Bluefin began as Firefly Exchange on the Moonbeam network, transitioned through Arbitrum, and ultimately settled on Sui, demonstrating a continuous commitment to providing a seamless onchain trading environment with a strong focus on user experience

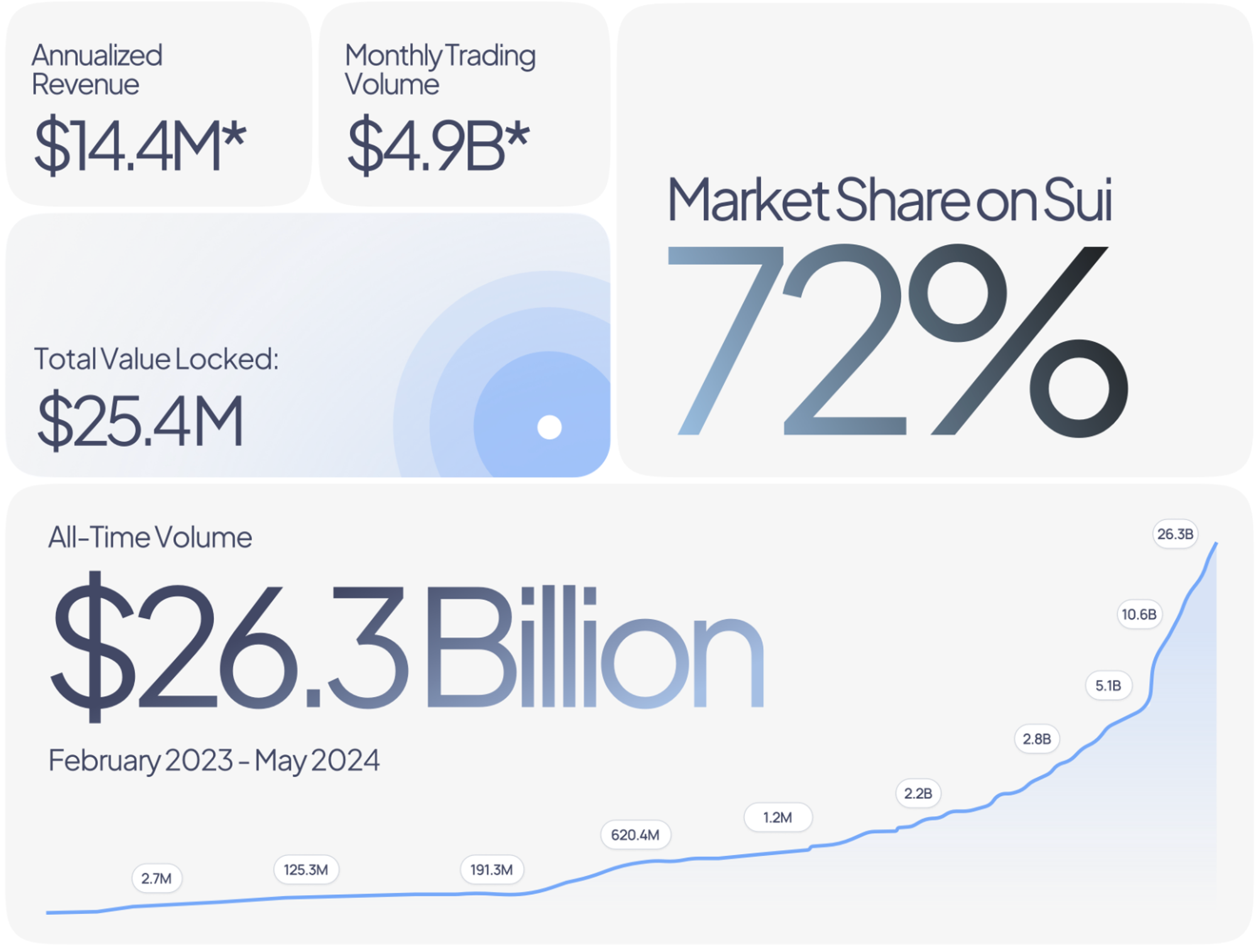

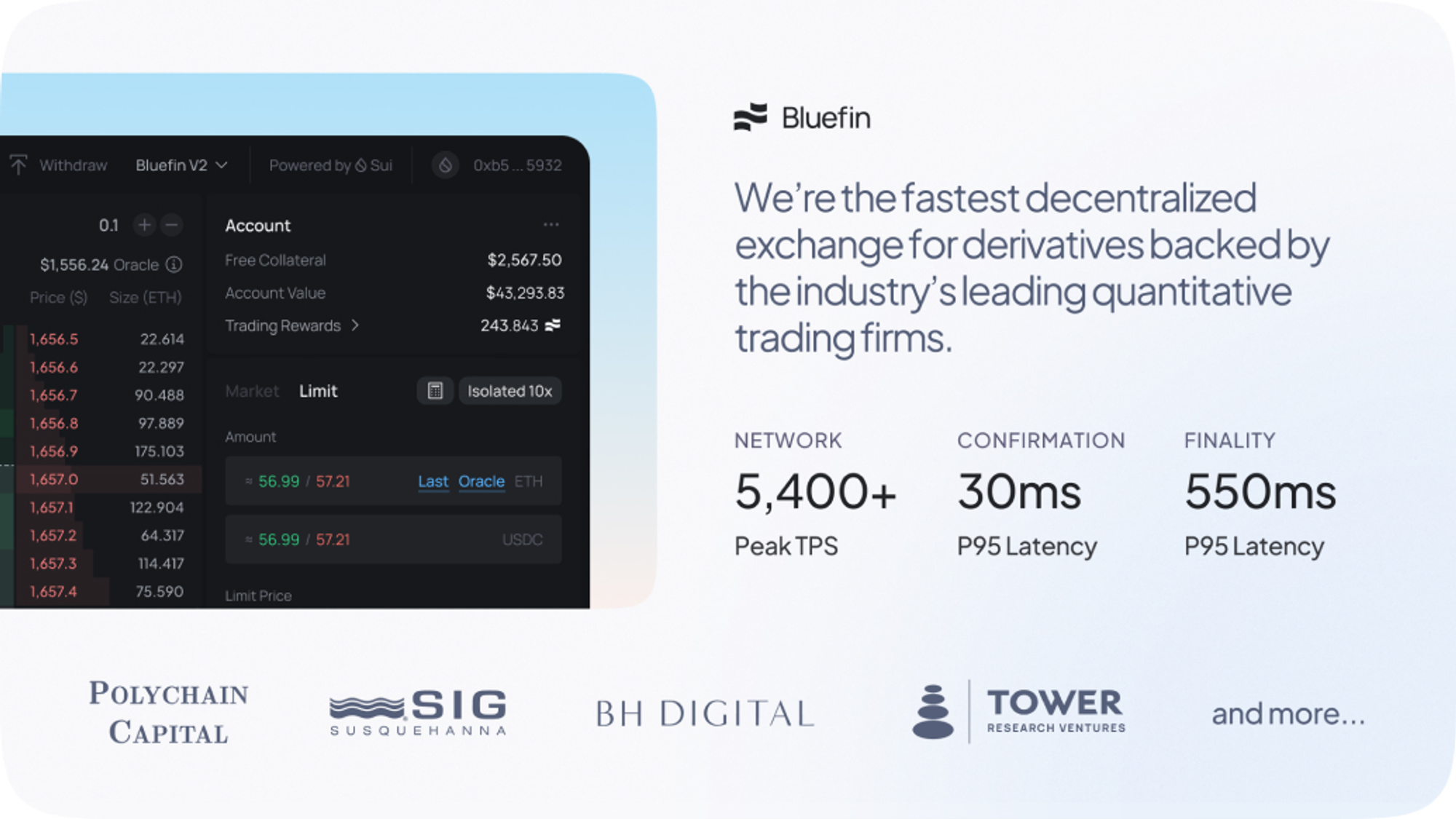

Since its launch on Sui, Bluefin has achieved impressive performance metrics, including over $26.3 billion in trading volume and capturing 70% of the market share. Its TVL also increased from $2 million to $25 million within a year, securing a strong user base and liquidity

Bluefin, which is currently operating as a derivatives exchange, shows its ambition to transform into a comprehensive decentralized trading platform by introducing key features such as a DEX aggregator, convenient on-ramp and cross-chain functionality through spot trading, and infrastructure that other DeFi protocols can leverage

Bluefin's growth trajectory shares similarities with Jupiter's success on Solana, utilizing high-performance blockchains and a user-centric strategy to capture market share and achieve high functionality. Similar to Jupiter's "grow the pie" strategy, Bluefin is expected to gain significant synergy from the expansion and growth of Sui

The upcoming Bluefin V3 will introduce features such as cross-margin trading, sub-30ms off-chain execution, 400ms onchain finality, and a throughput of up to 30,000 TPS. Bluefin's innovations are expected to make onchain trading more efficient and provide attractive features for both retail and institutional investors, solidifying its position in the market

1.1.1 Growth Potential of Perp DEX Market

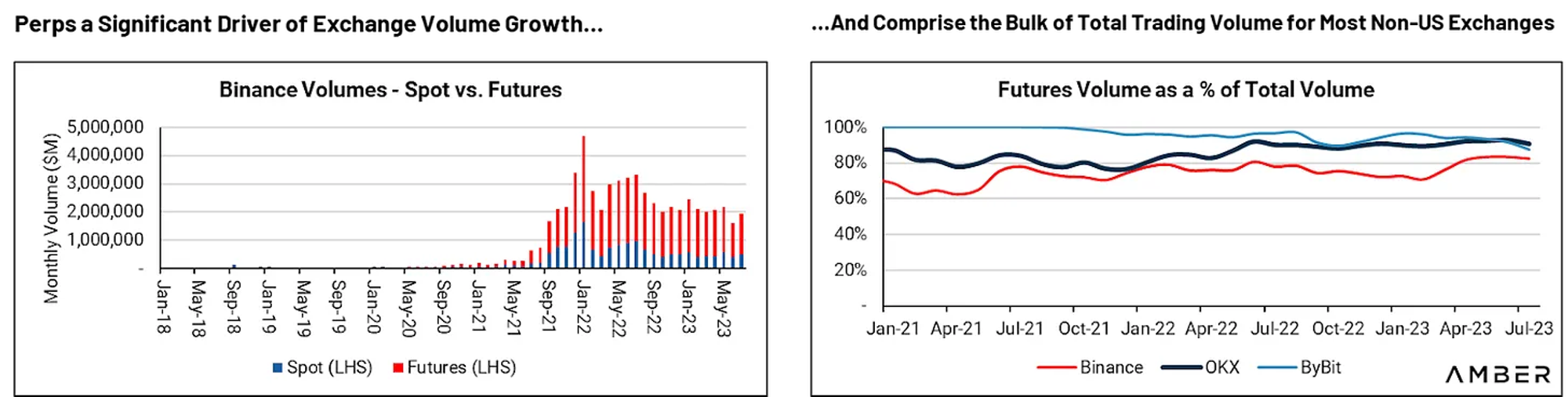

The perpetual market is on the rise, becoming a promising territory not yet fully conquered by DeFi. While CEXs still dominate perpetual trading, decentralized perpetual protocols have grown rapidly over the past two years, achieving nearly a 10X increase in total open interest. This intense competition has led to continuous innovation, with many protocols adapting and evolving to meet the changing needs of users.

Source: Crypto Derivatives Part 1: Perpetual Growth

When inspecting historical volumes, a tangible shift from CEXs to DEXs can already be seen in the spot markets. Currently, DEXs have grown to take around 10% of the total trading volume, reaching up to 15% through 2023. This shift indicates a growing preference among users for onchain trading, which is expected to extend to perpetual futures markets as well.

Despite slower adoption of onchain trading for perpetual futures compared to spot markets, the potential for growth is significant. The current landscape echoes the pre-DeFi-Summer period for spot markets, suggesting that perpetual DEXs might experience a similar boom in the near future. As the market matures and more sophisticated actors enter the space, onchain trading activity is expected to increase, further driving the expansion of the Perp DEX ecosystem.

