Recently, there have been debates about "What is actually Economic Security?" and "Can Restaking really be meaningful in production?" These questions stem from finding ideal way to “Stake” an asset in the PoS blockchain.

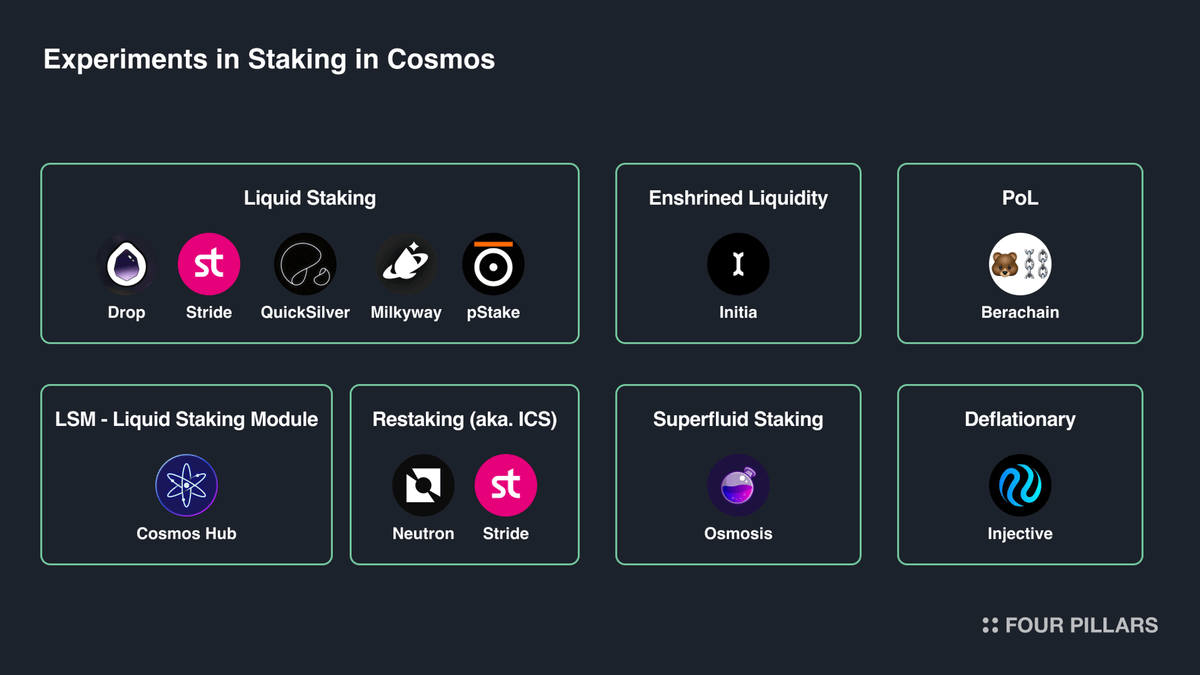

Staking in the PoS blockchain is crucial as it underpins network security and consensus by incentivizing participants to lock up their tokens as collateral. However, there can be many variations in staking operations. Cosmos, an ecosystem formed with appchains built with Cosmos-SDK, has conducted many experiments, including having restaking in production (aka ICS), multi-token staking, etc.

What were the experiments in staking in Cosmos, and what are the takeaways? These lessons will be valuable to AVS in restaking protocols, as they would need to consider how (re)staked assets should be utilized, and be part of their economics.

- Restaking through Interchain Security (ICS): Interchain security allows the Cosmos Hub (provider chain) validators to produce blocks for other blockchains (consumer chains). It enables new chains to leverage the Cosmos Hub's security, with validators earning rewards from multiple chains. Currently, Neutron and Stride are two consumer chains.

- LSM (Liquid Staking Module): It allows users to convert their staked token into liquid staked tokens without undergoing the traditional 21-day unbonding period. This is built in the network level, where most Liquid Staking is now built in the dapp level, which means there can be risks. However, the adoption of liquid staking is very low in Cosmos, and projects like drop protocol, backed by Lido Alliance, is trying to resolve this with its unique approach on making the supply chain of staking efficient and incentivizing.

- Superfluid Staking: Introduced by Osmosis, this feature allows users to simultaneously use their tokens for staking and providing liquidity to AMM pools. It enables liquidity providers to earn staking rewards on top of liquidity mining incentives, improving capital efficiency.

