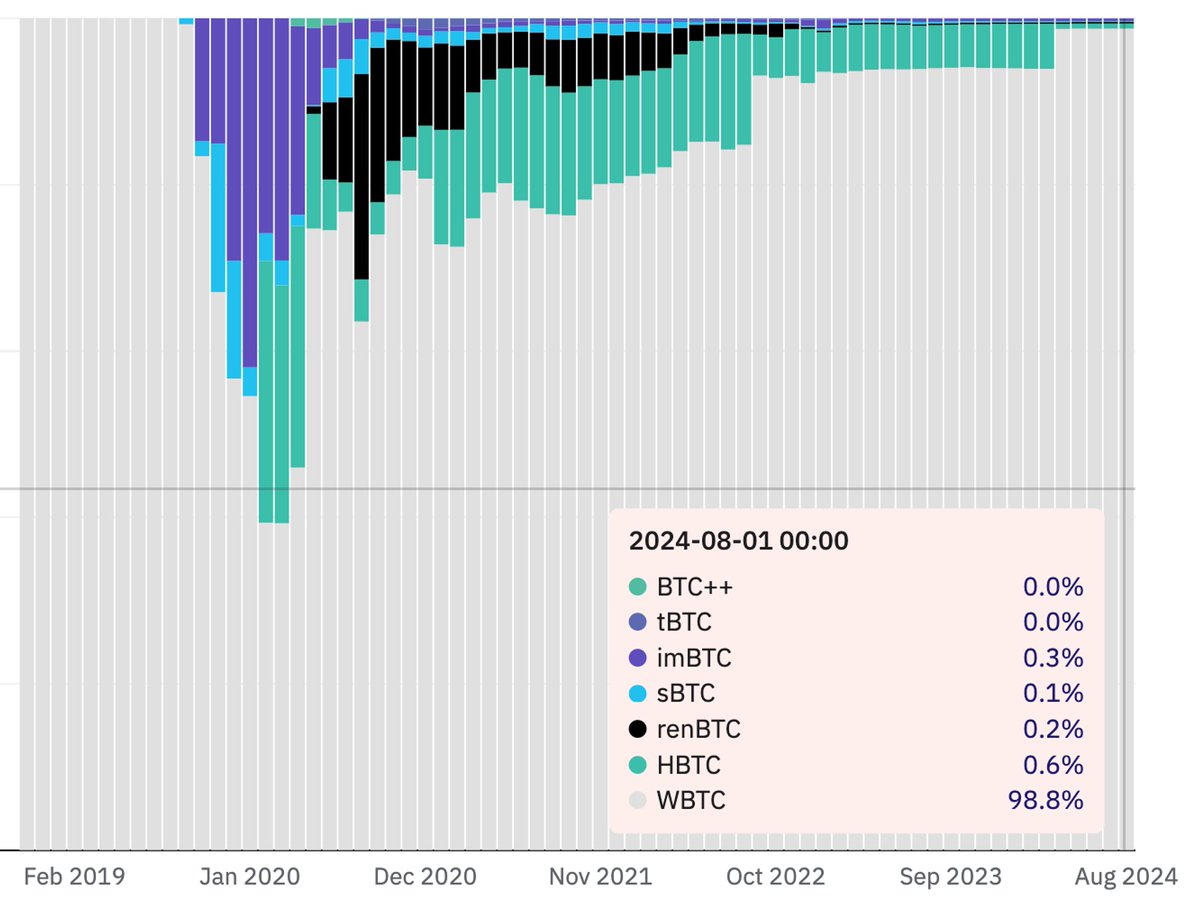

In these bridged BTC, wBTC accounts for the majority of the supply and has become the de facto BTC asset in the Ethereum DeFi ecosystem. Recently, BitGo announced a joint venture with Bit Global in HongKong, where it announced to distribute some of their three keys to the multi-signature wallet backing WBTC, to Bit Global in Hong Kong. This has sparked debate on whether wBTC would be safe, and other alternatives are being discussed and potentially being developed.

Source: btc on ethereum (WBTC, renBTC, more)

Bitcoin inscribed assets, such as Ordinals and Runes, are protocols insribed directly on the Bitcoin blockchain, leveraging its infrastructure for token creation and management. Both protocols, developed by Casey Rodarmor, highlight different use cases for Bitcoin's blockchain, with Ordinals focusing on NFTs and Runes enhancing the scalability of fungible tokens within the Bitcoin ecosystem.

Ordinals Protocol: The Ordinals protocol, introduced in January 2023, enables the creation of unique digital assets, or NFTs, or fungible tokens (BRC-20) on the Bitcoin blockchain. This protocol allows users to inscribe data onto individual satoshis (the smallest unit of Bitcoin), creating a new form of digital collectibles. BRC-20 tokens are a type of token standard similar to Ethereum's ERC-20 but built on the Bitcoin blockchain, and Bitcoin Ordinals, are usually considered a form of NFT.

