*This is the second part of a four-part series that examines the current solutions that are expanding the Bitcoin ecosystem.

Bitcoin, the first cryptocurrency, has achieved sophisticated security and decentralization through a relatively simple technology stack compared to the various emerging blockchains. However, to maximize security and decentralization, the Bitcoin blockchain had to sacrifice much of its scalability. As a result, it cannot process large quantities of small transactions efficiently. This limitation led to the belief that Bitcoin could not serve as a currency for the mass, as its initial purpose.

In this opinion article, let’s look into the technological changes in the Bitcoin ecosystem, on the emerging L2 solutions.

Bitcoin L2 projects received$94.6 million in fundingduring the second quarter of this year, compared to $34.7 million in Q1. Although there are more than 65 Bitcoin L2 solutions available, most do not meet the requirements to be considered true L2 solutions. Therefore, it is necessary to reconsider what the requirements are for becoming an L2 to identify the proper projects.

The reason why Bitcoin has not been able to build L2 for smart contracts is due to the limitations of Bitcoin scripts as follows .

Turing-incomplete

The states of the transactions are independent of each other (Statless)

Limited script size

Turing incompleteness means that a specific operation or Opcode cannot be executed. Satoshi designed Bitcoin intently to prevent repetitions from being executed, to protect Bitcoin from DDoS or other attacks. Since Bitcoin adopts the UTXO method, transactions in Bitcoin are stateless and have no concept of relationships between transactions. In addition, because Bitcoin's block size is limited to 1MB, there is a limit to writing a smart contract script itself.

As the article by Four Pillars "What Bitcoin L2s are Real?" states, a true L2 should depend on L1 and benefit from L1's liveness and security. Based on characteristics of L2, we can narrow it down to three criteria to be a L2:

Criteria1. Is it dependent on the L1 chain? L2 cannot exist without L1

Criteria2. Are verifiers of L1 involved in the deposit and withdrawal of assets? L2 has to follow L1’s consensus rules

Criteria3. Does the chain share the security of L1? DA should be proceeded on L1

With using the criteria above, let’s compare some of the Bitcoin L2 projects

When looking into Bitcoin L2 project that meets all the criteria like Citrea, you'll see BitVM as a core technology. Even projects not currently using BitVM often plan to adopt it in the future. So, how does BitVM inherit the benefits of Bitcoin's liveness and safety, which were once thought impossible?

BitVM allows for the optimistic verification of smart contract state changes off-chain. Transactions inherit Bitcoin's security because BitVM verifies them according to Bitcoin’s consensus rules. Additionally, BitVM works without changing the Bitcoin blockchain, so it doesn’t disrupt the Bitcoin community.

Similar to rollups, BitVM has a verifier and a prover. The prover tries to prove the smart contract was executed correctly. Both prover and verifier send the same amount of assets to a common address to prevent malicious behavior. The verifier's challenge begins after the prover commits a transaction to Bitcoin L1, indicating the smart contract was executed correctly.