1.1.2 The Last Unconquered Space in DeFi

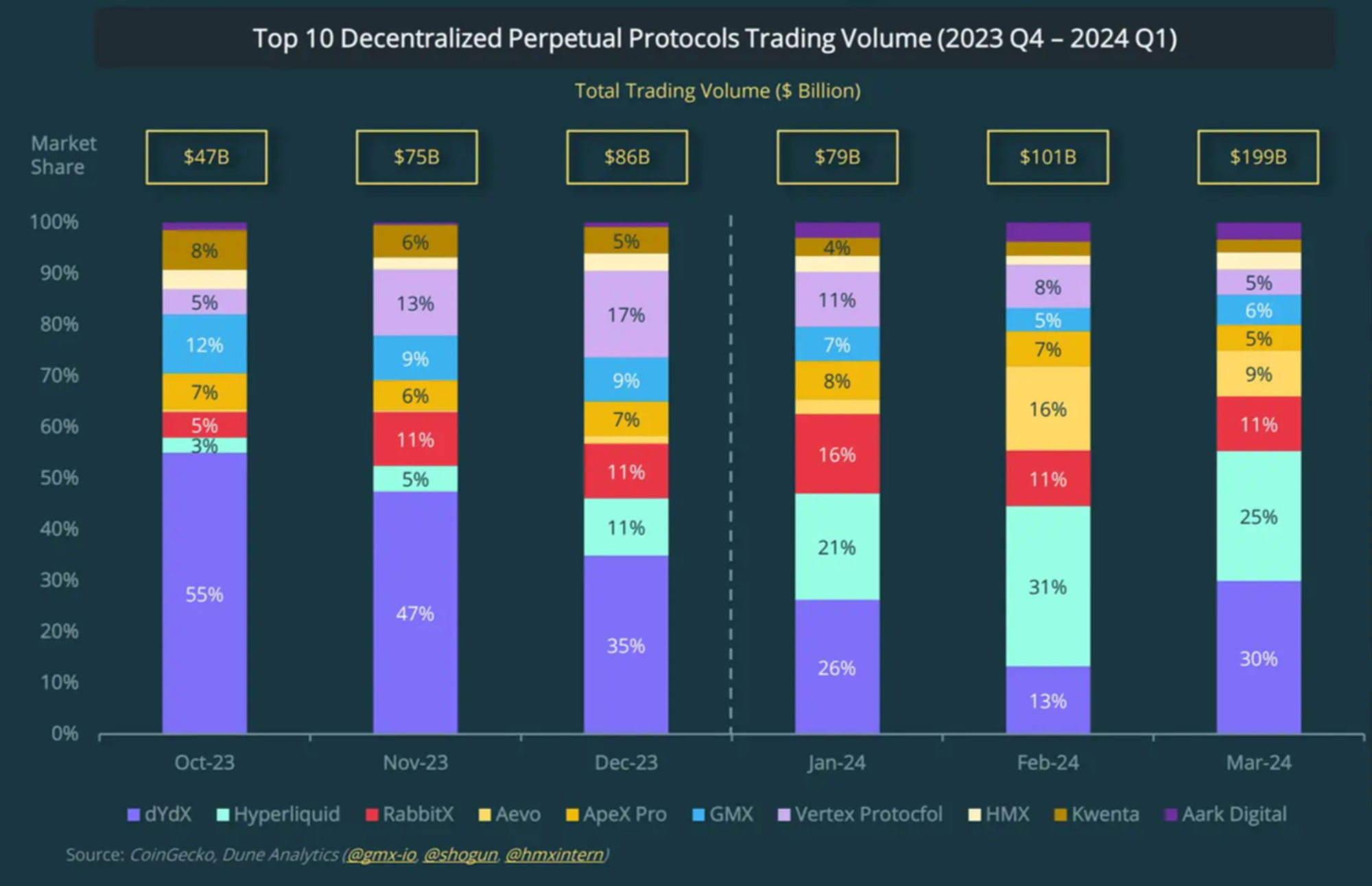

Source: 2024 Q1 Crypto Industry Report

Perp DEX market is experiencing a period of intense competition and rapid growth. In the first quarter of 2024, the top 10 Perp DEXs recorded their highest volumes ever, with March seeing an all-time high. Volumes surged from $207.7 billion in Q4 2023 to $379.8 billion in Q1 2024, driven by a significant increase in trading activity.

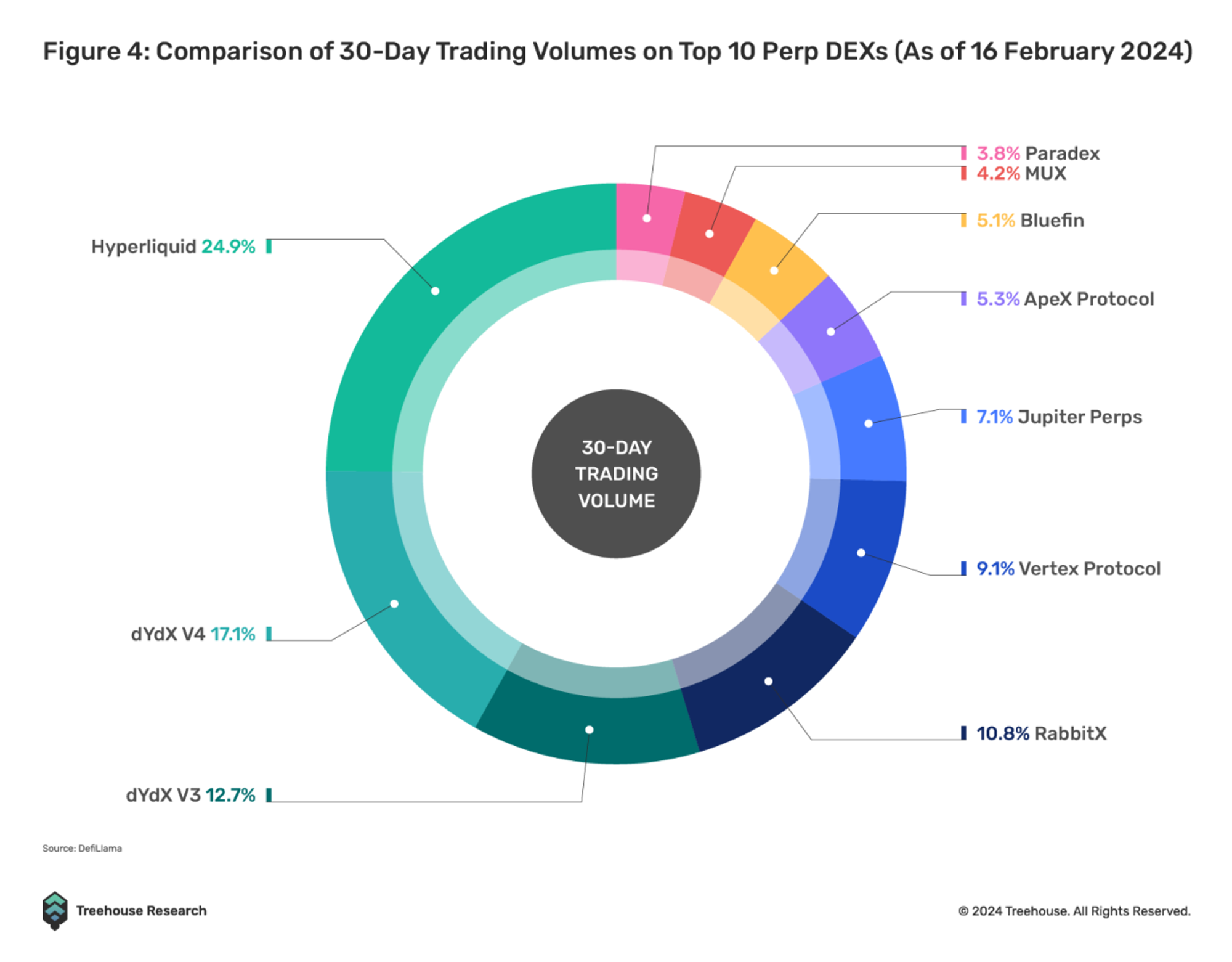

The market is becoming increasingly vibrant and competitive. Historically, dYdX dominated the Perp DEX market, commanding 59.7% of the 30-day trading volume as of October 1, 2023. This dominance was largely due to its first-mover advantage. However, it now faces stiffer competition. Recently, market dynamics have shifted significantly. Since 2023, new entrants like Hyperliquid have begun to challenge dominance occupied by the top players in the market. By February 16, 2024, Hyperliquid had overtaken both dYdX V3 and V4, capturing 24.9% of the market share.

Source: The Acceleration of Perp DEXes: Navigating the Fast Lane of DeFi

The development of newly launched projects and the introduction of novel features by existing projects are driving market dynamics and keeping pace with evolving trends. For example, Hyperliquid continues its rapid ascent fueled by its points program and the rollout of pre-launch markets. Incentives and airdrops have played a crucial role in shaping the fortunes of various DEXs. Aevo, for instance, saw its volumes surge as its token airdrop approached in March, while Vertex experienced a decline in volumes following its airdrop in November 2023 and the end of ARB trading incentives in January 2024. Overcoming the network effect through short-term incentives and the dynamic shift in market dynamics are creating an environment where new DEXs can effectively challenge existing players. The rise of new competitors indicates a healthy and dynamic market environment. This influx of innovative projects encourages continual improvement and differentiation among platforms, benefiting users with more choices and better services.

Despite most trading still occurring on centralized exchanges, it has become evident that centralized services compromise user trust and self-custody. The collapse of FTX highlighted the urgent need for a trustless alternative to centralized exchanges.

On the other hand, onchain exchanges face inherent limitations due to the nature of blockchains, such as slower speeds and limited computational capacity. Attempting to replicate the infrastructure of off-chain centralized exchanges on the blockchain often leads to inefficient use of resources. These unfavorable conditions discourage market maker participation.

Consequently, most onchain orderbook models struggle with issues like slow settlements, high spreads, and low liquidity. To overcome these challenges, there is a pressing need for better platforms that can provide on-chain users with efficient and convenient services, comparable to those offered by centralized counterparts. Without such advancements, the vision of Web3 and blockchain will remain unfulfilled and merely a slogan.

