The Stablecoin Wars - The Race to Dominate Stablecoins**,** USDC iPhone Tap to Pay, Tron USDT settles 1/3 of Visa’s Annual Settlement Volume

, The Fun-First Gaming Ecosystem Wants to Revive On-Chain Gaming

Meme Mania Continues -

and

Below, you can also find the Roundup, which summarizes the major market news, along with our Curated Insights, featuring a curated selection of materials that offer valuable trends and insights into consumer crypto.

Source: X(@aaronjmars)

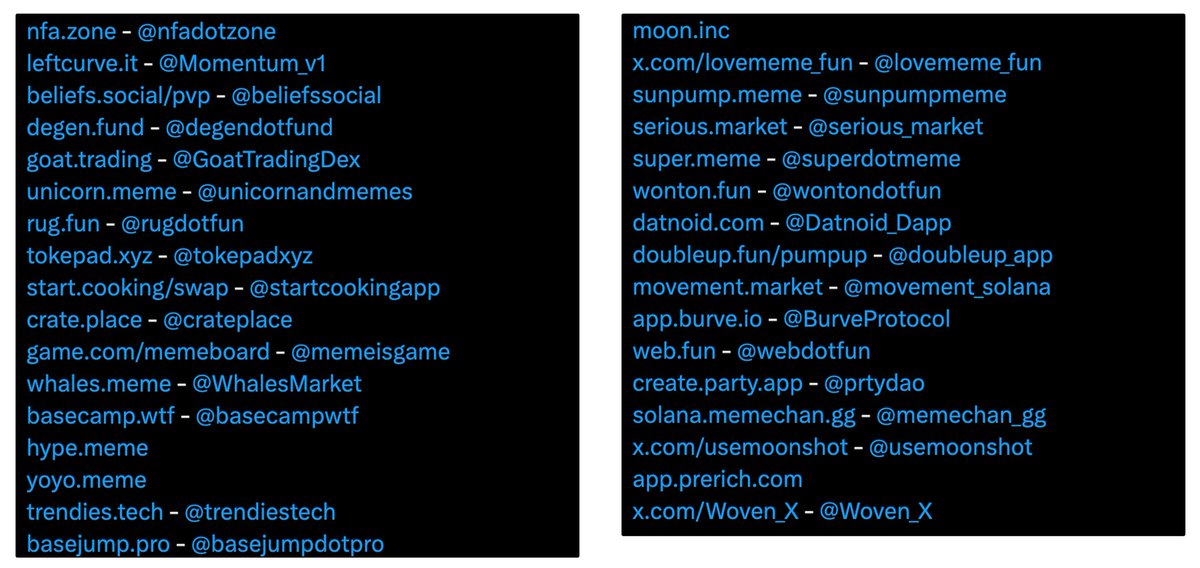

Pump.Fun is one of the most successful crypto applications, which once surpassed major L1/L2 networks in revenue. Since the rise of Pump.Fun there there has been a notable increase in debate and activity surrounding the consumer sector. However, like in most cases, the success of Pump.Fun has led to numerous spin-offs and copy-cats. The list above shows derivatives of Pump.Fun.

Most consumer apps launched recently seem to be either memecoin launchpads or prediction market derivatives. These categories now become the buzzwords in consumer crypto. I anticipate we can effortlessly line up a similarly extensive list of Polymarket forks.

I don't regard this as undesirable. Rather, there will likely be many other successful meme coin launchpads besides Pump.Fun in the foreseeable future. The market is too big to monopolize by a single app. However, I believe the ongoing dog-eat-dog world seems inefficient industry-wide, since there's still much unexplored space that can be extended from what pump or Polymarket has proven.

"Simplifying and democratizing creation was core to the defining social products of web2 (instagram, twitter), so it's not hard to imagine a powerful product being built around the idea of seamless memecoin creation. If the ease of creating a viral memecoin can approach the ease of creating a viral meme things are going to get weird" - Josh Cornelius

Naval Ravikant once described code and media as forms of "permissionless leverage," meaning that their open nature allowed for widespread experimentation and innovation. This permissionlessness fundamentally transformed the landscape of the internet and the tech industry. Many small apps from the early 2010s grew into today's major tech companies, and independent media outlets have risen to rival or even surpass traditional journals in popularity.

