Sui is positioning itself as a holistic platform integrating execution, consensus, storage, networking, and more to coordinate digital assets at internet scale.

By adopting first-principles design and rebuilding every layer from scratch rather than patching legacy constraints, Sui avoids centralization trade-offs and legacy “design debt,” creating a truly scalable, fault-tolerant foundation.

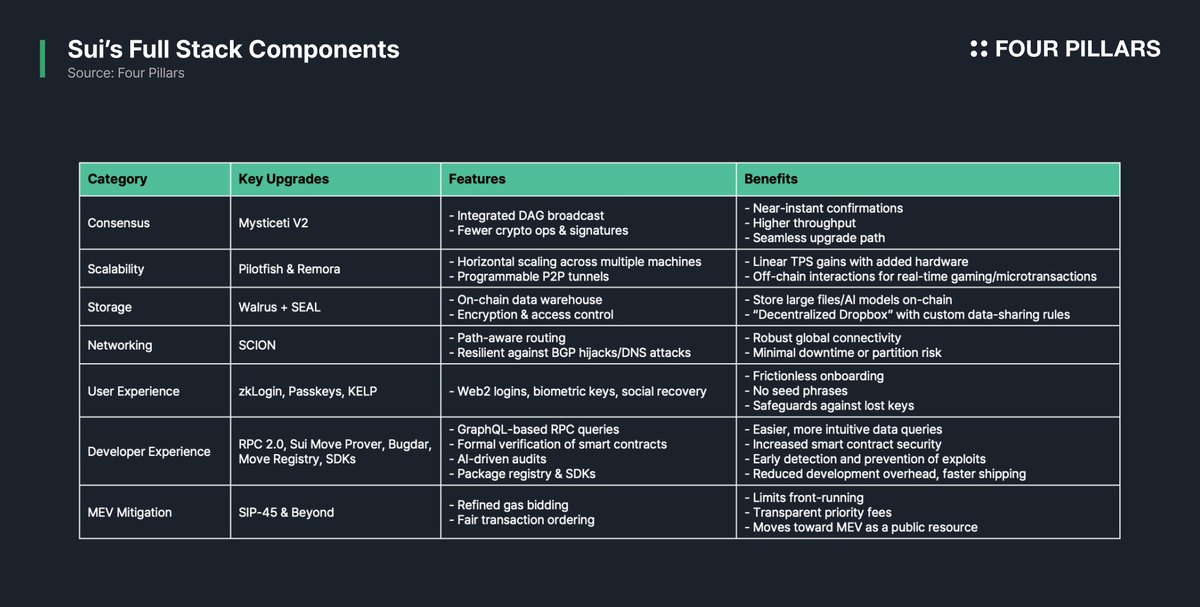

Sui weaves together solutions for sub-second finality (Mysticeti V2), limitless throughput (Remora), robust on-chain storage (Walrus & SEAL), network resilience (SCION), and frictionless user onboarding (zkLogin, Passkeys, KELP).

From a gaming console (SuiPlay0X1) to surging TVL in DeFi, Sui demonstrates real-world traction across consumer and institutional use cases, showing it can handle both high-volume finance and mainstream entertainment.

With major partnerships (Franklin Templeton, Grayscale) and a user-friendly stack, Sui is on track to become a next-generation “world computer,” bridging Web2 convenience with Web3 decentralization.

Sui is pulling a power move in 2025 with a full-stack blockchain strategy that breaks the usual crypto mold. Mysten Labs co-founder Adeniyi Abiodun said it best: “Sui isn’t just a blockchain, Sui is a global coordination layer for the internet.” That sentiment is rapidly becoming reality. Sui is becoming a unified platform where execution, consensus, storage, networking, frictionless UX, dev tooling, and fair MEV handling all work in concert.

Imagine a gamer in Seoul swapping a digital sword with an AI agent in LA, settled instantly on-chain. Or real-world assets flowing through a public ledger without congestion, enabling millions of people to onboard to Web3 as smoothly as logging into Gmail. This is the future Sui is building: a full-stack approach that’s equal parts visionary and practical, engineered from first principles to sidestep centralization traps and truly coordinate the world’s digital assets at scale.

The more I dig into Sui’s architecture, the more I’m convinced it might be the only chain, aside from Ethereum and Solana, that can truly compete at the highest level (or even surpass them), fulfilling the world computer dream every blockchain aspires to.