1.2.1 Multi-Chain Expansion

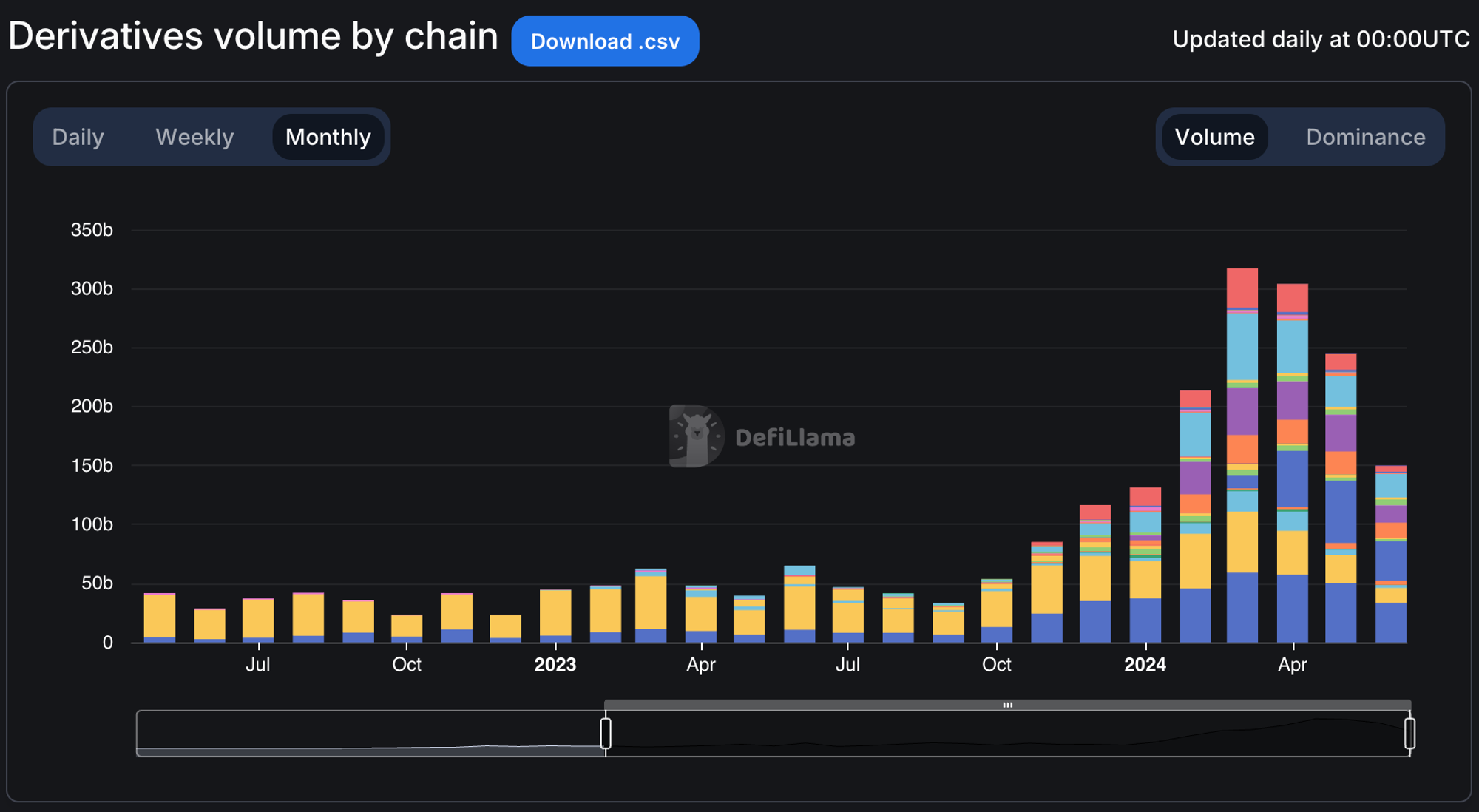

Source: Defi Llama

There are happening apparent changes and innovations in multiple spaces on DeFi landscape. As one of such cases, the DeFi landscape has experienced further fragmentation across multiple chains recently. Originally, the derivatives trading volume was dominated by Ethereum and Arbitrum, which accounted for over 50% and 25% of the total volume, respectively, as of last November. However, entering 2024, their dominance has significantly diminished, with Ethereum now capturing less than 10% of the market and no single chain occupying more than 25%.

This fragmentation presents a competitive advantage for exchanges on diverse chains that were not previously dominant. Chains like Solana and Sui offer much faster execution environments and lower fees, leading to better user experiences. Moreover, protocols on these chains benefit directly from their underlying network's growth. With fewer competitors in their local markets, new users and liquidity entering the network tend to concentrate on these platforms. This concentration provides a strategic advantage over competitors from more established chains, allowing these platforms to establish a strong foothold in the evolving DeFi landscape.

Moreover, numerous innovations are also reshaping the DeFi landscape. These include forex trading, NFT perpetuals, and pre-listing perpetuals. The concept of chains as closed ecosystems is becoming obsolete, with users now able to deposit funds from multiple chains and use platforms seamlessly, regardless of the underlying blockchain. The ability to integrate multiple blockchains into a cohesive user experience allows users to benefit from the best features of each chain without being limited to a single ecosystem. The interoperability between multiple ecosystems will likely lead to a more robust and resilient trading environment, attracting more users and increasing overall market liquidity.

1.2.2 Opportunities on High Performance Chains

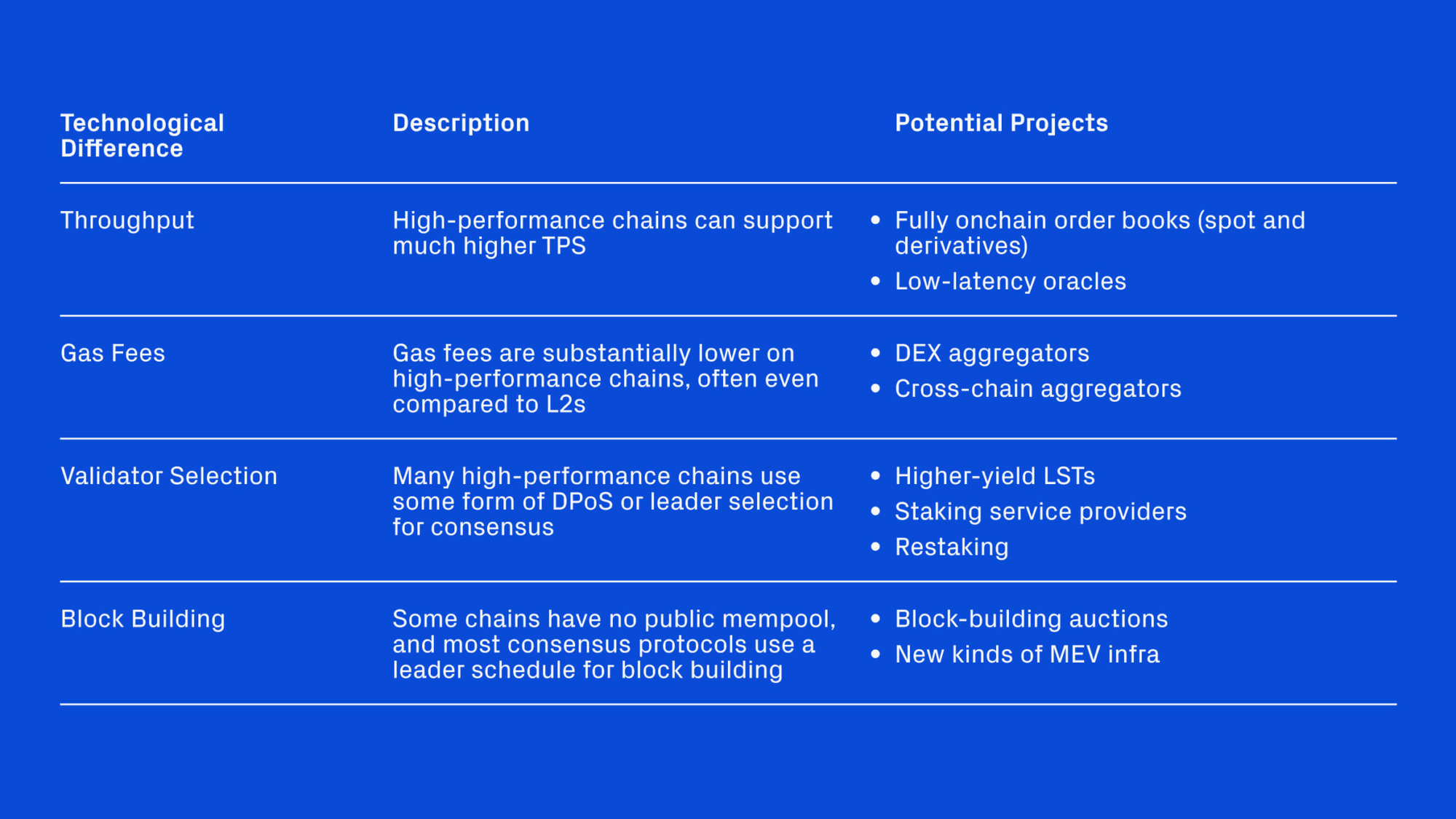

Source: DeFi Opportunities on High-Performance Chains

Furthermore, the continued development on L2s and high-performance chains will help DeFi protocols handle increased trading volumes without compromising performance. The focus on infrastructural development will become more important, as the network effect of a chain becomes less critical. In this circumstance, high-performance chains like Sui, Aptos, Sei and Monad are expected to benefit significantly from this evolution. There can be majorly two aspect of advantages and distinctiveness that the infra-level change can affect on the DeFi services on top of it

Throughput

To achieve fully onchain functionality, an orderbook must manage both trade settlements (moving assets between wallets) and the matching engine where traders place their bids. Hosting the matching engine onchain is particularly challenging because orderbooks need to process a substantial amount of request including spam. Compared to Automated Market Makers (AMMs), order books require significantly higher liquidity and throughput. However, they offer a more capital-efficient market structure for trading since they do not depend on passive LPs.

Gas Fee

Lower gas fees, combined with high throughput and low latency, have profound implications for DeFi applications, particularly for DEX aggregators like Bluefin. Aggregators seek the best prices from various onchain and even off-chain liquidity sources. On Ethereum mainnet, high gas fees and latency often restrict price retrieval to a single DEX or off-chain source. In contrast, high-performance chains with low fees and low latency enable aggregators to find the best prices for an asset across multiple liquidity venues. This capability allows an aggregator to execute a token swap on one DEX and then perform another swap on a different DEX if it offers a better price, or even follow more complex trading paths. Consequently, aggregator pricing on high-performance chains is more competitive than on the mainnet or slow finality chains.

1.2.3 Improving User Experiences

A positive trend in the DeFi space is the increasing focus on seamless user experiences within onchain protocols. The importance of user experience is becoming more widely recognized across all crypto applications, including financial products. Recently, a success of new contenders like Hyperliquid and Bluefin shows that services offering superior user experiences tend to achieve better traction in terms of trading volume and user engagement.