Memes represent the simplest form of social context. Considering the trends and history of the internet, there is vast potential in expanding the ability to assign economic value to any form of media and social interaction—whether it's photos, writings, or even commerce—without needing permission.

We have yet to see the full potential of this category.

1.1 The Race to Dominate Stablecoins

Stablecoins have the potential to revolutionize the financial system, threatening even sectors like banking and financial services, which have largely remained untouched by the internet's creative destruction.

Major players like PayPal's PYUSD are increasingly entering the stablecoin market. This competition will likely intensify, possibly leading to dirty tactics as firms vie for dominance. However, the playing field may be uneven. Regulators, aware of the threat stablecoins pose to traditional banks, might favor incumbents by imposing restrictive rules. If this happens, many stablecoins could face the same fate as Libra.

The critical question is whether one or two stablecoins will dominate the market or if multiple issuers will coexist. Currently, Tether (USDT) and Circle's USDC are leading contenders. However, both Tether and Circle face big regulatory challenges. Therefore, they must navigate stricter compliance and consumer protection requirements while maintaining profitability in the stablecoin ecosystem.

Alternatively, we could see a market with numerous stablecoins benefiting infrastructure providers like Paxos, which supports branded stablecoin issuance. Paxos helped PayPal to launch PYUSD, and if they can replicate this success with other companies, the market could see significant growth in the number of stablecoins available.

Leading crypto exchanges like Coinbase and Binance also have great potential to become major stablecoin issuers, leveraging their large user bases, technical expertise, and regulatory experience. Both have large networks (Base & BNB Chain) for payments and financial applications, which is important; as the stablecoin market matures, the competition will likely center on practical applications rather than technology and existing market positions.

Ultimately, the future likely holds a diverse range of stablecoins that facilitate lower-cost, faster payments, benefiting consumers and businesses, though possibly at the expense of current stablecoin leaders, who traditional banks could absorb. The competition will only get more fierce, making it necessary for crypto-native companies to continue innovating if they want to survive.

Source:X(@jerallaire)