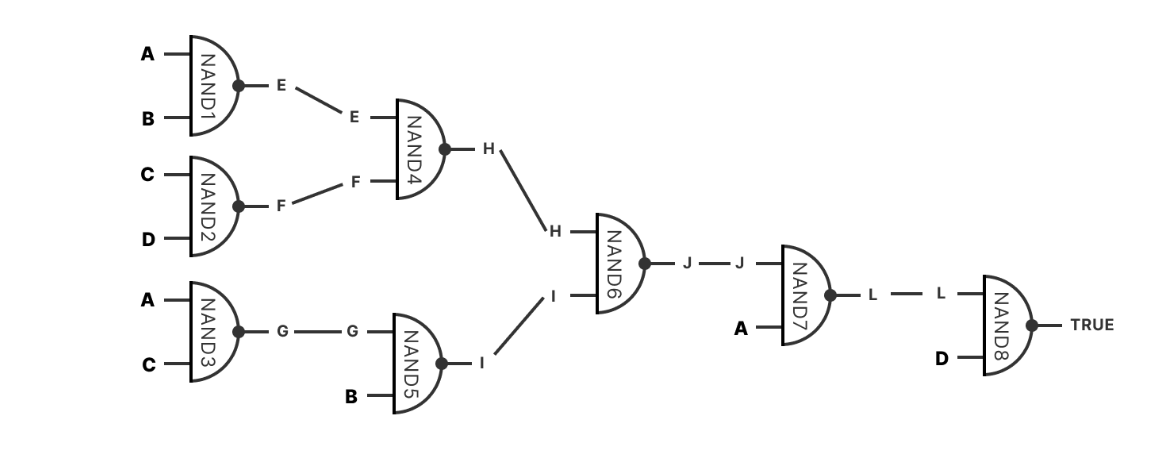

BitVM uses a unique method by breaking down smart contracts into minimal units called NAND gates. This method is similar to how early computer CPUs worked. A NAND gate takes two bits as inputs and produces one specific output. Even complex smart contracts can be split into NAND gates and converted into a Bitcoin-style script. Verification starts by decomposing the smart contract script into NAND gates.

Both prover and verifier have the script in NAND gate form. The verifier reveals the pre-image of a specific hash value to the prover. The prover must show the verifier the output of a specific NAND gate corresponding to the exposed hash value. If the prover's output doesn’t match the exposed hash value, it’s considered malicious behavior, and the prover's assets are forfeited to the verifier. To enforce communication, BitVM slashes deposited assets if there is no reply within a week.

Source:https://bitvm.org/bitvm.pdf

Once the Challenge→Response→Challenge→Response process is completed without slashing, the deposited assets are returned to both parties. By updating with a pre-commitment to L1, the transaction status is updated with the agreement of Bitcoin nodes. This series of processes ensures that BitVM inherits the security benefits of Bitcoin while enabling off-chain smart contract verification.

As of now, since OP_CAT has not been introduced, BitVM is the only technology that can make it possible to meet all the requirements of L2 on Bitcoin.

BitVM implemented an optimistic verification method on Bitcoin that it assumes the both prover and verifier will act honestly by game theory. If smart contracts are verified through BitVM, the execution environment is not limited because consensus is achieved by Bitcoin. This is how projects such as YONA are using SVM as their execution layer. BitVM is expected to be able to serve as a bridge between Bitcoin's L2 and other chains in the future.

However, it is true that BitVM still has many challenge elements. First of all, decomposing and verifying smart contracts are costly. Even if the smart contract become slightly longer, the number of NAND gates increases exponentially, so the workload increase accordingly. In addition, BitVM also cannot avoid the centralization issue because the centralized subject act as a verifier.

Currently, BitVM has begun engineering to improve many of the problems listed above. The team is also conducting research to implement virtual CPUs in the future for easier calculations. Considering that the profitability of Bitcoin miners will inevitably decrease through another halving which will occur in four years, there are many views that the Bitcoin community will be bit more open to implement new upgrades to create additional revenue sources for miners. Thus, there’s high possibility that Bitcoin community could implement a logic that would enhance BitVM down the road.

Stepping back from the technical analysis on Bitcoin L2, will it gain traction? What applications could be powered exclusively by Bitcoin L2? This is a crucial question for Bitcoin L2 developers to address. Most initial projects on Bitcoin L2 will be forks of popular dapps from other ecosystems, such as AMM DEX, lending, and CDP. However, there needs to be a unique application to make the ecosystem stand out and attract users. An early example would be the token protocols like Ordinals and Rune have showcased what is uniquely possible in Bitcoin and have formed a community.

It is undeniable that Bitcoin L2 will gain adoption as the rewards for Bitcoin mining decrease. Since Bitcoin's utility is now almost solely as digital gold, there needs to be a place where this digital gold can be utilized. I hope more interesting projects emerge in the Bitcoin L2 landscape and ultimately lead to application-focused L2s that provide “Only Possible in Bitcoin” experiences.

Related Articles, News, Tweets etc. :

Four Pillars -

Spartan Research -

Dive into 'Narratives' that will be important in the next year