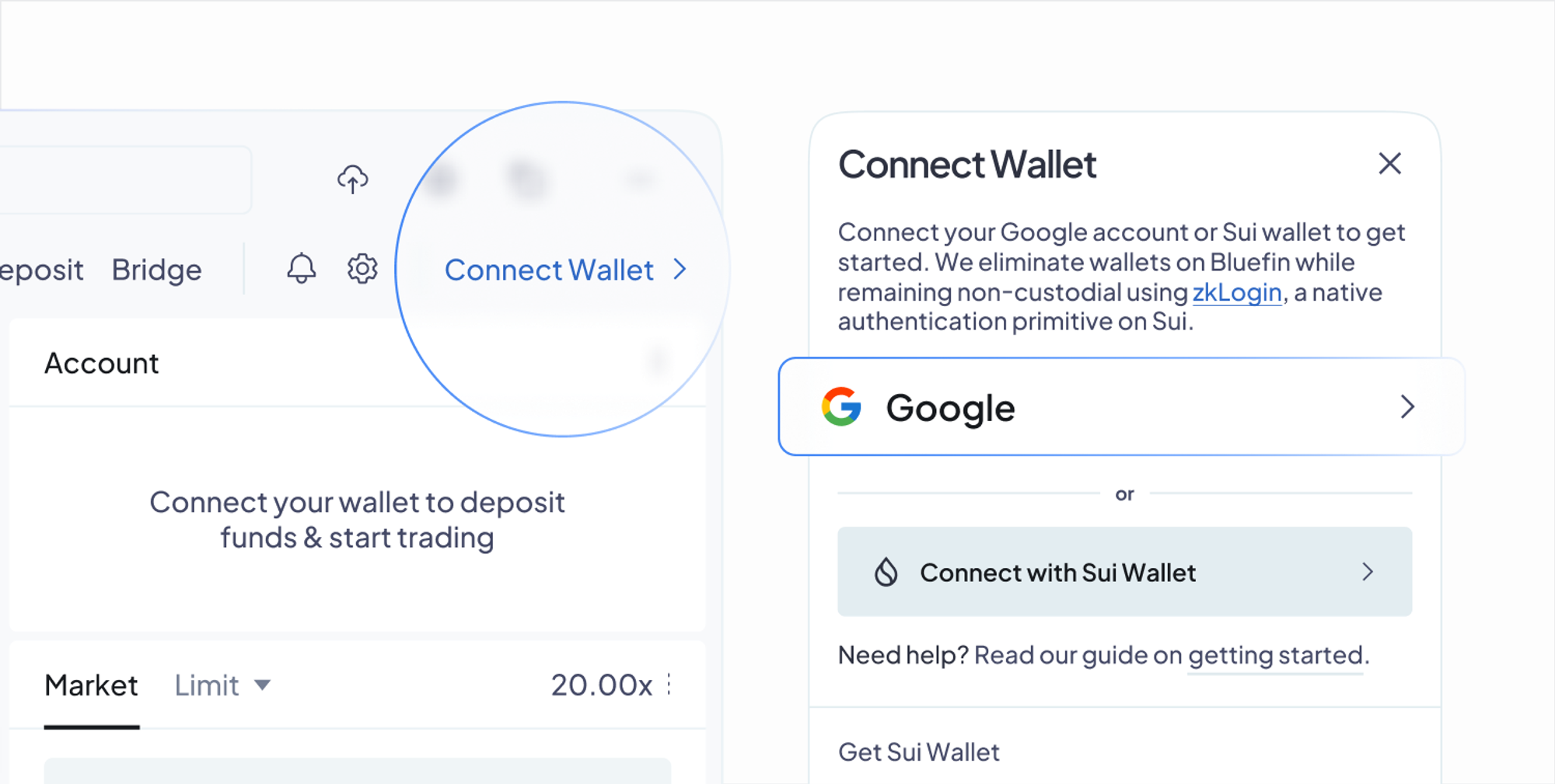

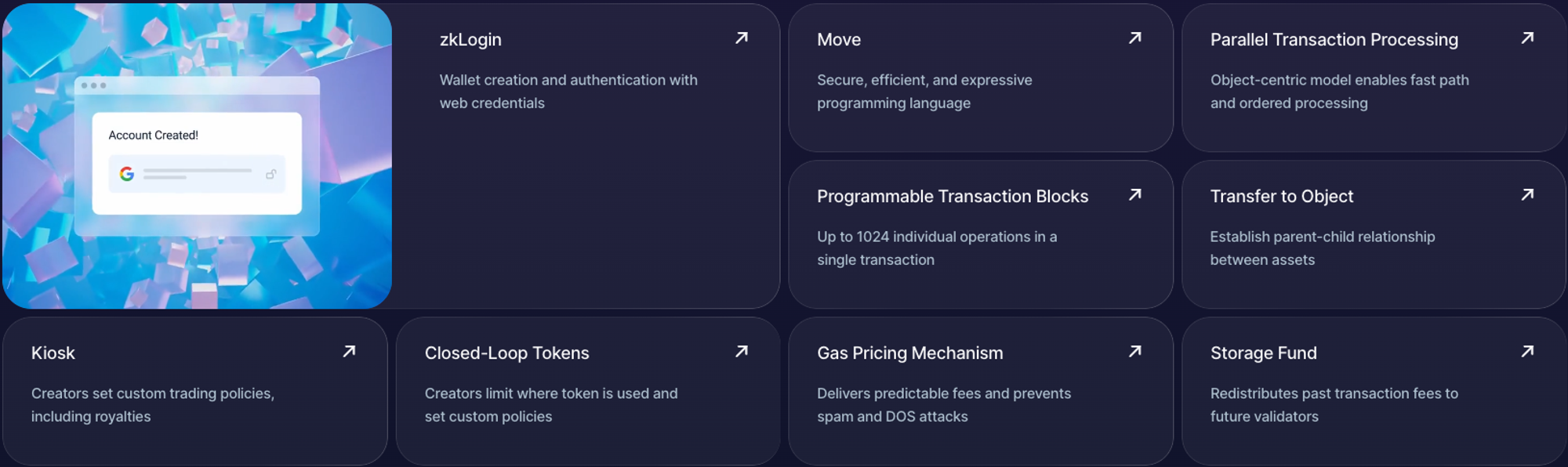

Source: Bluefin Docs

Streamlining the onboarding process has proven to be highly effective for attracting and retaining high-value users. While on-chain protocols have often used their decentralized nature as an excuse for suboptimal and clunky user experiences, rising user standards have changed this expectation. Users now demand experiences that are on par with centralized services. Newly launched or updated services are exhibiting interfaces and user experiences that rival those of their web2 counterparts. This trend is expected to continue, ensuring that users of on-chain protocols will soon notice little difference when compared to centralized services.

As decentralized trading platforms continue to innovate, they will provide more advanced trading instruments and financial products, further narrowing the gap between themselves and centralized counterparts. Ongoing developments will make onchain protocols more appealing to both retail and institutional investors, who seek sophisticated tools to manage risk and optimize returns.

Source: Bluefin

In this dynamic landscape, Bluefin has emerged as a dark horse, rapidly establishing itself as a significant player in the derivatives trading landscape. Bluefin records more than $25B of total trading volume and 25000 users from the start of this year. Despite a relatively short period of operation, Bluefin currently commands the largest volume on the Sui network, capturing approximately 70% of the market share.

Bluefin is a decentralized exchange that offers a advanced trading experience on Sui network. Unlike traditional DEXs, Bluefin offers the experience of centralized services without compromising on performance and user experience. Users can enjoy the benefits of decentralization and a fully onchain experience. The rationale for building an integrated financial infrastructure on decentralized environment is simple: leveraging Sui’s superior performance and technology, Bluefin can provide a seamless and efficient onchain trading experience to users.

While Bluefin currently operates as a derivatives exchange, its vision extends beyond this. Noting that Bluefin is still in its beta phase, it will evolve into the most powerful financial ecosystem to provide a comprehensive decentralized trading experience. With the upcoming launch of an aggregator and spot trading, Bluefin aims to create a platform where all financial activities can take place. The aggregator will offer highly efficient price discovery and routing with near-instant settlement and finality. The forthcoming spot trading feature will enable users to onboard effortlessly and access multiple chains without fragmentation. With all these features integrated into a single platform, onchain trading experience is expected to redefined again.

Source: Intro to Sui

Bluefin's success is rooted in its obsession with user experience and its maximization of the advantages offered by the underlying Sui network. Leveraging Sui's superior scalability and advanced user experience, Bluefin provides a trading environment that elevates the transaction experience beyond what existing DeFi services used to offer. Additionally, with the release of its latest version, V3, Bluefin introduces noteworthy features to enhance performance and user experience of their platform.

In the following analysis, we will delve deeper into Bluefin's features, performance metrics, and the strategic advantages that set it apart from other players in the decentralized trading market. We will also introduce the new features applied in the V3 upgrade, which offer near-instant settlement enabled by the Mysticeti upgrade of the Sui network. Furthermore, we will cover the design of the newly launched BLUE token and Bluefin's vision to become a fully comprehensive financial infrastructure, not limited to just a derivatives exchange of status quo. By understanding the story of Bluefin and its impact on the trading experience, we can better appreciate its potential to shape the future of decentralized derivatives trading.

The evolution of Bluefin is a testament to the dedication and user-centric approach of its team. From the beginning, the team has demonstrated an unwavering commitment to delivering exceptional user experiences. The focus on user satisfaction over technological novelty has been a defining characteristic of Bluefin’s journey. The history of development of Bluefin is not just a timeline of events but a narrative of a team obsessed with improving and perfecting the trading experience in derivatives trading.

Source: Firefly Building on Moonbeam for Derivatives Trading in the Polkadot Ecosystem

The story of Bluefin began as Firefly Exchange on the Moonbeam network, which is a part of Polkadot ecosystem in 2021. Remarkable is, from the very first beginning, how the team commits to delivering value to users and creating a frictionless trading environment. By integrating EVM environment(which was novel approach back then), the platform aimed to attract more onchain users. The platform utilized rollups for near-instant trade settlements, efficient liquidations, lower penalties, and higher leverage. Additionally, Firefly DAO’s onchain treasury covered gas fees, ensuring a seamless user experience. Some of these features are quite common now, but they were very novel at that time, showcasing the team's obsession with supporting users without being limited by the technology available.

After operating Firefly for some time, the team encountered a challenge marked by harsh market conditions, which leads to heading down for about a year. Running a decentralized exchange during this period proved to be never an easy task, as many projects that had thrived during the last bull run failed to survive the downturn. Despite these difficulties, Bluefin's journey did not end there. Supported by core contributors and a dedicated community, the team maintained their focus on delivering meaningful products to users. This unwavering commitment and resilience allowed Bluefin to navigate the turbulent market successfully, laying a solid foundation for future growth and innovation.

At the beginning of 2023, the team rebrands their platform as Bluefin. After the successful rebranding, Bluefin launched V1 on the Arbitrum network. The launch on Arbitrum, a layer 2 network built on Ethereum, was intended as a transitional phase. Instead of waiting for the perfect moment, the team chose to showcase their platform to users as soon as possible. The approach demonstrated the platform's robustness and the team's capability to operate in multiple execution environments swiftly. Over the less-than-a-year operation on Arbitrum, Bluefin successfully transacted over $700 million.

Source: Bluefin v2 - Decentralized Trading Without Wallets

By September 2023, Bluefin had transitioned to the Sui network, launching V2. The migration was driven by the founders' ambition to provide a decentralized platform offering advanced, capital-efficient derivatives trading that could compete with traditional finance. Sui's blockchain was selected for its performance, cost-effectiveness, and accessibility, which were essential to serve both institutional and individual users effectively. The V2 launch on Sui was marked by significant growth and impressive trading volumes, demonstrating the enhanced capabilities and user experience of the platform.

Currently, Bluefin is preparing to launch V3, which aims to bring further improvements. The upcoming version promises significantly reduced fees, improved trade execution latency, and the introduction of cross-margin trading accounts. Bluefin V3 will feature 30ms off-chain trade confirmations, sub-second onchain finality (approximately 400ms), and a capacity of up to 30,000 TPS. These advancements are made possible by leveraging Sui’s owned object transactions(which I will explain in detail), which eliminate the need for global consensus among validators, thereby optimizing transaction processing efficiency.

Throughout its evolution, Bluefin has demonstrated a highly competitive team with extensive experience, capable of rapid iteration and possessing a legitimate history of delivering user-focused solutions. The team consistently prioritizes the user experience, choosing infrastructure that minimizes friction and enhances the overall trading process. By continually adapting to new technologies and responding to user needs, Bluefin has positioned itself as a leading player in derivatives trading. The platform's journey from Firefly Exchange on Moonbeam to Bluefin V3 on Sui reflects a commitment to innovation and excellence, aiming to redefine the trading landscape in the DeFi ecosystem.

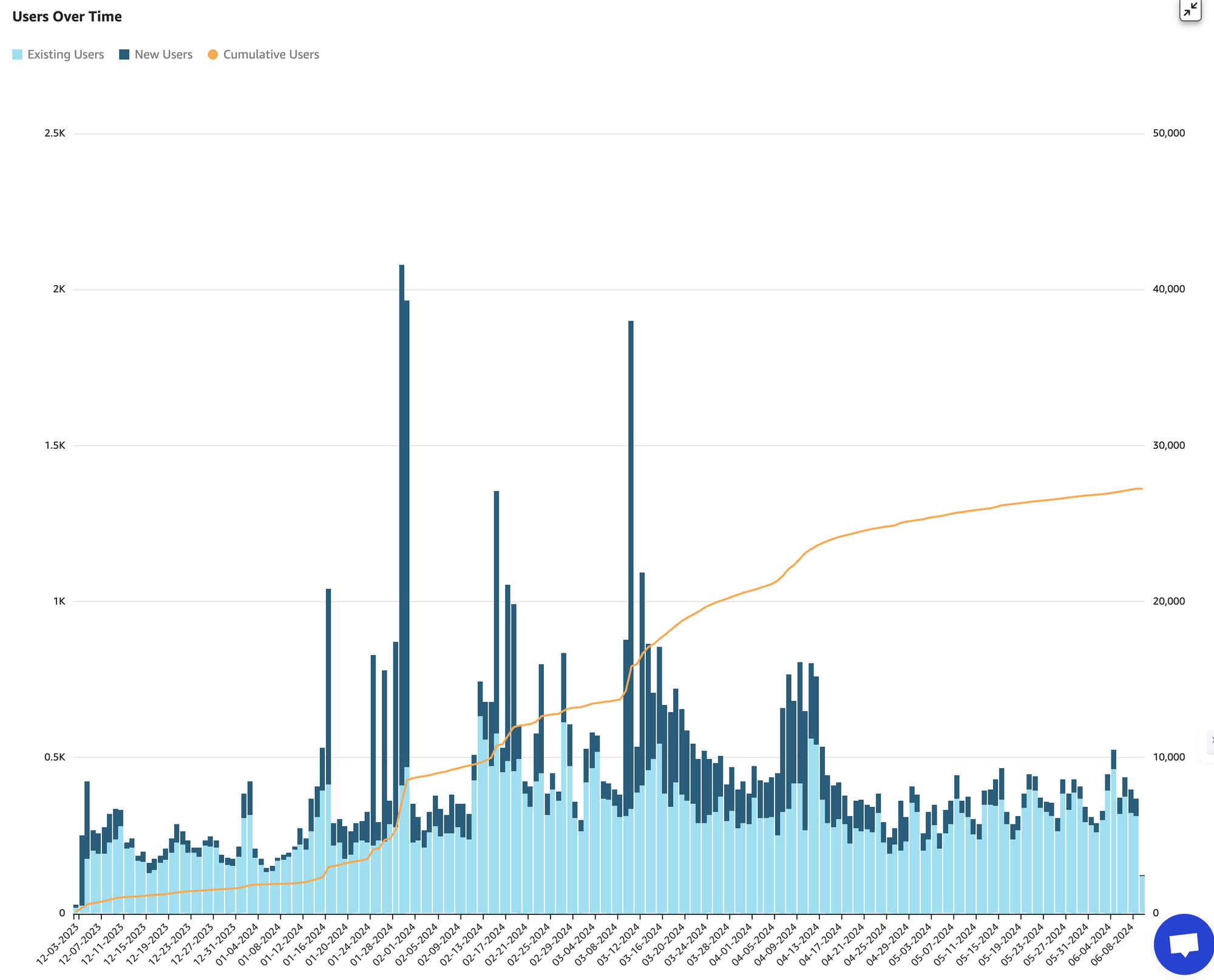

Since its inception, Bluefin has shown remarkable growth and significant performance metrics, reflecting its strong market presence and user adoption. Bluefin has captured over 70% of the market share on the Sui network. This dominant position is a testament to the platform's robust infrastructure and user-centric design. Since their launch in February 2023, Bluefin's all-time trading volume has reached an impressive $26.3 billion. This substantial figure underscores the platform's ability to attract and retain traders, facilitating large volumes of transactions on a consistent basis.