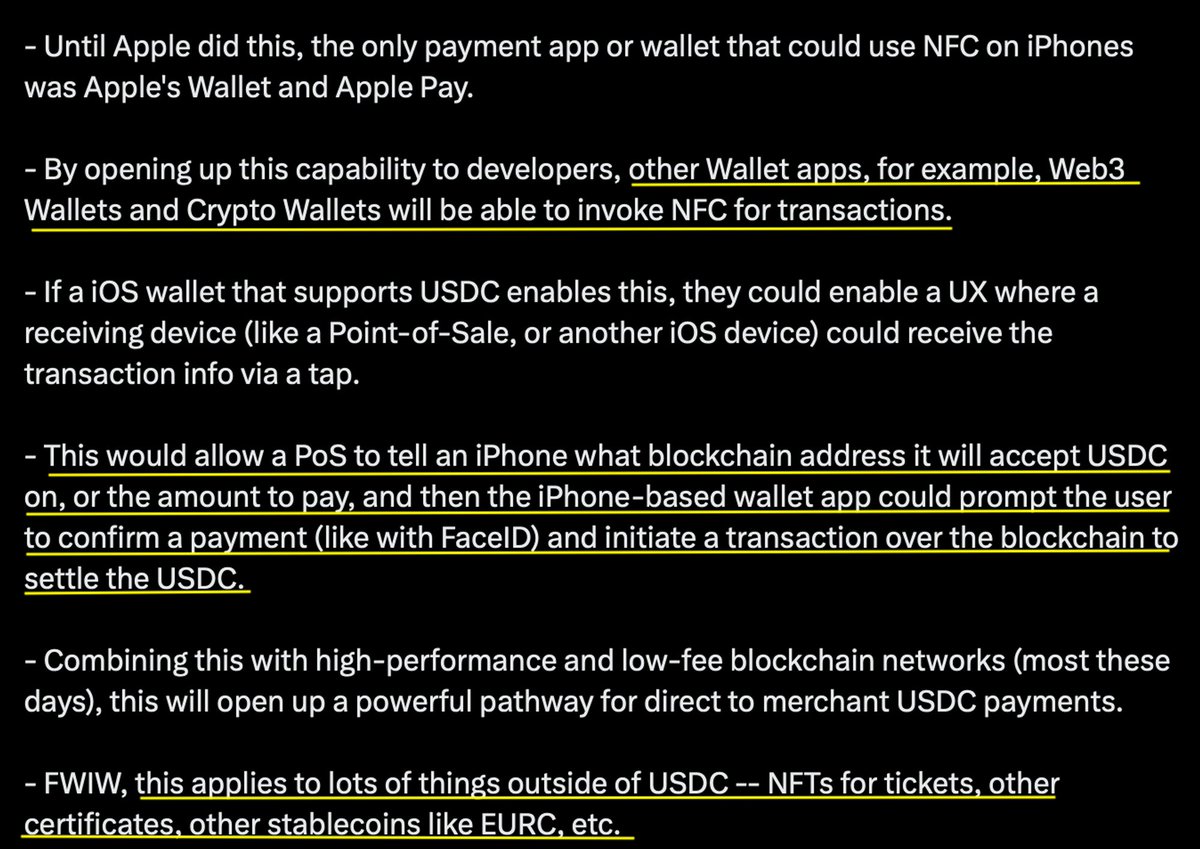

Jeremy Allaire, Co-founder & CEO of Circle, the company behind the second largest stablecoin USDC, announced that Tap to Pay using USDC could soon be possible on iPhone. This was posted after Apple revealed that it will now let third-parties use its NFC (Near Field Communication) technology for transactions and payments.

This means that starting from iOS 18.1, alternative payment systems such as Circle’s USDC can integrate and provide various services on iPhones. For instance, developers will be able to create apps that support a wide range of contactless transactions, including in-store payments, car keys, transit passes, corporate badges, student IDs, home and hotel keys, merchant loyalty and rewards cards, and event tickets shortly.

The update comes after extensive regulatory pressure from institutions like the European Union. However, ironically, the European Union is not included on the list, as it is only available to developers in Australia, Brazil, Canada, Japan, New Zealand, the U.K., and the U.S.

Source: X(@jerallaire)

Most notably, enabling Web3 wallets to use NFC for transactions could significantly enhance the user experience within Web3. This would allow users to make cryptocurrency payments directly at points of sale (PoS) or between iOS devices, much like Apple Pay, but using native wallets such as Phantom or MetaMask.

Additionally, stablecoin payments could be settled seamlessly using iPhone’s FaceID to initiate a blockchain transaction and complete the payment. Jeremy Allaire emphasized that this has great potential to pave the way for direct-to-merchant USDC payments and other use cases, such as NFTs for tickets and certificates.