Sui’s architects started with a clean slate. Every layer of the stack, from how transactions are executed and confirmed, to how data is stored and delivered, has been designed from first principles. The goal: avoid the compromises and accrued design debt that plague legacy systems. Where former blockchains often bolted on fixes (l2s for scaling, off-chain storage for data, bandaids for MEV, etc.), Sui chose to integrate solutions natively. This holistic approach means Sui can scale without centralizing, innovate without breaking, and serve as a long-term foundation rather than a short-term patchwork.

Source: Medium (@Tayo Sadique)

Consider the internet itself, built on protocols like BGP (Border Gateway Protocol) and TCP/IP that have been patched over decades. We still suffer route hijacks and single points of failure because the foundations weren’t built with security or scale in mind. Blockchains are similar: many early chains carry the baggage of past decisions. Sui’s answer is radical simplicity: start fresh and get it right at every layer.

The result is a blockchain that feels less like a narrow ledger and more like a unified operating system for the next web.

So what does the full stack entail? In Sui’s case, it means tightly weaving together components that are usually siloed. Here’s a quick breakdown:

Consensus (Mysticeti V2): Mysticeti V2 focuses on speeding up shared-object transactions, which previously lagged due to higher consensus overhead. By streamlining cryptographic operations and validator communication through an optimized DAG-based, parallel-processing approach, Mysticeti V2 now delivers consistent, sub-second finality across all transaction types.

Scalability (Pilotfish & Remora): Pilotfish research led to Remora, which distributes validator workloads across multiple machines – so adding hardware equals linear TPS gains. Plus, “Programmable P2P Tunnels” allow off-chain interactions that settle on-chain, opening doors for real-time gaming and microtransactions.

Storage (Walrus & SEAL): Walrus acts as a decentralized storage sidechain accessible to Sui, efficiently handling data from gigabytes to exabytes without centralized solutions like AWS. Combined with Sui, Walrus-stored data gains advanced functionalities. SEAL enhances this with encryption and fine-grained access control, similar to a “decentralized Dropbox.”

Networking (SCION): Sui hardens its infrastructure by integrating SCION, providing path-aware routing that resists BGP hijacks, DDoS, or DNS hacks. Result: robust, fault-tolerant connectivity for global-scale activity.

User Experience (zkLogin, Passkeys, KELP): zkLogin drops seed phrases for simple Web2 logins (Google, Meta, etc.). Passkeys remove repetitive signing by linking biometrics to ephemeral sessions. KELP provides an embedded safety net (2FA, social recovery), ending the “lost key” nightmare. The upshot: Web2 convenience meets Web3 sovereignty.

Developer Experience (RPC 2.0, Sui Move Prover, Bugdar, Move Registry, SDKs): GraphQL-based RPC 2.0 for better queries. Sui Move Prover formal-verifies contract safety. Bugdar (AI auditing) catches sneaky exploits. Move Registry standardizes package management, and new SDKs reduce friction for devs. The net effect: shipping on Sui feels less like cryptography and more like modern app dev.

MEV Mitigation (SIP-45 & Beyond): SIP-45 refines gas-bidding logic, clarifying transaction ordering and capping predatory front-runs. Combined with future features (like DAG observability), Sui wants MEV to become a fair, transparent “public resource,” not just a zero-sum race.

Some of these features are already live; others are on the 2025 roadmap. Below are some big technical upgrades slated for this year:

Sui made waves with its original Mysticeti V1 consensus, which delivered sub-second finality (~390ms) in 2023. Mysticeti V2 expands this performance benefit, focusing specifically on accelerating shared-object transactions (transactions that previously faced higher latency due to consensus overhead). By reducing cryptographic overhead and streamlining communication between validators through an optimized DAG-based parallel processing approach, Mysticeti V2 ensures that all transaction types on Sui achieve consistent, lightning-fast finality. For users and developers, this uniform speed boost is critical, especially in scenarios demanding real-time responsiveness, such as gaming, high-frequency trading, and interactive applications.

In short, Mysticeti V2 ensures shared-object transactions reach the benchmark already established by owned-object transactions, aligning with Sui’s ethos of uncompromising performance at the foundational layer.

The next step is unlimited scale, which is where Remora comes in.