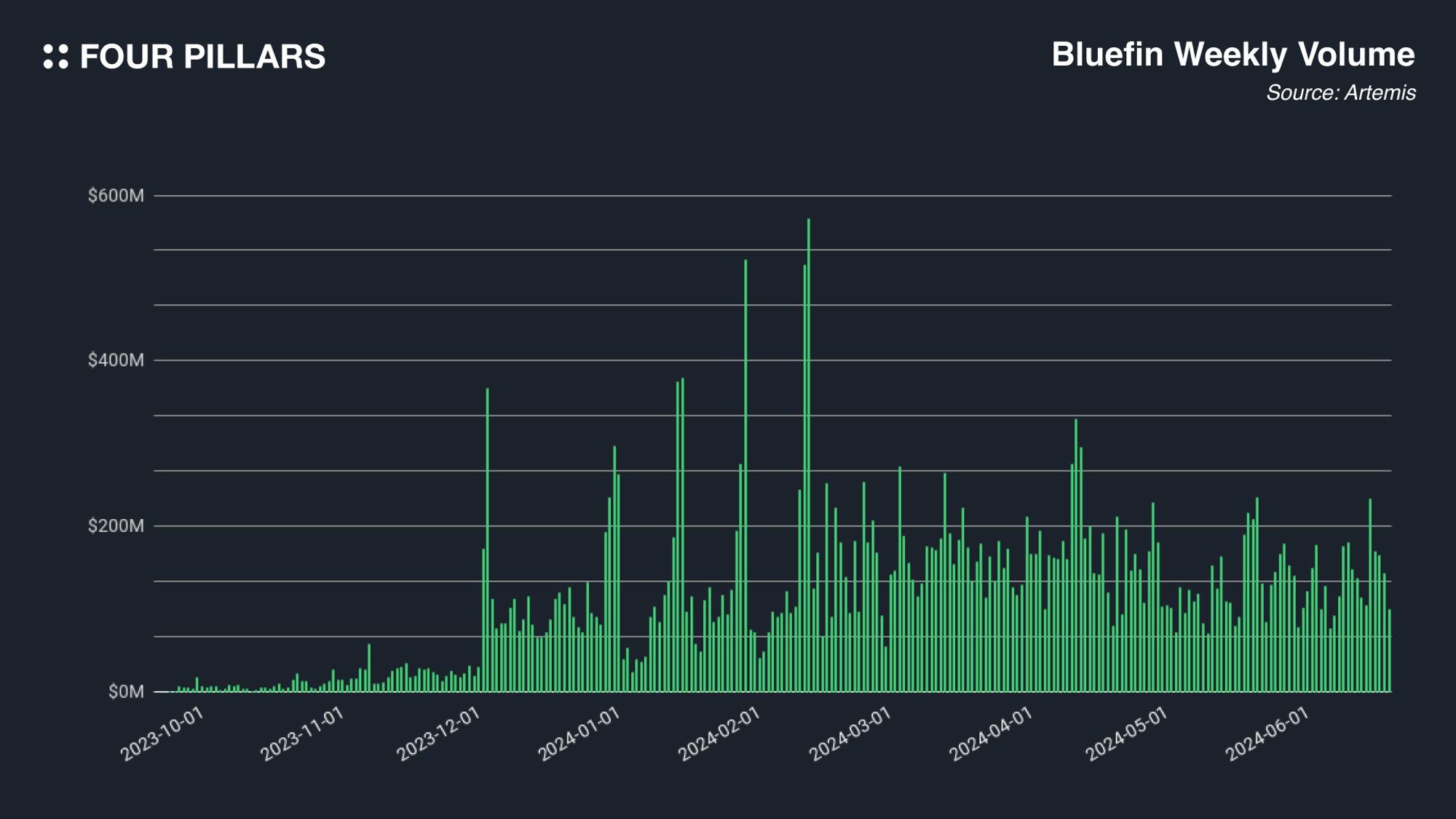

Weekly trading volume has also shown a rapid increase since the launch on Sui in October. In February, the trading volume peaked at $2 billion, showcasing the platform's growing popularity and the increasing trust of users in its services. Currently, the weekly trading volume ranges between $500 million and $1 billion, indicating sustained high activity and continuous user engagement.

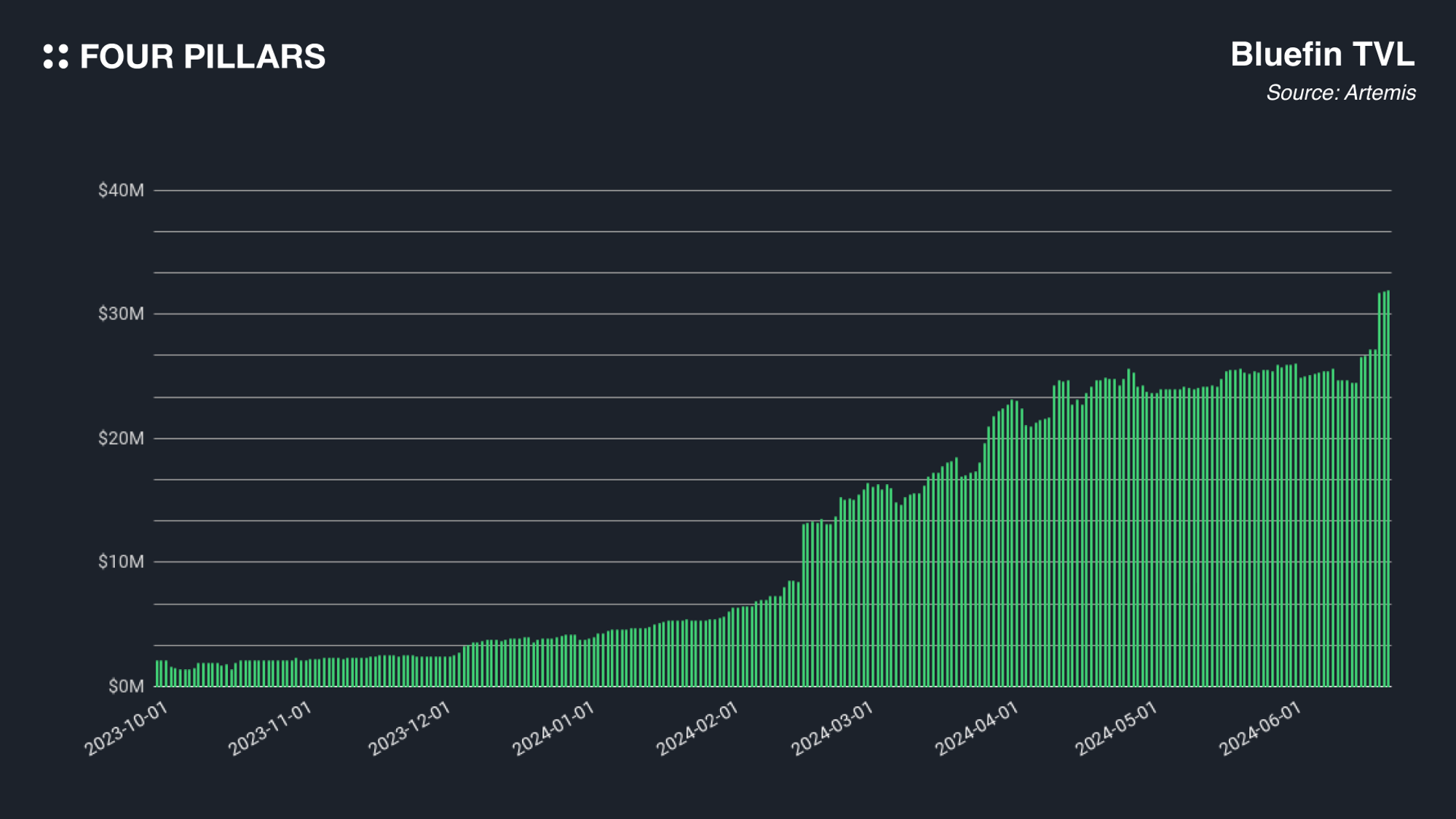

A significant metric that highlights Bluefin's success is its Total Value Locked (TVL). In less than a year, Bluefin's TVL grew from $2 million to $25 million, more than a twelve-fold increase. This growth in TVL reflects the trust and confidence that users place in the platform, as well as the increasing number of assets being traded and held within Bluefin's ecosystem. The platform’s liquidity is provided by some of the world’s leading market makers, including Wintermute, Keyrock and Amber Group, ensuring efficient market making and providing better trading execution.

Source: Bluefin Metrics

The platform's user base has also seen significant growth. With approximately 30,000 cumulative users and about 2,000 weekly active users, Bluefin is not only attracting new traders but also retaining them. This high level of user engagement highlights the superior user experience offered by the platform, which is crucial for maintaining a loyal user base and ensuring continuous growth.

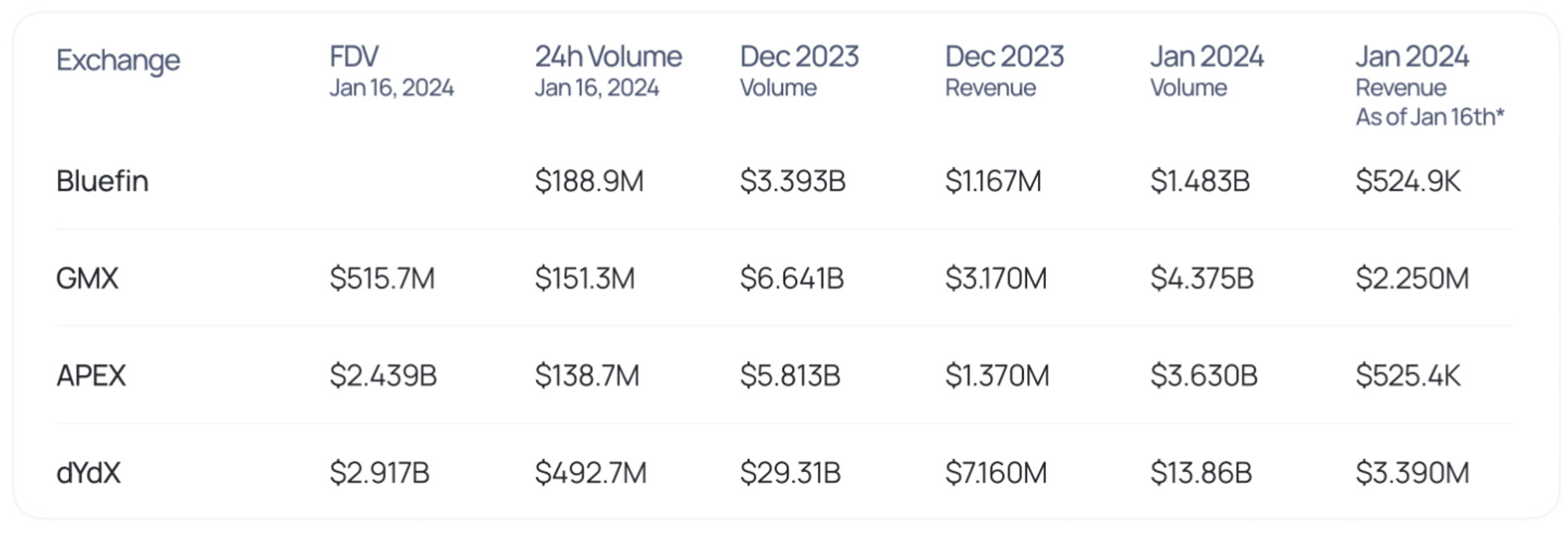

Souce: Bluefin

Comparing Bluefin's performance with other competitors, the results are quite remarkable. Although Bluefin was launched relatively recently and operates on Sui, which has a smaller user base compared to other major blockchains, its metrics are quite comparable with top leaders in the market. Bluefin recorded a trading volume of $3.4 billion in December, which is more than half of what major protocols like GMX and APEX achieved. The total revenue of the protocol exceeded $1 million, placing it even closer to its heavy-weight competitors. Given the dynamic and fragmented market conditions of the Perp DEX sector, Bluefin's presence is expected to grow further. The platform is poised to extend its reach not only within the Sui network but also across the overall perpetual market, leveraging its strong performance and innovative features.