Source: NFC Payments Market Research, 2032

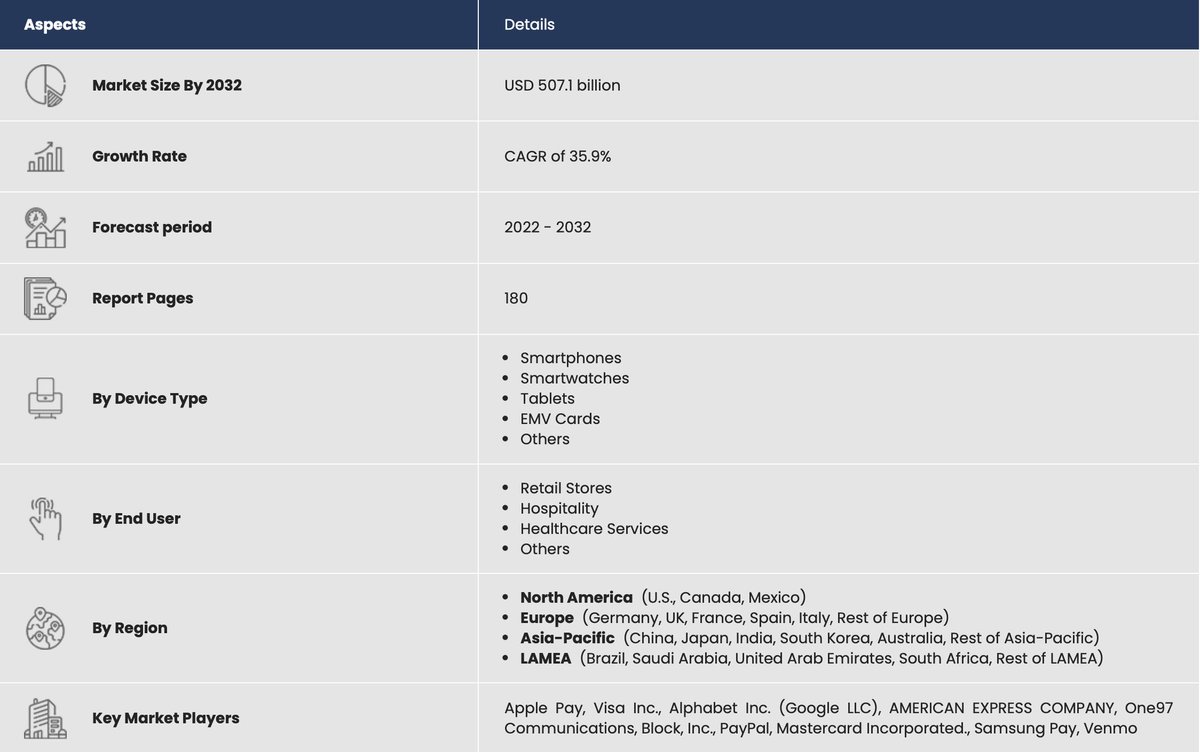

This news is particularly exciting since it can potentially address one of the major bottlenecks of crypto adoption — Onboarding users unfamiliar with wallets and blockchain technology.

Crypto-native NFC payments could significantly simplify this process for consumers by allowing them to make payments and send transactions just by simply waving or tapping their cards, phones, or wearable devices like the Apple Watch. This is very intuitive and user-friendly, similar to traditional payment methods.

While we don't want to get ahead of ourselves, the update could signal a larger market opportunity for stablecoins in the global NFC payments market, a rapidly growing market projected to reach $507.1 billion by 2032.

1.3 Tron USDT settles 1/3 of Visa’s Annual Settlement Volume

Source: X(@tokenterminal)

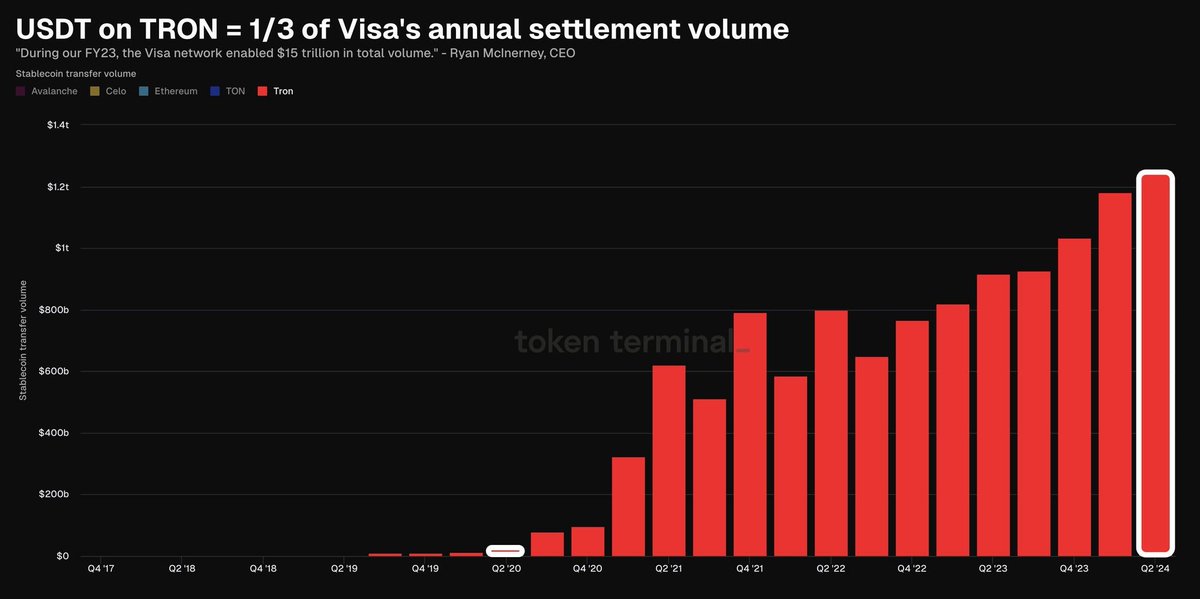

Most people who have been in the crypto industry for a while will probably associate TRON with Justin Sun or with an old ghost chain that nobody barely uses. However, in reality, TRON has had significant growth in terms of stablecoin settlements. In Q2 of 2020, USDT on TRON had a settlement volume of $25.2 billion; four years later, that number has grown to $1.25 trillion, which accounts for 1/3 of Visa’s annual settlement volume.