Raw speed per validator is only half the battle; you also want to scale out. Remora is Sui’s solution for horizontal scaling of the network’s throughput. Instead of each validator being a single machine processing one stream of transactions, Remora allows validator duties to be split across multiple machines working in parallel. In internal testing, this architecture has shown the potential for hundreds of thousands of transactions per second without hitting a performance ceiling. More importantly, Remora is designed to maintain Sui’s ultra-low transaction fees even as usage skyrockets; the network can grow capacity to meet demand, preventing the nasty congestion fee spikes we’ve seen on other chains during peak usage.

For builders, this means the dapp you launch today can still serve millions of users tomorrow, since the infrastructure can expand underneath it. Coupled with Mysticeti V2, Remora ensures Sui can scale both up and out – a one-two punch that aims to future-proof the chain against both everyday loads and sudden viral dapp moments. In short, no matter how popular Sui gets, it shouldn’t slow down or price out its users.

Another innovative component of Sui’s scaling toolkit is its Programmable P2P Tunnels – essentially an off-chain transaction system for near-instant, high-volume interactions. This feature lets two or more parties transact off-chain with zero latency, while still relying on the Sui network for security and eventual settlement. Think of it like a secure side-channel between players that reports back to the blockchain, kind of a built-in lightning network. For use cases such as payments, fast-paced multiplayer games, or any interactive application, P2P tunnels eliminate the slight delay of on-chain consensus by allowing limitless, real-time updates off-chain and then batching the results onto the ledger.

Sui’s P2P Tunnels are programmable, meaning developers can tailor the rules of these off-chain interactions to their app’s needs. Importantly, this is achieved without sacrificing trustlessness. Cryptographic guarantees ensure that even if parties drop offline or act maliciously, the funds and game state remain secure and can fall back to on-chain resolution. By integrating this capability at the protocol level, Sui provides a way to reach interactive Web2 speeds when needed, all while users remain under the umbrella of blockchain security. It’s a clever example of Sui’s full-stack philosophy: if a problem (like network latency) can’t be fully solved on-chain, build a complementary module into the stack so developers have an easy, safe workaround.

Walrus is Sui’s decentralized storage solution (launched May 27, 2025) that, together with SEAL, transforms Sui into a decentralized data warehouse with fine-grained access control. Think of Walrus as an expansive memory accessible to Sui: it stores large files (images, videos, game assets, AI models) across a distributed node network using erasure coding (nicknamed “Red Stuff”), which only needs part of the file to reconstruct the whole. This design keeps overhead low (akin to cloud efficiency) and lets dapps remain fully on-chain instead of relying on external servers for data storage. For additional details on Walrus, please refer to the report ‘How Walrus Differs from Existing Storage Protocols’.

Already used by prominent Web3 projects like Plume (L1), Linera (L1), Claynosaurz (NFT) and Decrypt (Media outlet), Walrus offers programmable, scalable storage natively tied to Sui smart contracts. Developers can store substantial files directly in their on-chain logic, from user-generated videos to AI models, while Sui acts as a control-plane.

On top of Walrus, SEAL adds an encryption and access-control framework that enforces custom data-sharing rules (e.g., only NFT holders can decrypt a file, or data expires after a set time). This setup allows a “decentralized Dropbox” model, where sensitive content remains secure yet accessible under cryptographically enforced conditions. By handling both storage and privacy, Walrus and SEAL open Sui to new app categories, like social networks or enterprise solutions, where code and data coexist fully on-chain.

Thus far we’ve covered Sui’s moves in computation and storage. But even the fastest, most feature-rich blockchain is only as good as its reliability. Sui is addressing a less glamorous but critical aspect of infrastructure: network resilience. The integration of SCION into Sui’s core is a forward-looking move to protect the blockchain from the vulnerabilities of the traditional internet. SCION is a secure networking protocol (pioneered in academia) that allows data to route around faults and attacks in the Internet backbone. By adopting SCION for validator communication, Sui’s network can essentially withstand DDoS attacks, BGP hijacks, DNS spoofing, and other common network-level attacks far better than a typical blockchain. In practice, this means even if parts of the internet are disrupted or malicious actors try to isolate Sui nodes, the validators can still find paths to talk to each other and keep the network humming.

