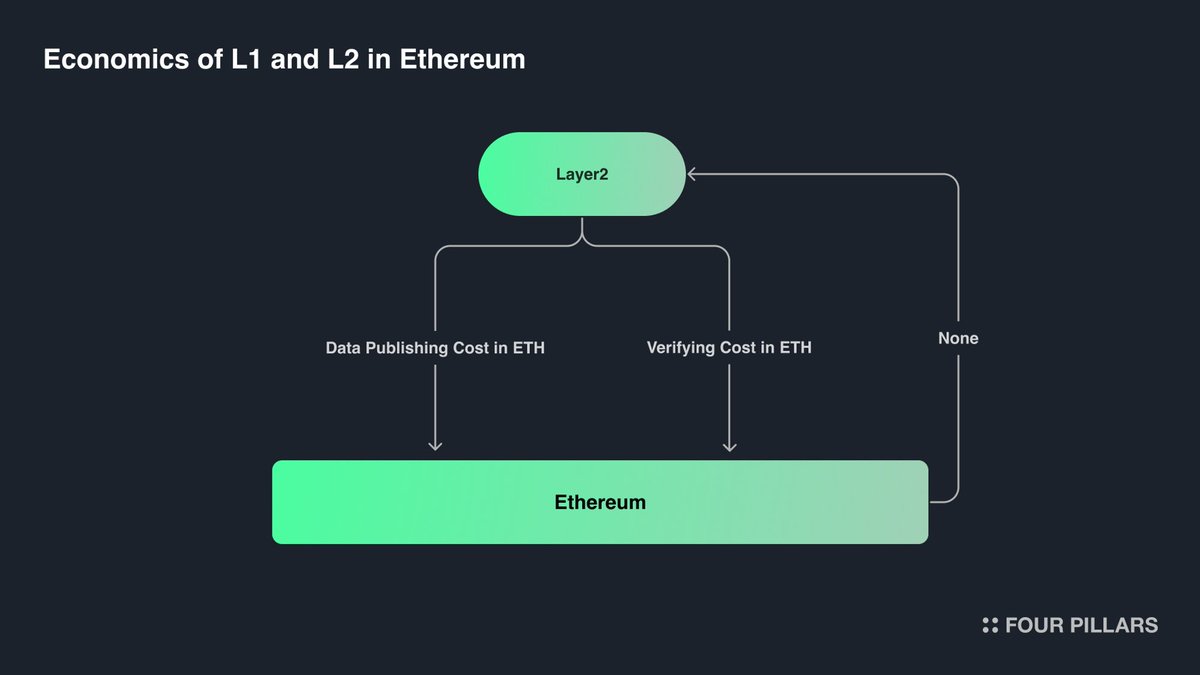

Layer2s pay rent to the settlement blockchain to leverage its security and liquidity. However, in the Ethereum ecosystem, the value only flows into Ethereum. Since Ethereum's priority is to build a neutral state machine for all related parties, it tries to have as few enshrined components as possible. This means there aren’t direct rewards when L2s flourish.