The metrics collectively illustrate Bluefin's strong performance and its ability to scale effectively. The platform's growth in market share, trading volume, TVL, and user base underscores its position as a leading player in the DeFi space. By continuously enhancing the user experience and expanding its features, Bluefin is well-positioned to maintain its competitive edge and drive further growth in the decentralized trading ecosystem.

Orderbooks have long been recognized as the best mechanism for price discovery, a concept dating back to the inception of organized stock exchanges in the late 16th and early 17th centuries. Despite technological evolutions, the fundamental value of orderbooks in recording and organizing buy and sell orders has remained consistent.

After evaluating various designs such as Automated Market Makers (AMMs), virtual AMMs, bonding curves, and peer-to-peer (P2P) protocols, Bluefin chose an orderbook design due to its performance, flexibility, and scalability advantages. Bluefin's current setup combines a decentralized on-chain trading engine with an off-chain orderbook. This hybrid approach allows smart contracts to function independently of the orderbooks, enabling fully on-chain permissionless trading while the off-chain orderbook efficiently matches orders and sends them to the on-chain settlement engine for execution.

Advantages of using off-chain orderbook model as liquidity provision include:

Performance: Off-chain orderbooks provide high-performance trading experiences with low-latency order execution and efficient matching, essential for effective price discovery

Flexibility: They support a broader range of trading strategies, including algorithmic trading and market-making conditional orders, which can be slow or costly with AMMs or on-chain orderbooks

Scalability: Off-chain orderbooks can handle tens of thousands of order-creation and cancellation requests per second without impacting the performance of the underlying blockchain

Security: While maintaining the security and transparency of decentralized systems, off-chain orderbooks allow users to retain control of their funds. Orders are cryptographically signed and verified off-chain and subsequently confirmed on-chain before settlement to ensure integrity

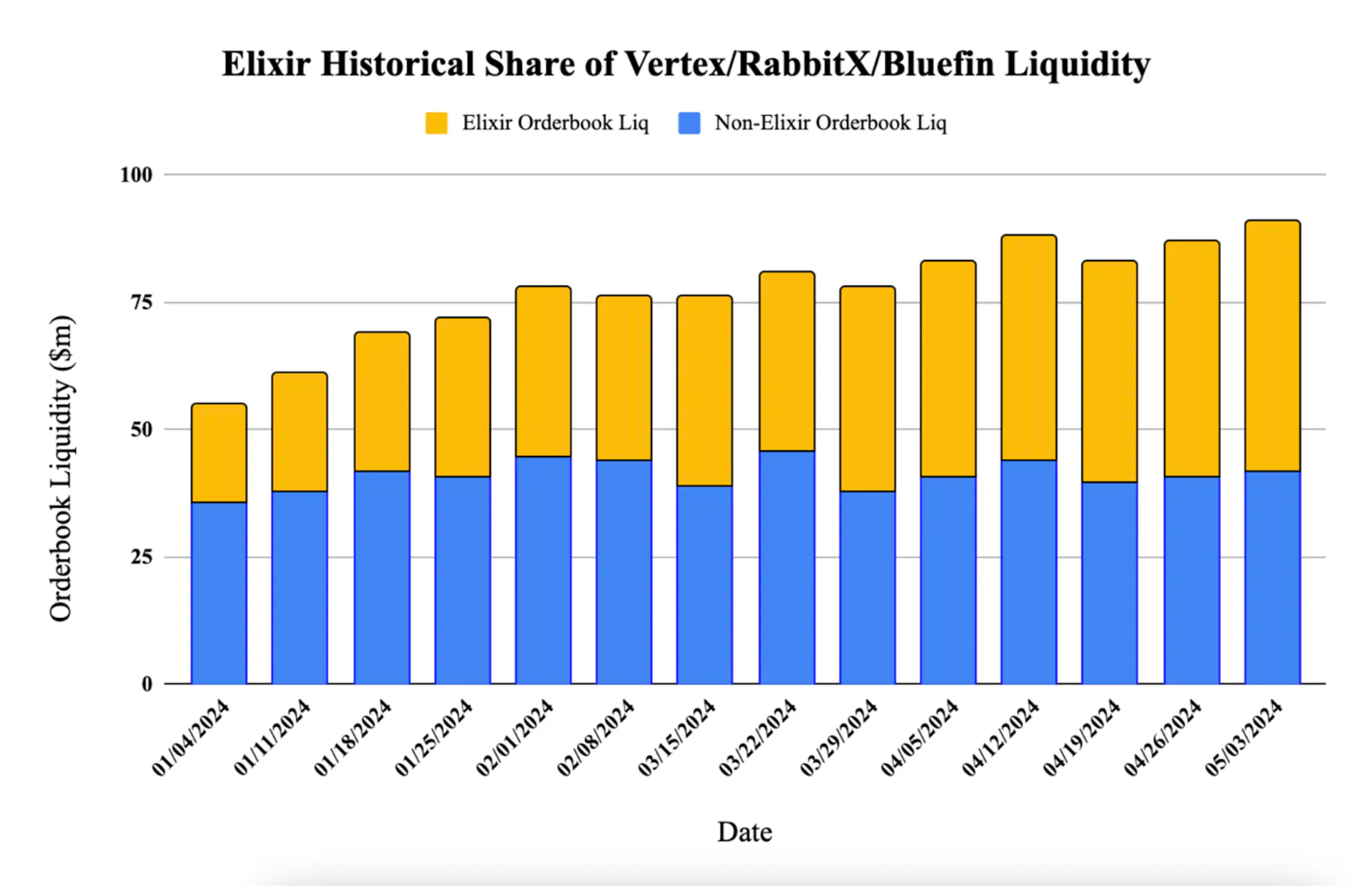

Alongside with their off-chain orderbook model, Bluefin uses two primary methods to provide liquidity: Elixir Protocol and Sui’s DeepBook.

2.3.1 Elixir Protocol

Source: Elixir Network by the Numbers

Elixir serves as Bluefin's primary liquidity engine, supplying most of the liquidity through a decentralized orderbook mechanism. Unlike AMMs, which rely on liquidity pools, orderbook DEXes like Bluefin require continuous submission and adjustment of orders by liquidity providers. Elixir measures real-time variables such as price volatility, the state of the order book, and inventory risk to provide a liquidity experience similar to Constant Product Market Makers (CPMM).

Elixir uses two key algorithms to manage liquidity: the Benchmark Price Setting Algorithm and the Spread Setting Algorithm. The Benchmark Price Setting Algorithm sets an appropriate base price for token pairs, considering inventory risk and volatility. The Spread Setting Algorithm establishes the spread between buy and sell prices based on these factors. These methods ensure stable liquidity provision and manage inventory risk, similar to CPMM, while compensating through arbitrage profits and incentives.

2.3.2 Sui’s DeepBook

Source: Deepbook

DeepBook is Sui's native liquidity layer, providing foundational support for token trading activities. Operating as a decentralized and permissionless environment, DeepBook offers transparency, a full range of trading options, and user privacy. It acts as the infrastructure for financial projects building on the Sui network, adding layers of composability through bootstrapping, liquidating, and matching services.

DeepBook incentivizes liquidity providers to improve the quality and depth of the order book, resulting in better order prices for all market participants. By integrating with various DeFi protocols, DeepBook serves as a one-stop shop where users can access a wide range of financial services.

DeepBook operates like a digital ledger within the Sui network, recording bids and asks in chronological order. The system automatically connects buyers and sellers, ensuring efficient and accurate transactions. The transparency and fairness provided by DeepBook offer a foundation for users to monitor trading activities or conduct detailed analyses. While DeepBook itself does not provide a user interface for direct token trading, it includes embedded trading functionality, enabling seamless integration with other DEXs, wallets, and applications to deliver a more comprehensive trading experience to users.

Bluefin's journey has led to the advancement of its mission to build a professional trading platform accessible to all. The next phase of the Bluefin protocol aims to deliver meaningful value to its community and the broader DeFi ecosystem. Ownership of the Bluefin protocol will extend to the entire community, fostering a decentralized governance model that aligns with the foundational principles of Web3.

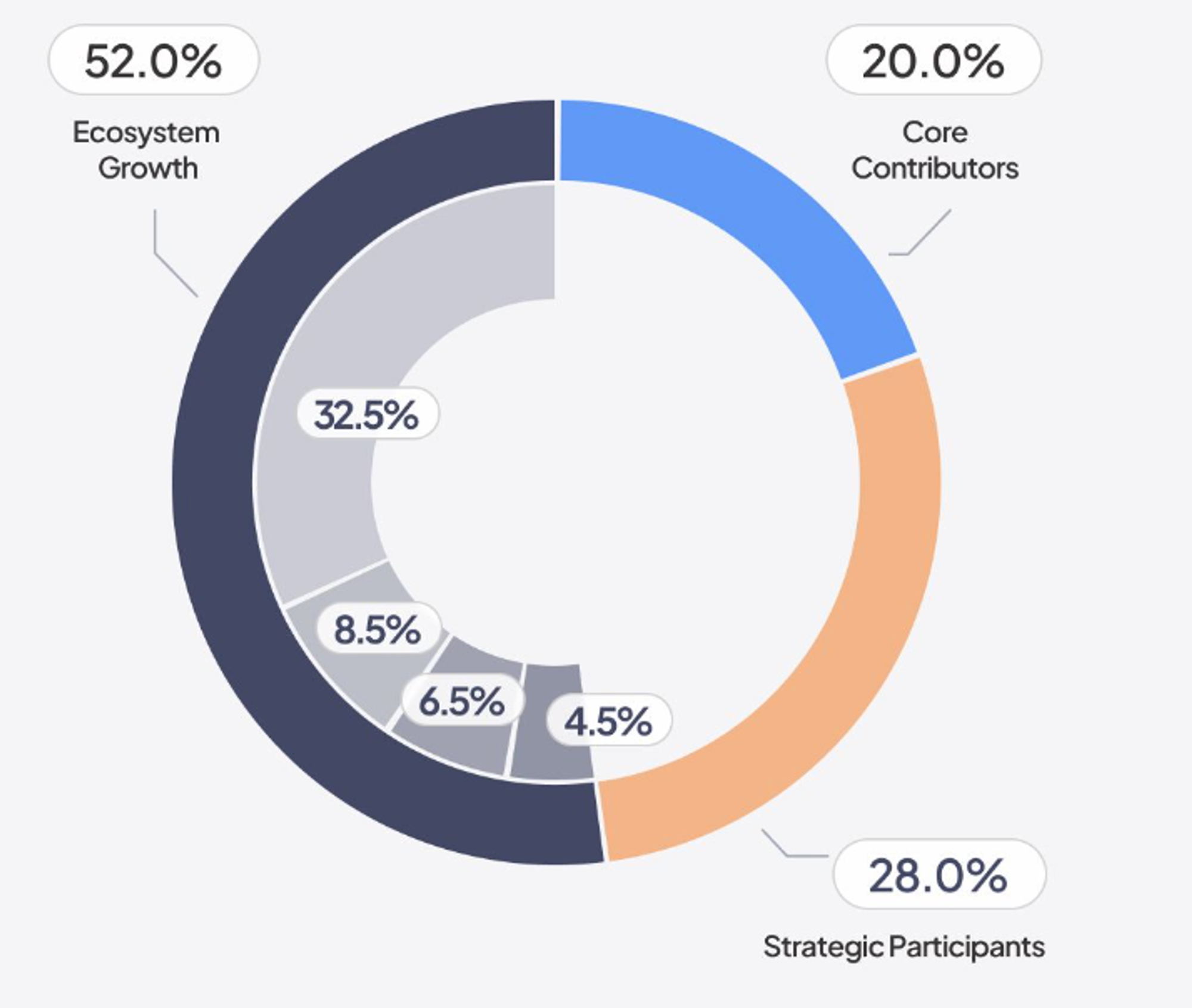

The upcoming launch of the BLUE token will be a significant milestone in Bluefin's journey toward decentralized governance. Bluefin's strategy focuses on aligning incentives among users, contributors, and stakeholders to ensure long-term ecosystem growth and platform integrity. With the token launch, the Bluefin DAO will be established, taking on the role of making key decisions and managing the services of the Bluefin protocol. The Bluefin DAO will democratically determine the direction of protocol development and have the authority to make decisions regarding token issuance, commission rates, protocol upgrades, and market openings.