Source: SCION Network Topology

For institutional users and large-scale applications, this kind of robustness is a big green flag – it reduces the risk of downtime or consensus halts due to external internet issues. It’s also somewhat unique: not many chains have thought to engineer their networking stack to this level of resiliency. Sui’s adoption of SCION reflects its “enterprise-grade” mindset within the full-stack strategy. They’re not just relying on existing internet infrastructure and hoping for the best; they’re layering in additional defenses so that the chain can be a dependable backbone for mission-critical apps. This is especially important as Sui envisions itself as a backbone for finance and global games; two arenas where outages or attacks can be extremely costly. The bottom line: Sui is making sure that its network can’t be easily knocked offline, setting it apart as a fortified L1 ready for prime time.

Sui is doubling down on gaming by moving beyond software into hardware, SuiPlay0X1. SuiPlay0X1 is a dedicated handheld console unveiled in late 2024 that merges sleek design with deep Sui blockchain integration. Think of it as a “crypto Switch,” capable of running both traditional PC/Steam titles and Web3-enhanced games. Gamers get a high-powered device featuring a beefy processor, advanced graphics, and half a terabyte of storage alongside on-board Sui wallet functionality and a built-in storefront. This setup allows players to seamlessly own and trade in-game assets, earn crypto rewards, and explore the broader blockchain economy, all without fussing over wallets or seed phrases. In short, the console handles distribution, onboarding, and engagement for Web3 gaming in one fell swoop.

Source: Decrypt

But Sui’s gaming ambitions extend well beyond a single device. From a strategy standpoint, SuiPlay0X1 is about owning the distribution channel for Web3 games. Rather than hoping mainstream gamers randomly discover crypto games on their PCs or phones, Mysten Labs and partners are putting a Web3-capable device directly in gamers’ hands. The console comes pre-loaded with Sui wallet functionality and a storefront for Sui games, lowering the friction for players to jump into blockchain gaming. Impressively, the Sui team has lined up content: over 70 new titles are reportedly in the pipeline for SuiPlay, from more than 65 gaming studios ranging from indie to AAA (Ambrus Studio, BIRDs, Gamisodes, etc.).

Meanwhile, the Sui network itself is is uniquely positioned to support the next-generation of games. Its Move programming model lets developers treat in-game assets as dynamic on-chain objects, avoiding the contract complexity of Ethereum. Features like sub-second finality and off-chain tunnels mean real-time, large-scale gameplay is possible without choking the network. Add mainstream partnerships (Major League Soccer, ATP tennis, ONE Championship, etc.) rolling out NFT collectibles, loyalty programs, and ticketing on Sui, and you see why the chain is also meeting users on the fun side. Taken together, Sui is gunning to be the birthplace of the next breakout crypto game, whether a major brand crossover or an indie viral phenomenon. And with SuiPlay0X1 acting as a frictionless gateway for players, the entire stack is set up to deliver a gaming experience that feels more Web2 than Web3, just with all the benefits of true asset ownership and unstoppable, on-chain economies. If blockchain gaming has a shot at going mainstream, Sui aims to be the chain that makes it happen.

On the finance side of the house, Sui’s Defi ecosystem saw astonishing growth over the past year, reinforcing the chain’s credibility to investors. By late 2024, Sui’s TVL in Defi smart contracts blew past the $2 billion mark, reflecting a 600%+ increase within the year. Monthly DEX trading volumes on Sui accelerated into the multi-billion dollar range (For context, November 2024 alone recorded over $7.8B in volume, up from just $1.9B in September). Those figures placed Sui among the top blockchains for decentralized trading activity, an impressive feat for a relatively new network.

What drove this growth? Partly, the presence of primitives like DeepBook attracted sophisticated trading activity and liquidity providers. But also, several homegrown Sui protocols hit their stride, including lending platforms and DEXes (for example, protocols like Navi, SuiLend, and Cetus each amassed hundreds of millions in TVL on their own). Users were clearly drawn to Sui’s low fees and fast settlement, as well as some creative yield opportunities unique to the ecosystem. For additional details on DeepBook, please refer to the report ‘Why Sui? Understanding Through the Case of DeepBook’.

Source: 4Q 2024 Defi Roundup

Another pillar of Defi growth has been stablecoins and assets moving into Sui. Over 2023-2024, multiple major stablecoins launched natively on Sui, including USDC and FDUSD (First Digital’s stablecoin), among others. By the end of the year, over $160M of stablecoin liquidity had been issued directly on Sui, with an overall stablecoin market cap around $400M on the network when counting bridged assets. This stablecoin base is the fuel for trading, lending, and real-world asset tokenization in Defi.