Source: Token Terminal

Additionally, TRON is one of the most profitable crypto chains. Next to Ethereum, TRON had the second-highest revenue Year to Date (YTD) at $1.033B. Although stablecoins are perhaps not the most exciting, they are one of the true use cases we have in crypto, and TRON has found significant adoption of them.

Source: X(@b3dotfun)

B3 is a new L3 gaming ecosystem built on Base L2 infrastructure, which aims to bring the next generation of gamers and game creators on-chain. B3 was built to solve fundamental flaws of on-chain gaming, such as fragmented user experience, fractionalized liquidity, and high operational costs that make maintenance burdensome and complex for developers. The gaming ecosystem recently raised $21M in a seed round led by Pantera Capital and other prominent VCs like Hashed.

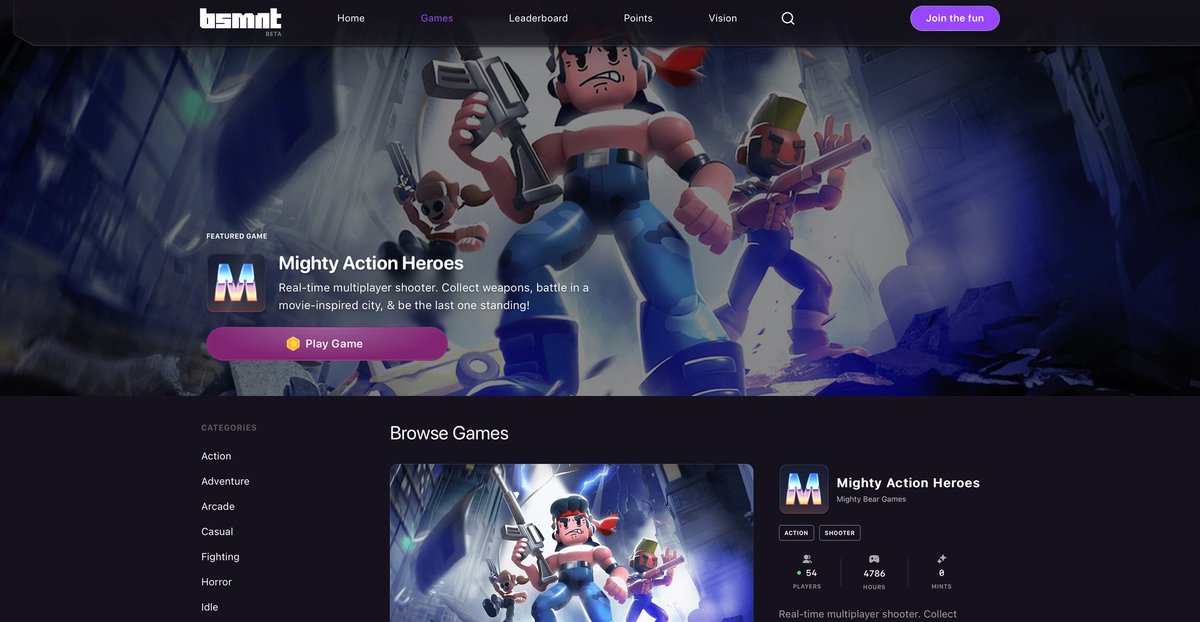

Source: Basement.fun

The B3 mainnet is live, and they have launched the beta version of Basement.fun, a discovery platform for on-chain games. The gaming platform launched with more than 20 gaming studios onboarded, such as top on-chain game developers Might Bear Games, Parallel and the Echelon Prime Ecosystem, Nifty Island, Infinigods, and more. Going forward, basement.fun will be releasing new games every week. Additionally, they've introduced the B3 point system, allowing both gamers and developers to earn rewards.