Source: Bluefin

The BLUE token has a maximum supply of 1 billion tokens, with an initial circulating supply of 150,700,000. The BLUE tokens have been distributed across various categories to ensure the growth and stability of the Bluefin protocol. The largest allocation, 52% of the total supply, is dedicated to ecosystem growth, focusing on the long-term development of the Bluefin ecosystem. Initiatives for Ecosystem growth includes user incentives to promote platform adoption, funds for ongoing protocol development, and reserves to ensure liquidity and operational stability. Among these, user incentives takes the biggest portion of 32.5%, which will be vested over next 5 years. Strategic partners, including market makers, are allocated 28% of the tokens, as they play a crucial role in supporting Bluefin's growth. Lastly, the core contributors, who have been pivotal in the development and success of Bluefin, receive 20% of the token supply, ensuring that those who build and enhance the platform are adequately incentivized.

Bluefin stands out not only for its superior trading environment but also for its rich array of features that make the platform uniquely appealing. It is important to note that features described in this section only represent status quo of Bluefin as is. Bluefin is planning to introduce its users with much powerful features and comprehensive platform in near future. Detailed vision and roadmap of Bluefin are depicted in the section below.

2.5.1 Wallet Abstraction

Source: Onboarding Made Simple with zkLogin

One of Bluefin's key features is the elimination of the need for traditional wallets, significantly simplifying the user experience. By leveraging Sui's zkLogin functionality, Bluefin allows new users to create addresses using their Google or Apple login credentials. Sui's native zkLogin uses zero-knowledge proofs to encrypt user identity, ensuring privacy and security while providing an excellent user experience. Wallet abstraction through zkLogin enables a Web2-level trading experience while maintaining the benefits of decentralization inherent in an on-chain protocol. Existing DeFi users can still connect their traditional wallets, but zkLogin offers a seamless onboarding option for new users without the security risks associated with storing IDs or passwords.

zkLogin enhances user convenience by using temporary keypairs and zero-knowledge cryptography to link Web2 authentication providers' responses to specific Sui accounts. This method allows users to engage with dApps built on Sui as easily as signing in with familiar web credentials. Application developers can choose to use invisible wallets, making blockchain interactions fully abstracted from the user, or offer simpler access to on-chain assets. This approach lowers the barrier to entry for new users who may be intimidated by the complexities of traditional crypto wallets, thereby broadening the platform’s user base.

2.5.2 Stable Pools

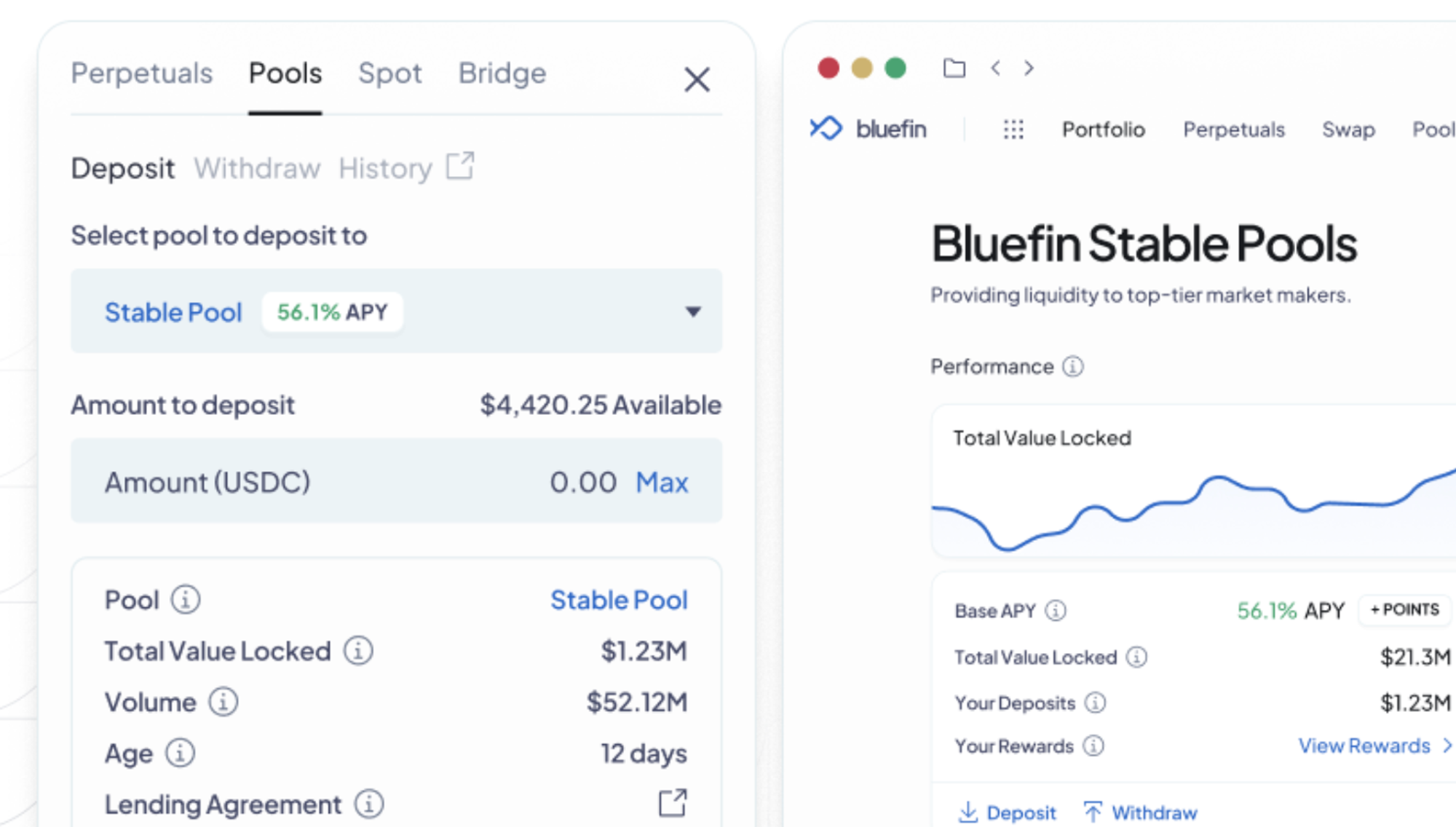

Source: Bluefin Docs

Recently launched, Bluefin’s stable pool is a liquidity pool managed by professional market makers, designed to provide optimal returns to liquidity providers with minimal risk. The stable pool is designed to maintain stability and efficiency in the relatively challenging order book-based environment, benefiting both traders and liquidity providers. Liquidity in the stable pool is accessible only through non-custodial accounts managed by verified market makers, eliminating the risk of users' funds being compromised.

Moreover, these market makers take on the profit and loss (P&L) risk, protecting users from potential downsides. This means that if the market maker incurs losses, it is their responsibility to cover these losses, ensuring that the users' funds are safeguarded. This arrangement provides an added layer of security and trust for users, knowing that their investments are protected from adverse market movements.

2.5.3 Risk Management

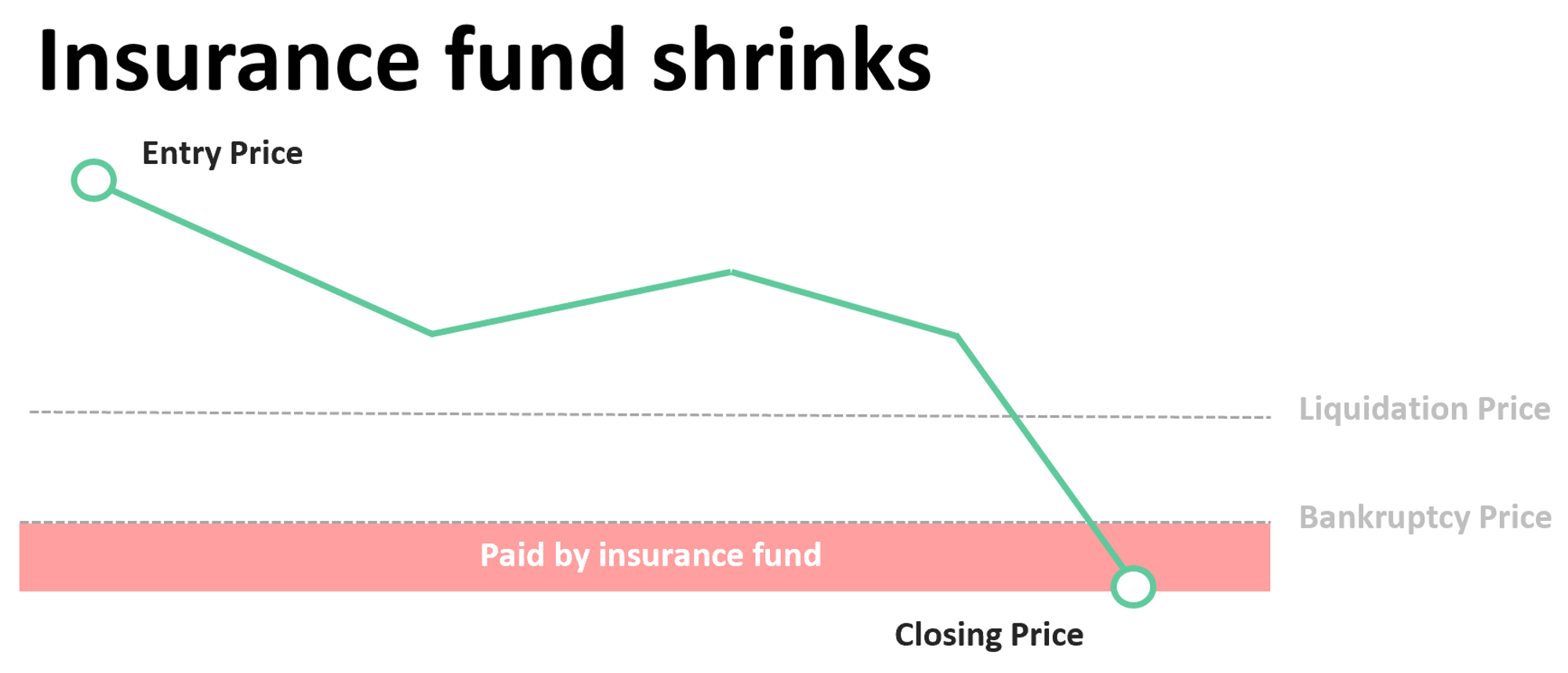

Source: Basics of Insurance Funds & Auto Deleveraging

Bluefin's risk management system is designed to protect the exchange's solvency and fairness while enabling leveraged trading. The multi-layered approach includes liquidations, insurance funds, and auto-deleveraging (ADL) to manage the risks associated with leveraged trading and potential capital drawdowns.

Liquidation

This first layer clears under-collateralized positions to prevent exchange-wide capital drawdowns. When a trader's margin falls below the required level, third-party liquidators step in to liquidate the position, maintaining the exchange's solvency. This process helps to mitigate the risk of systemic failure and ensures that all participants in the market are protected from the consequences of individual traders' actions.

