*This is the first part of a four-part series that examines the current solutions that are expanding the Bitcoin ecosystem.

We are now witnessing the “Next Phase of Bitcoin.” Undeniably, Bitcoin is the biggest asset in crypto and has been recognized by many institutions and crypto ecosystem. It boosts $1.3 Trillion, which account for 40% of total crypto market.

Especially 2024 was a big year for Bitcoin, some of the achievements include

ATH to $70,000 (although is felt to $5400 as of 5th of August).

The first crypto ETF, and it now has an AUM of $50 billion.

Bitcoin halving which is an event that occurs approximately every four years, reducing the reward for mining new blocks by 50%, which decreases the rate at which new bitcoins are created and increases scarcity. It occured in April 20, 2024 reducing the block reward from 6.25 BTC to 3.125 BTC.

Although these were important events, it is something related to price and market rather than a sustainable driver for the utility of Bitcoin. Then what would drive the utilities of Bitcoin, and scale the Bitcoin ecosystem?

Bitcoin can be more than a store of value, and there are three ways to grow the ecosystem. First is expanding the asset class of Bitcoin, which involves wrapping BTC to sending to other ecosystem or having a new token issuance protocol within Bitcoin. Second is adding execution, which focuses on adding smart contract capabilities on top of Bitcoin. Third is providing security for other services that leverages Bitcoin infrastructure. However, it is far from production but as there have a huge progress over several months, let’s look into these approaches.

1.1 Expanding Asset

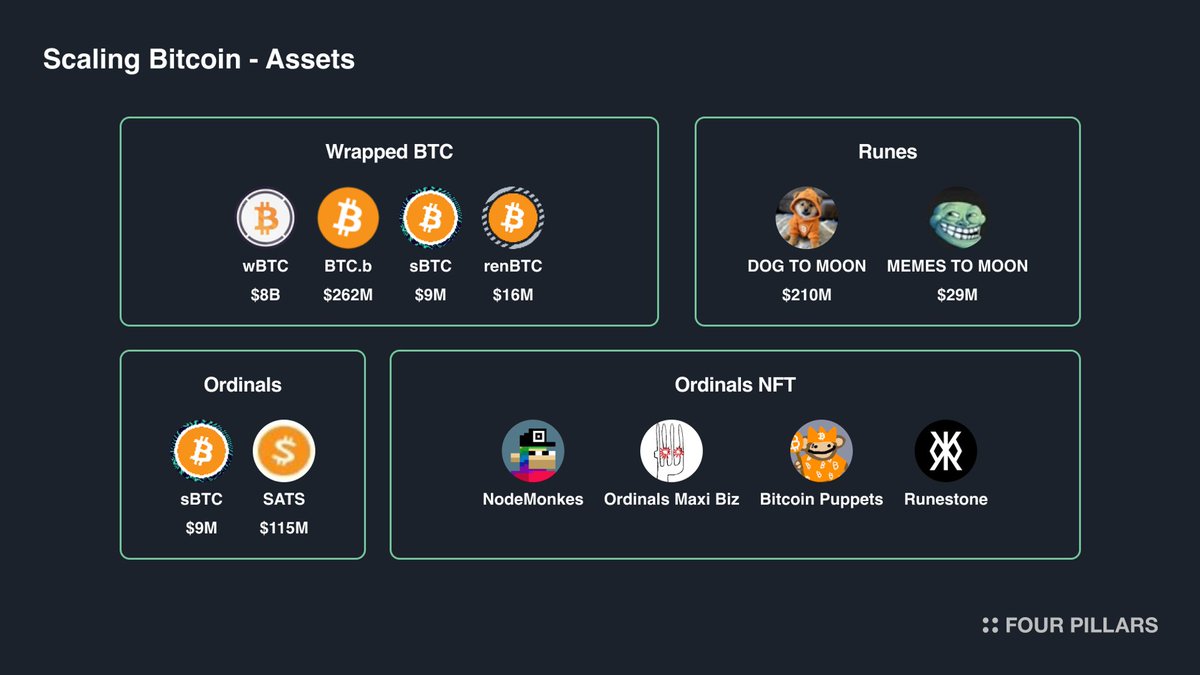

In the overall cryptocurrency market, Bitcoin holds the most valuable assets. Its asset class is not limited to its native BTC. In addition to having its BTC wrapped and sent to other blockchains for utilization, it also includes bitcoin-inscribed assets like Ordinals and the Rune protocol. Currently, the market cap of wrapped Bitcoin is around $10B, with wBTC holding most of the market share.

1.2 Adding Execution

Source: X (

)

In the past, projects like the Lightning Network enabled instant micropayments through a network of payment channels. However, due to limitations in decentralization and performance, recent Layer 2 projects aim to enhance Bitcoin's programmability by building L2 for smart contracts based dApps to be deployed. Bitcoin Layer 2 solutions handle transactions off the main Bitcoin chain and then send them back to the base layer for final settlement.

1.3 Leveraging Bitcoin Security

Although Bitcoin does not inherently support staking, the Bitcoin community has devised methods to circumvent this limitation and facilitate Bitcoin staking. These solutions often involve leveraging Bitcoin's secure network and integrating it with other blockchain that do support staking. By doing so, Bitcoin holders can participate in staking activities, thereby earning rewards.

Bitcoin staking operates as a two-sided marketplace. On one side, there are PoS chains that require additional security and are willing to offer yields to those who can provide it. On the other side, there are Bitcoin holders who possess the necessary capital and are willing to earn returns on their investments. This relationship benefits both parties: PoS chains gain the security they need to maintain network integrity, while Bitcoin holders receive a steady yield on their assets.

Although these projects are in a very early stage, projects like Babylon have raised significant funding, totaling $96 million.

2.1 Heechang from Four Pillars - “It Needs Better Tech and Infra for Onboarding”

Let’s look into the three approaches in more detail:

Bitcoin-related assets are currently community-driven: Most inscribed assets in Bitcoin are memecoins and do not have revenue-generating methods or appreciation strategies. For example, ORDI does not have a traditional revenue-generating mechanism. Its value is driven by market speculation and broader interest in the Ordinals protocol and BRC-20 tokens. The increased transaction fees from the use of Ordinals benefit Bitcoin miners, but this is not a direct revenue stream for ORDI. However, as the execution environment is added, there could be more utilities.

Bitcoin Execution Layer is in test status, and the onboarding experience needs improvement: The proof system and transaction processing in Bitcoin L2 are still in the early stages, with each project taking different approaches. More development and research are needed. For user experience, since users need to navigate new interfaces, manage different wallets, and understand the process of moving assets between networks, it is important to have tools that allow users from other ecosystems to onboard easily and for BTC holders to use the dapps in L2s.

Leveraging Security is bringing potential for yields: The landscape of projects leveraging Bitcoin's security is expanding with solutions like Babylon and BounceBit. Babylon focuses on enhancing the security of PoS blockchains by allowing them to benefit from Bitcoin's economic security without complex bridging processes. These projects could make BTC holders to earn higher yields. As projects like Babylon and BounceBit go live, yield opportunities can become diverse and attractive.

Looking into three main approaches that aim to scale Bitcoin, most are in a very early stage, but it is undeniable that the Bitcoin ecosystem will flourish in the near future as they stand as the most representative crypto asset. However current approaches are currently not ideal in terms of technology, and adoption. There need to be more production-level infra with better security, and better onboarding experience for users.

Related Articles, News, Tweets etc. :

Four Pilars -

Portal Ventures -

Thanefield Capital -

A hundred schools of thought contend: A comprehensive review of BTC L2 30+ projects

Dive into 'Narratives' that will be important in the next year