3.1 Dub Social - Make the Trenches Fun Again

Source: X(@j0hnwang)

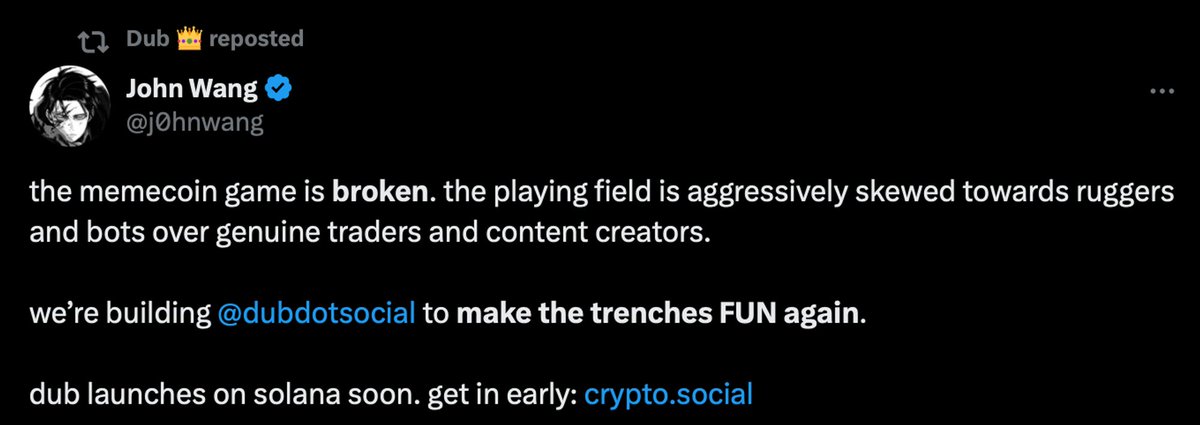

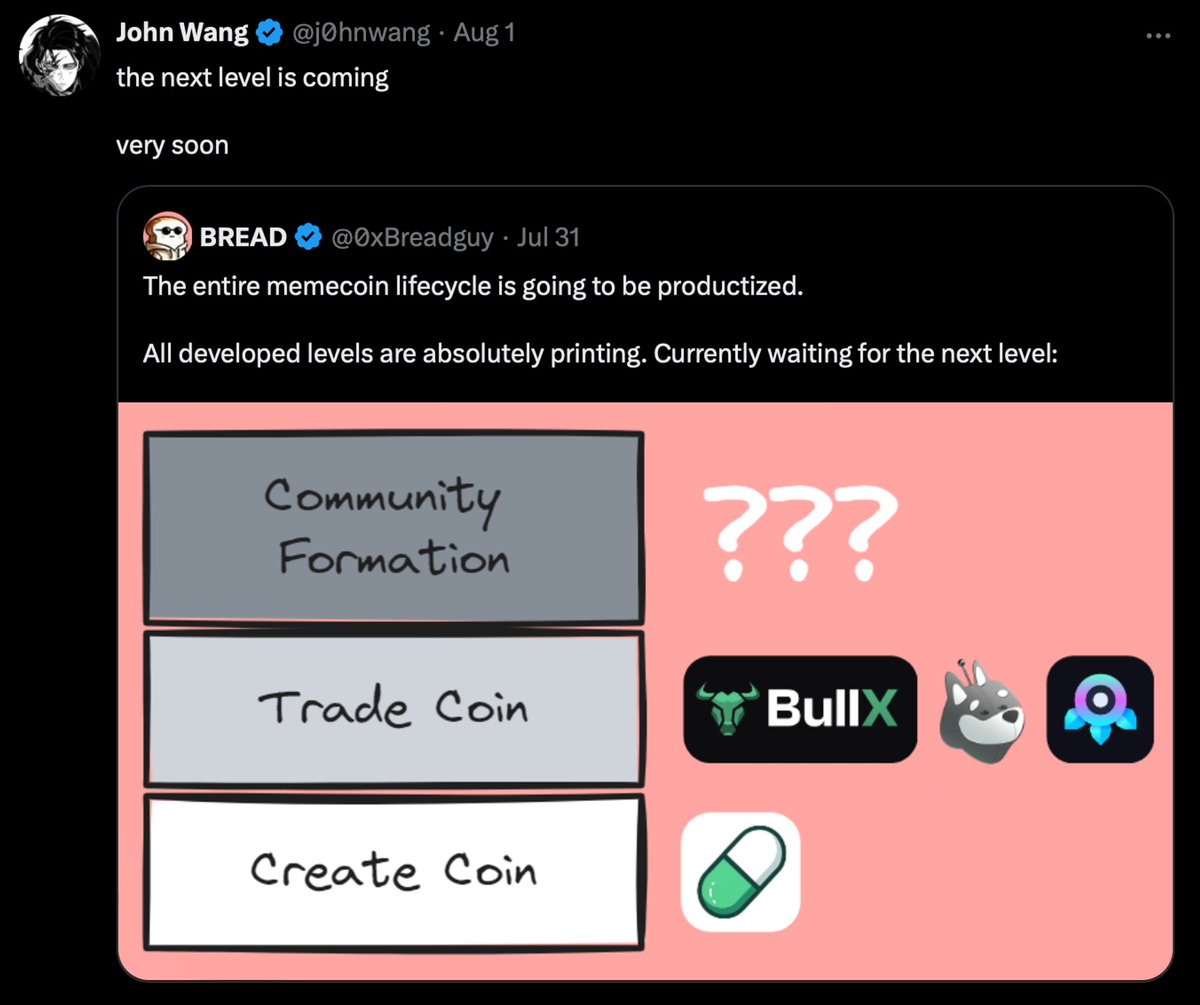

As touched upon in the introduction, the success of Pump.Fun and the large mindshare that meme coins currently occupy in the market is naturally giving way to new iterations of meme coin launchpads and social applications. One of which is dub.social, a new social platform spearheaded by John Wang, who decided to create it in response to the severe saturation and PVP on-chain condition created by Pump.fun. Thus far, the platform has seen great response, with 14,000 Twitter users signed up.

Source: X(@j0hnwang)

We don’t know exactly what the platform will offer as it is yet to be launched. However, judging from John Wang’s tweets, the platform may be more of a social app focused on community formation around meme coins.

3.2 jeetdotso - Keep Influencers Accountable

Source: X(@connorking_)