Runes Protocol: It is a fungible token standard that utilizes Bitcoin's UTXO model. Unlike the BRC-20 standard, which led to network congestion due to the proliferation of "junk" UTXOs, Runes leverages Bitcoin's inherent UTXO model to create tokens with a minimal on-chain footprint. This protocol uses Bitcoin’s existing UTXO model along with a script that allows for the inclusion of small amounts of data on the blockchain without affecting transaction outputs. The embedded specialized structures called runestones in Bitcoin transaction outputs contain instructions for creating, minting, or transferring tokens. This method allows for more efficient data storage and reduces the potential for network bloat.

Source: Regular Txs vs BRC20 Txs vs other Inscription Txs vs Runes Txs

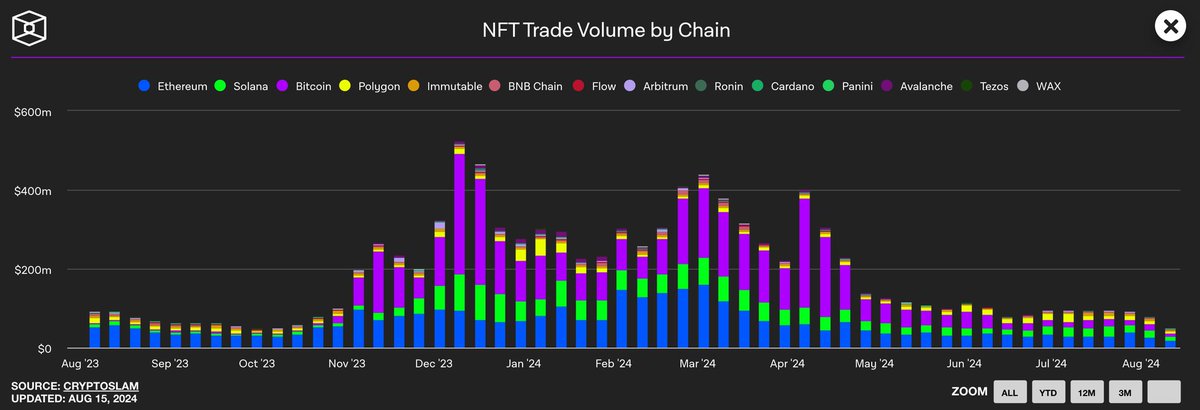

The Bitcoin NFT market has experienced significant growth over the past year, even as the broader NFT market has contracted. This sector is emerging as a notable asset class within the Bitcoin ecosystem, forming a cohesive community.

The expansion of the Bitcoin NFT marketplace has been fueled by increasing interest in Bitcoin-based NFTs. According to CryptoSlam data, in the all-time trading volume of NFTs by blockchain, Bitcoin sits in third place, right behind Ethereum and Solana.

Source: NFT Trade Volume by Chain

BTC, besides being held as digital gold for price appreciation, is often sent to other blockchains as Bridged BTC to be used as collateral or for yields in DeFi protocols, especially in Ethereum. This allows DeFi users to get exposed to BTC easily.

This week, the operator of wBTC announced plans to hand some control to Bit Global, a joint venture by Justin Sun. Out of three multi-sig keys, two will be handled by Bit Global, and one will be handled by BitGo.

Since Justin Sun has not been perfectly transparent about his projects in the past, such as TUSD and stUSDT, people are expressing concern about the "custody risk" due to the "reputation risk" of Justin Sun. Since wBTC accounts for over 95% of Bitcoin assets in Ethereum, this could negatively impact the ecosystem, potentially causing a discount compared to other bridged BTC if not handled properly.

Now that this problem is identified, more projects will likely try to market themselves (e.g., tBTC, BTC.b) and create new wrapped BTC (e.g., Coinbase cbBTC).

Source: btc on ethereum (WBTC, renBTC, more)

Most Bitcoin inscribed assets, like memecoins, don't have ways to generate revenue or increase in value, making them reliant on community interest. This means the market can crash if sentiment drops. For example, ORDI doesn't generate traditional revenue. Its value comes from market speculation and interest in the Ordinals protocol and BRC-20 tokens. While Ordinals usage increases transaction fees benefiting Bitcoin miners, this does not directly generate revenue for ORDI itself. This dependence on community enthusiasm makes these assets volatile, as their value could sharply decline if community interest wanes.

As Bitcoin L2s are developed, better user experiences in creating and trading Bitcoin tokens could attract more attention, similar to having a pump dot fun version on Bitcoin. For these Bitcoin token protocols to thrive, further developments are necessary.

Related Articles, News, Tweets etc. :

Dive into 'Narratives' that will be important in the next year