Moreover, Sui’s technical design (parallel transaction processing) means it handles high-volume stablecoin usage (like payments or arbitrage flows) without clogging up. We also saw the Sui ecosystem branch into RWAs and novel instruments; for example, tokenized Treasury products like Ondo’s USDY found support via institutional-grade custody on Sui. All told, 2024 proved that Sui’s financial stack is not a ghost town; it’s vibrant and competitive, with the kind of liquidity and usage metrics that catch any crypto investor’s eye. And remember: this DeFi expansion is happening in parallel with Sui’s pushes in gaming and retail use cases, which is exactly the benefit of a full-stack approach (different pieces of the ecosystem can grow synergistically without one starving the other for resources).

Perhaps one of the strongest validations of Sui’s strategy is the caliber of institutions taking notice. In late 2024, the Sui Foundation inked a strategic partnership with Franklin Templeton Digital Assets, a heavyweight in traditional finance. This partnership is aimed at supporting Sui ecosystem developers and exploring new use cases on Sui, essentially bringing in the expertise and resources of a $1.5 trillion asset manager to help grow the network. Franklin Templeton’s interest was piqued by Sui’s unique projects (they specifically highlighted DeepBook as “Defi’s answer to an exchange orderbook” and even novel concepts like decentralized telecom on Sui), signaling that major finance sees something different in Sui’s tech.

They weren’t alone: earlier in the year, Grayscale launched a Grayscale Sui Trust, making it easier for institutional and accredited investors to get exposure to $SUI through traditional investment channels. Investment firms like VanEck have also discussed Sui in the context of being “ready for mass adoption,” and at least one firm (Canary Capital) has filed for a future SUI ETF. This flurry of activity means Sui is being included in the conversation alongside the top layer-1s when it comes to institutional portfolios and products.

On the infrastructure side, companies that specialize in connecting TradFi to crypto have been integrating Sui as well. For example, custody provider Copper announced support for Sui assets, enabling secure storage for institutions handling $SUI or Sui-based tokens. Liquidity and settlement facilitators like Zero Hash and Fordefi are working to support Sui for their fintech and banking clients, particularly to handle the influx of stablecoins and tokenized assets now live on Sui.

Beyond the finance world, Sui has drawn interest from large Web2 tech players: it’s been publicly noted that ByteDance (the parent of TikTok) and gaming giant Netmarble have explored building on Sui or partnering in some capacity. And with Sui’s push into sports and entertainment (e.g., partnerships with major sports leagues for fan tokens), it has the attention of brands and enterprises looking to engage customers via blockchain. This multi-faceted institutional traction spanning Wall Street, Silicon Valley, and even Hollywood, is a strong indicator that Sui’s full-stack approach is resonating. By offering speed, scalability, and user-friendly onramps, Sui makes it easier for big players to say “yes” to using blockchain in their products. And every new partnership or integration creates a ripple effect, attracting more developers and capital into the ecosystem.

Sui’s “All Mighty Full Stack” is about realizing what Web3 was always meant to be: an open, global coordination layer that scales to entire economies and billions of people. It’s ambitious because true innovation means rebuilding consensus, storage, networking, and user experience from scratch—and weaving them into one seamless platform. It’s necessary because bolting on half-solutions wasn’t going to get us there.

Every piece of Sui, from Mysticeti V2 to SCION and SEAL, points to a future where performance doesn’t compromise decentralization, and frictionless on-chain experiences become the default. If it succeeds, Sui won’t just power finance or gaming; it could underpin social networks, AI economies, and a million other use cases without forcing users to care about how blocks finalize or how data sharding works. Think of it as a new internet, but with trust and value coded into its DNA.

Will Sui dominate Web3? It doesn’t need to. By offering a robust, versatile foundation, it naturally invites broader ecosystems to flourish on top. The real bet here is that performance, scale, and decentralization can reinforce one another when built from first principles. Judging by sub-second finality, throughput breakthroughs, and live dapps already gaining traction, Sui is on a path to truly earn the moniker “All Mighty.”

Of course, it’s still young, and grand visions face grand challenges. But the endgame is set, the layers are stacked, and every piece is moving into place. Whether you’re a developer, investor, or gamer, you’ll want to watch how Sui executes.

Dive into 'Narratives' that will be important in the next year