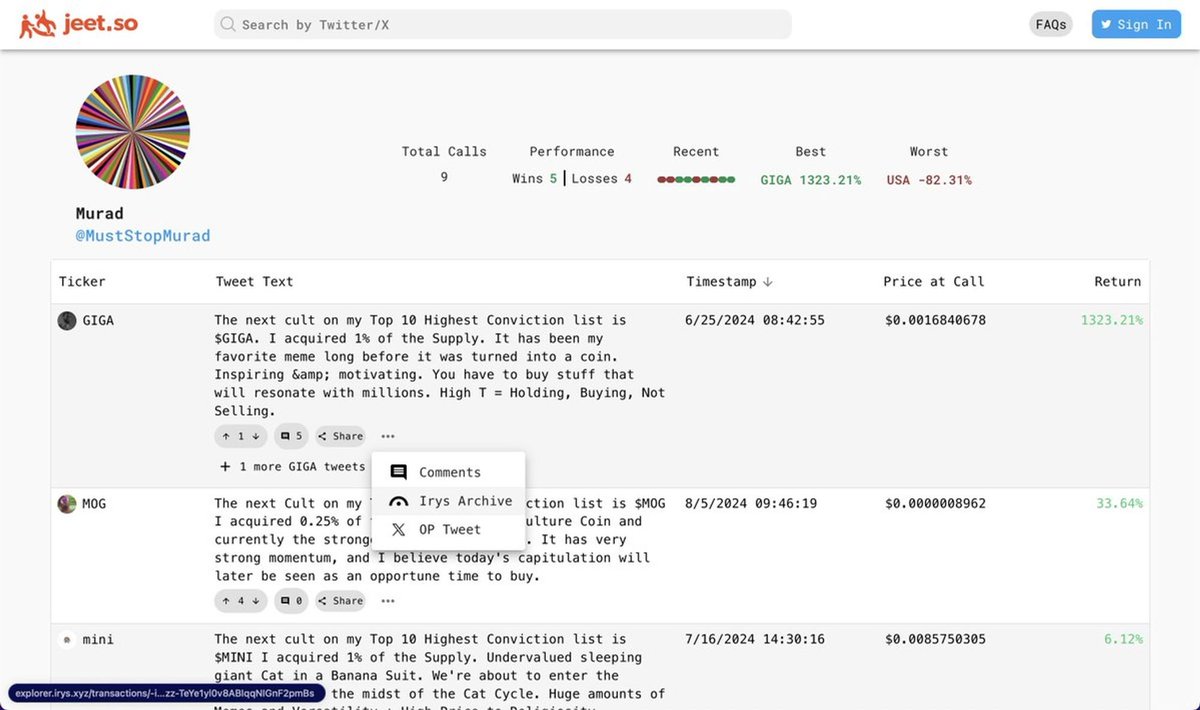

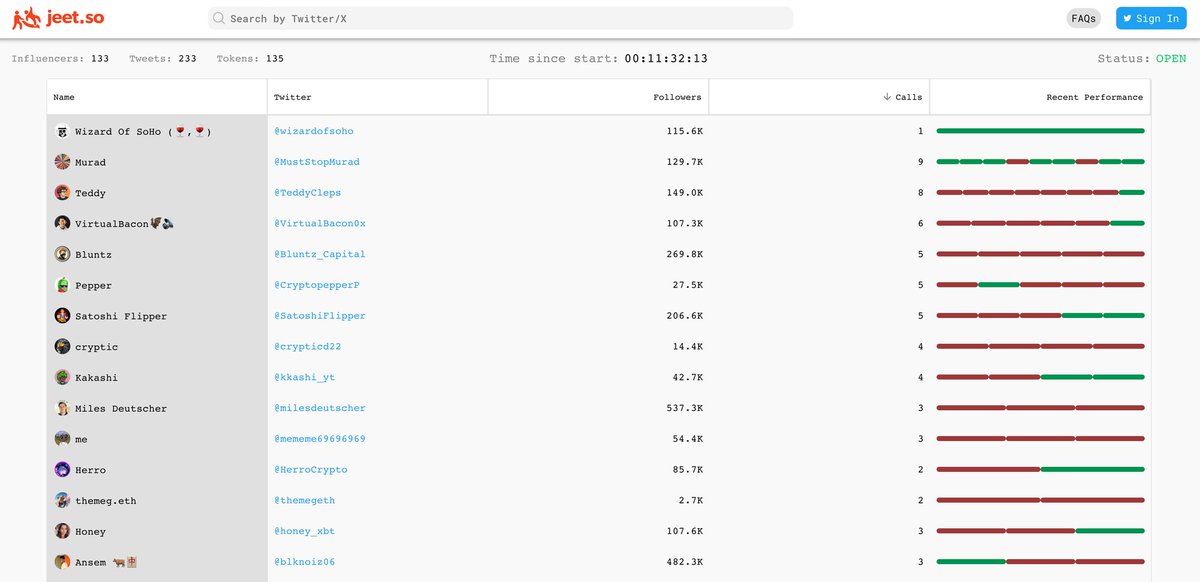

In a viral tweet from Connor King, we discovered a new interesting app called jeet.so, which was made to ensure that KOLs and CT traders are held accountable for the tokens they shill to their audiences online.

The app lets anyone tag the (@jeetbotapp) in the reply section of KOLs and CT traders, which automatically archive the “shill” tweet, and coin ticker with timestaps on Irys. Moreover, the app brilliantly calculates the percentage (%) return of each call, and tracks the historical performance for each influencer.

Influencer’s track record can easily be viewed on the website, which displays the performance of recent calls. Thiseffectively serves as a social reputation scoreboard that hopefully will hold KOLs and CT traders more accountable for the coins they shill to their followers. The app is live and is already tracking the calls of 133 influencers.

Although people should always DYOR before buying any coin, the fact is that many newcomers to crypto still blindly follow the calls of large influencers due to their lack of knowledge. While it is unlikely that scams and paid “shills” will disappear completely, the jeet.so app provides cool new features that can bring more transparency to crypto twitter.

Animoca Brands partners with Lamborghini to advance digital vehicle culture

Base has introduced the euro (EURC) on its platform, enabling zero-fee transfers

Polymarket On Track to Reach $475M in Volume and 75,000 New Accounts in August

Coinbase Teases Possible Wrapped Bitcoin Product, “cbBTC” Following wBTC Worries

Farcaster Introduce Explore, a new way to discover apps and frames

It's Time for a DePIN Update with Dylan Bane | Unqualified Opinions

Ordinals, & User Generated Assets, w/ Jesse Walden of Variant Fund & Hedrin of Ordinal Genesis Ep.41

Building the Perfect Crypto Ecosystem in 2024 | Keone & Smokeythebera

Dive into 'Narratives' that will be important in the next year