- Proof of Liquidity: Berachain's Proof of Liquidity (PoL) is a consensus mechanism that addresses key shortcomings of traditional Proof of Stake systems. Operating on a tri-token system (BERA, BGT, and HONEY), PoL incentivizes users to provide liquidity rather than simply staking tokens. Validators stake BERA and are rewarded with BGT, which they can direct to liquidity pools of their choice. This approach maintains higher liquidity, promotes decentralization by distributing BGT to liquidity providers, and aligns validator incentives with the success of the applications they support.

- Enshrined Liquidity: Pioneered by Initia, it refers to the integration of liquidity mechanisms directly into the protocol layer, ensuring that liquidity is shared in the Initia ecosystem. It allows multiple tokens, including solo INIT tokens and whitelisted tokens, to be staked with validators to gain voting power and earn block rewards. This method diversifies security by reducing dependency on the volatility of solo INIT, and enhances staking rewards as LP stakers benefit from swap fees and yield from other tokens within the pair. Moreover, it significantly boosts liquidity on the L1, making it more accessible to both L1 applications and L2 chains, while facilitating inter-minitia routing and the use of tokens within whitelisted LPs for gas payments.

- Inflation and Tokenomics: Cosmos has experimented with various inflation models and tokenomics to incentivize network participation and security. The ATOM token, for example, has an inflation rate that adjusts based on the percentage of tokens staked. Historically, the inflation rate for ATOM was set between 7% and 20%. However, this high inflation rate led to concerns about overpayment for security and long-term impacts on the token's value. In response, the Cosmos community approved a proposal to cap the maximum inflation rate at 10%, down from 14%. This change also reduced the annualized staking yield from approximately 19% to about 13.4%.

- Deflationary Tokenomics: Injective has implemented a unique deflationary tokenomic model designed to create scarcity, which ultimately makes the economics of staking sustainable. At the core of this model is a weekly on-chain buy-back-and-burn auction that aggregates 60% of all fees collected on the Injective network, including those from exchange dApps built on the platform. This weekly burn process consistently reduces the circulating supply of INJ tokens, making them increasingly scarce. Additionally, the recent approval of the INJ 3.0 tokenomics upgrade further enhances these deflationary characteristics by modifying the token's minting properties. It revises the token's inflationary bounds, setting lower and upper limits at 4% and 7% respectively, to be implemented incrementally over the next two years. Regular users can also participate in the auction for a chance to win and get buy-backed.

Staking itself is a very asset-inefficient way to secure a blockchain. Since the risk of slashing is quite low compared to the rewards, there have been two major developments to tokenize the staked position. The first is liquid staking, where staked positions become tokenized and tradable. The second is restaking, where the staked position can be staked again to secure other operations.

Restaking has been a hot narrative, amassing more than $18 billion according to DefiLlama. However, the economics of restaked services are not yet in production. That's why it's worth taking a look at how restaking works in Cosmos.

As Myles from Reveriee said, “restaking v1 is dead, long live restaking v2-n. End of mini-rant.” There will be more attempts to optimize staking operations or adopt a hybrid approach, and some lessons can be learned from the Cosmos ecosystem.

In the Cosmos ecosystem, I would like to focus on two examples that @xparadimgs highlighted: Superfluid Staking and ICS. Superfluid Staking, developed by Osmosis, the DeFi protocol with the highest TVL in the Cosmos ecosystem, received a great response from DeFi enthusiasts immediately upon its release. On the other hand, ICS garnered significant interest for its potential to offer stakers better returns and access to new project tokens compared to traditional staking.

However, after both initiatives were launched, the difference in their reception by the public became quite evident. Superfluid Staking allowed beneficiaries to 1) directly propose governance actions to support the protocols they desired or that were popular, 2) and, in return, receive unprecedented high yields. In contrast, ICS faced several challenges: 1) already popular protocols had little incentive to utilize ICS, 2) retail investors had to sacrifice other high-yield opportunities like Superfluid Staking, and the lack of due diligence on new projects made it difficult for them to make informed participation decisions, and 3) there was growing uncertainty about whether new projects would eventually build their own security systems to avoid reliance on protocols that leverage security.

Fundamentally, the primary beneficiaries of Liquid Staking and Restaking differ (i.e., retail investors vs. validators and new projects). This suggests that when initiatives like ICS, which leverage security and involve complex stakeholder relationships, are developed, different KPIs from those used by Liquid Staking projects must be established. Additionally, setting up a GTM strategy to continuously attract promising protocols will likely be necessary.

Related Articles, News, Tweets etc. : • https://x.com/Steve_4P/status/1799127948341178541… • https://x.com/MylesOneil/status/1818040193632346622… • https://4pillars.io/en/articles/from-lido-to-an-integration-appchain/public…

Dive into 'Narratives' that will be important in the next year