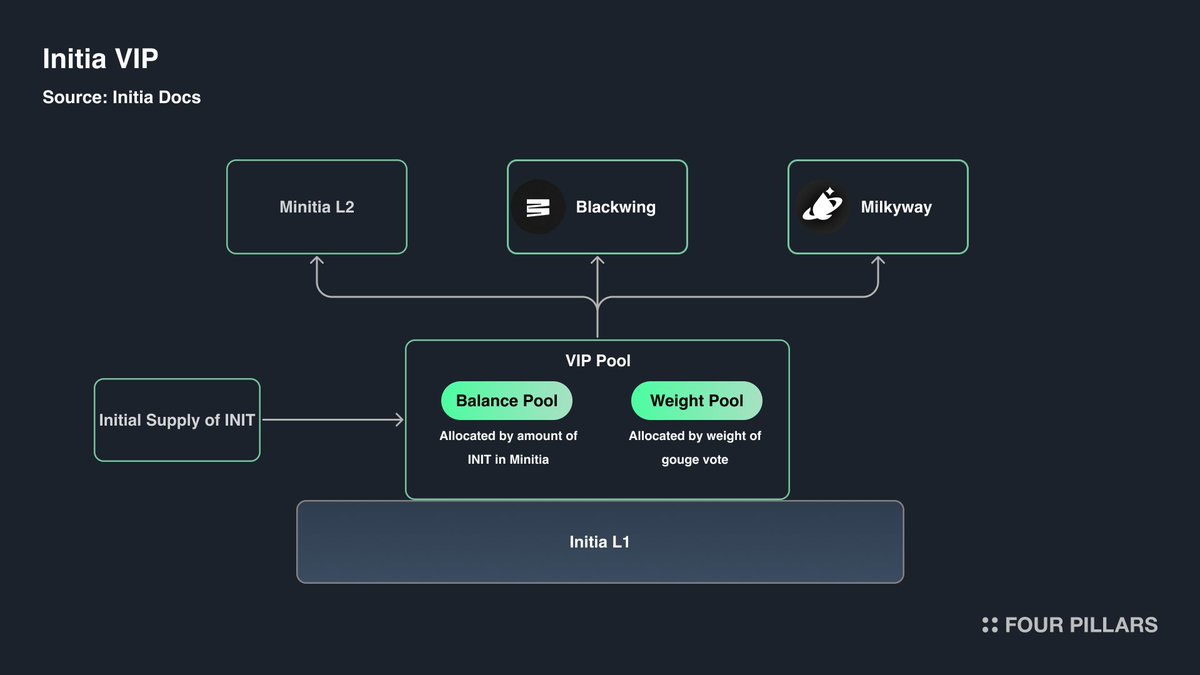

On the other hand, Initia has formed a cohesive ecosystem where economic incentives flow bidirectionally. Layer2s pay the INIT token to L1 for settlement, and a system called VIP (Vested Interest Program) pays out to L2s based on their involvement in the ecosystem. Examining this VIP system can offer valuable lessons to projects that are considering to build L2. Let’s explore this further.

The economic structure between L2s and Ethereum is primarily driven by gas fees paid in Ether (ETH) for data publishing cost in calldata or blob and smart contract executions for verification, by the L2 operators. Layer2s generally show profitability, with collecting fees for L2 transactions. Look into this article “Rollup Income Statement: OP-Mainnet, zkSync Era, and Polygon zkEVM,” to dive into the economics of L2s.

The Initia Vested Interest Program (VIP) is designed to economically align all participants within the Initia multi-chain ecosystem, having a distribution mechanism of native token, INIT. The program programmatically distributes INIT rewards to incentivize users, developers, and L2s to integrate and engage with the network. By setting aside 10% (Not Determined Yet) of the INIT supply at network genesis, these rewards are distributed to eligible participants bi-weekly through a Balance Pool, which allocates rewards based on the amount of INIT tokens held and a Weight Pool determined by gauge votes, which works similar to convex. This ensures that Minitias (L2s within Initia) actively and continuously create use cases for INIT, thus driving value across the ecosystem.

VIP rewards come in the form of escrowed INIT (esINIT), which is non-transferable and must be vested over subsequent epochs to become usable. This vesting process can be achieved either by maintaining consistent engagement and high VIP Scores within a Minitia or by converting esINIT into a locked, staked Enshrined Liquidity position. This dual approach not only motivates sustained interaction with Initia's applications but also creates a monetization model for L2 teams and promotes long-term alignment with the success of the INIT token.

The playbook for protocols to capture value is changing. As projects form their user base and the frameworks for building their own Layer2s become simpler, major protocols are taking steps to have its infrastructure to capture the most value. Dapps are considering to build their own Layer2s, and Layer2s are trying to create their own appchains. For instance, Frax Finance launched Fraxtal, Swell launched Swell L2, dYdX moved from Ethereum L2 to a Cosmos appchain, and Blast changed their handle from Blast_L2 to Blast.

This is not a bad signal for Ethereum. The value of Ethereum lies in its vast liquidity and dapps with the most neutral infrastructure, so protocols and Layer2s will choose their strategies based on their incentives. However, this is why Initia stands out among the Layer1s that are trying to form a Layer2 ecosystem, because it is building an ecosystem focused on interconnected Layer2s through bridging with IBC and LayerZero and liquidity sharing with Enshrined Liquidity, as well as a shared economic structures like VIP. Especially VIP allows Layer2s to capture more values for their activities in Initia ecosystem while being encouraged to utilize INIT token as much as possible in their Layer2s.

As Initia is soon to launch its mainnet, it would be notable to see how these alignment with Layer2s and Initia will unfold. However, there is an overall ecosystem risk when the value of INIT tokens declines, so it is important to pay attention to this, and since I will support staking not only INIT tokens but also USDC, it is important to see how much USDC is staked to stabilize the ecosystem.

“Initia VIP is the first on-chain economic framework that allows Initia to bind the system of interwoven rollups in a meaningful manner by giving builders, and most importantly, their end users a stake in the success of greater ecosystem.”

“Our goal is then to create a framework that incentivizes INIT to become the underlying asset that unites various domains and applications within Initia’s multi-chain world. Drive INIT into the hands of as many people in the ecosystem as possible, nudge it into becoming the denominating asset across all L2s, and use it in a +EV way that helps Minitias win. In this way, we can create use-cases for INIT across every L2 and create supply sinks for the token itself.”

Related Articles, News, Tweets etc. :

Four Pillars -

Four Pillars -

Rollup Income Statement: OP-Mainnet, zkSync Era, and Polygon zkEVM

Four Pillars -

Initia -

Initia -

Initia -

Initia -

Dive into 'Narratives' that will be important in the next year