Insurance Fund

Serving as a capital buffer, the insurance fund covers losses from bankrupt liquidations. It reassures winning traders that their profits are protected, maintaining platform stability and fairness. Each trading pair has a dedicated insurance fund to manage risks independently. The insurance fund is capitalized by contributions from all traders who experience liquidations, spreading the risk and ensuring that the platform can absorb shocks from significant losses.

Auto-Deleveraging (ADL)

ADL is the final defense, activating when a position cannot be closed above the bankruptcy price and the insurance fund is insufficient. A permissioned ADL worker automatically deleverages bankrupt positions against top-of-queue positions from the opposite side, prioritizing the most profitable and high-leverage traders to reduce counterparty risk. This mechanism ensures that the most at-risk positions are closed first, minimizing the impact on the overall market and protecting the platform's integrity.

The 3-layered risk management system ensure Bluefin remains solvent and fair, safeguarding traders from the inherent risks of leveraged trading and providing a secure trading environment. By employing a comprehensive risk management system, Bluefin demonstrates its commitment to maintaining a stable and reliable trading platform for all users.

2.6.1 Building A Comprehensive Trading Ecosystem

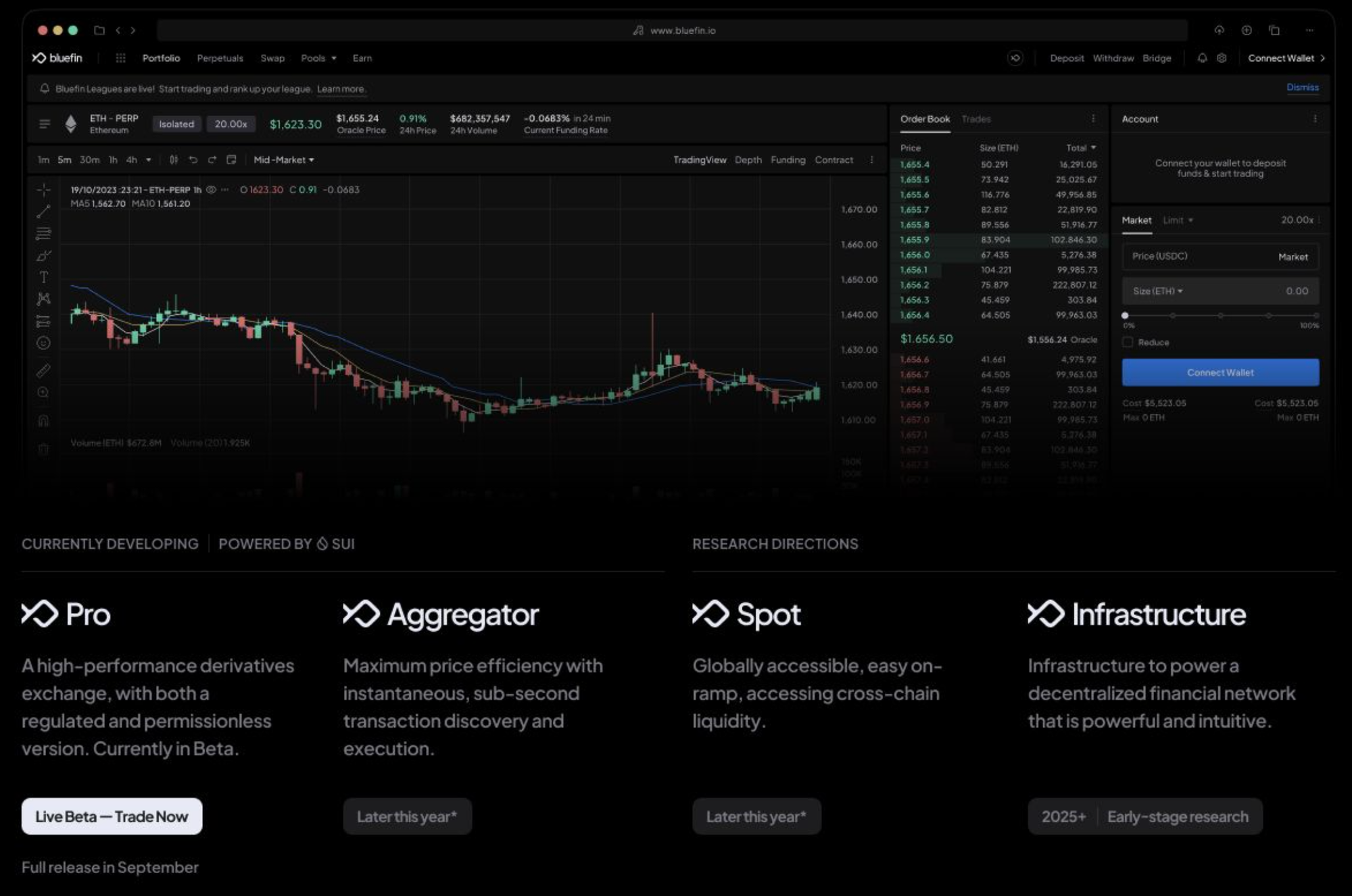

Source: Bluefin

Currently operating in its Beta phase, Bluefin focuses on derivatives trading but aims to evolve into a comprehensive decentralized trading platform. The platform envisions creating a space where nearly every onchain trading activity can take place, transforming from a mere perpetual DEX to a robust financial ecosystem. Ambitious vision of Bluefin reflects its commitment to addressing the limitations of current DeFi platforms and setting new standards in the industry. By integrating a variety of trading features and services, Bluefin seeks to provide users with a seamless and efficient trading experience that rivals centralized exchanges.

By expanding beyond derivatives trading, Bluefin aims to capture a broader user base, including retail and institutional investors, as well as developers seeking a versatile and scalable platform. Bluefin's strategic shift is expected to boost user engagement and liquidity, elevating its position as a leader in the overall DeFi space. Additionally, by addressing the issues of limited throughput and liquidity fragmentation that currently plague the DeFi ecosystem, Bluefin is set to provide a more integrated and consistent trading environment. This approach will not only enhance overall user satisfaction but also contribute to the growth and maturation of the entire ecosystem. The services that Bluefin aims to offer through its comprehensive trading platform are as follows:

Aggregator

One of Bluefin's key features will be a DEX aggregator, designed to ensure maximum price efficiency with near-instant transaction settlement and finality. On an integrated chain like Sui, where all assets are located on a single chain, the aggregation feature can possess significance. This setup contrasts with Ethereum, where assets are often dispersed across multiple chains, leading to inefficiencies and higher costs. By consolidating assets on a single chain, Bluefin’s aggregator can offer users the best possible prices and transaction speeds. This feature is expected to launch in the coming weeks, marking a significant milestone in Bluefin’s development.

Spot Trading

Bluefin is also set to introduce a spot trading feature, which will provide a globally accessible, easy on-ramp and cross-chain functionality. This feature aims to simplify the onboarding process, allowing users to access multiple chains seamlessly without fragmentation. Scheduled for implementation later this year, spot trading will enable users to trade assets across different blockchains effortlessly, significantly improving the overall user experience and accessibility of the platform.

Infrastructure

To support its ambitious vision, Bluefin is developing a robust infrastructure layer designed to underpin a decentralized financial network. This infrastructure will serve as the foundation for various DeFi protocols, ensuring that they have the necessary liquidity and efficiency to operate effectively. While still in the research phase, this infrastructure layer is expected to be delivered in the next year. By providing a solid foundation, Bluefin aims to power a new generation of decentralized trading services, ensuring that the platform can scale and adapt to future demands.

2.6.2 Drawing Parallels with Jupiter's Success on Solana

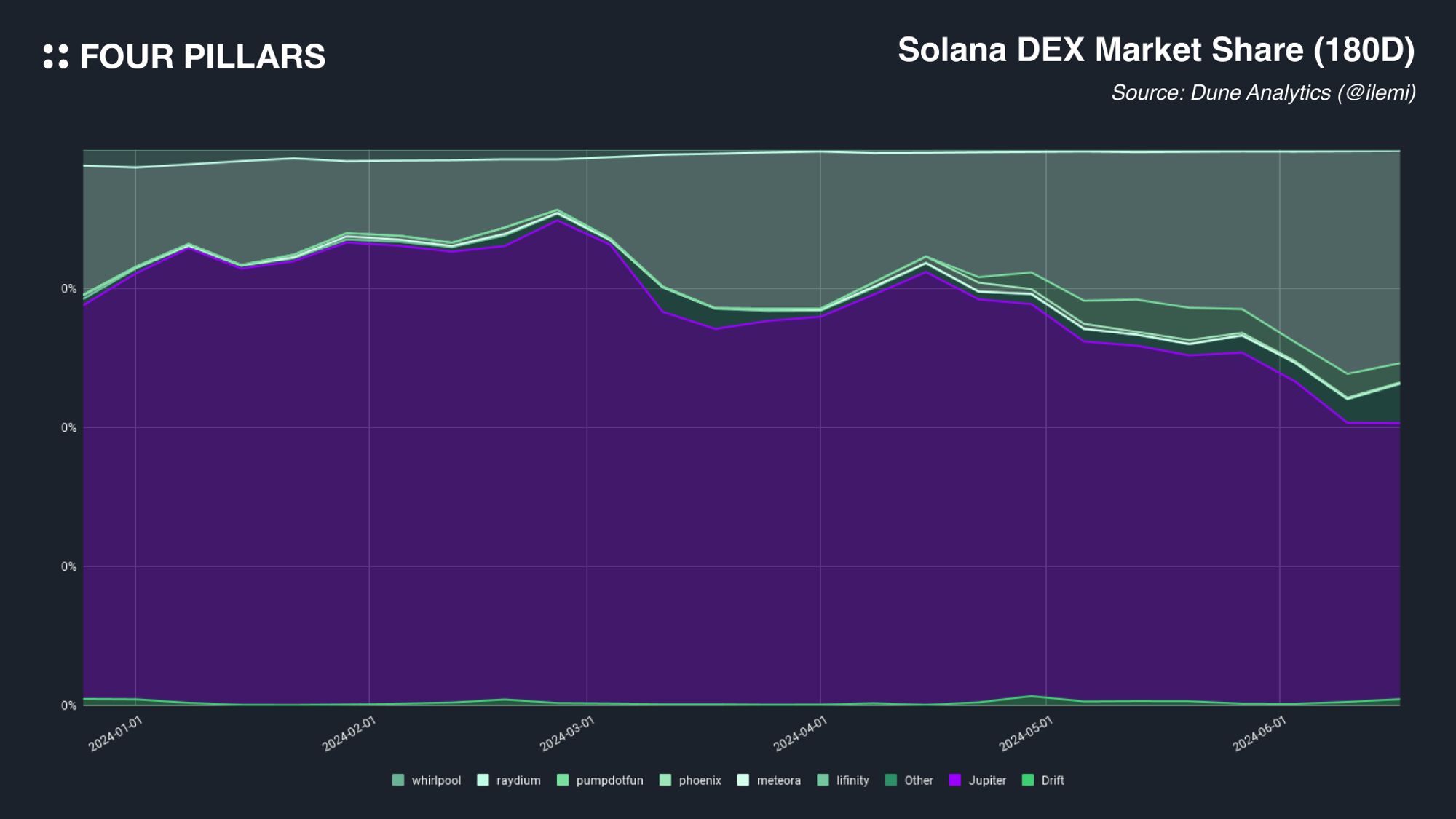

Jupiter is considered one of the most notable projects in the revival and expansion of the Solana ecosystem since the last year. As the Solana ecosystem expanded, Jupiter effectively captured a significant market share and user base. Jupiter's rapid growth was marked by the launch of its token, JUP, which further fueled its expansion. Today, Jupiter aggregator alone handles approximately 60-70% of the total organic volume on Solana, processing over $1 billion on a weekly basis. Remarkable growth of Jupiter can be attributed to the synergistic expansion of the Solana ecosystem, combined with its powerful features and excellent user experience, making it a default destination for trading and swapping.

Bluefin shares many similarities with Jupiter in this regard. Both platforms offer comprehensive solutions for on-chain financial activities, extending beyond simple aggregation to include a variety of trading and financial services. Second, the key factor in the success of both Jupiter and Bluefin is their focus on high-performance blockchains and a user-centric strategy. The similarities also lies in that both teams had endured harsh market conditions and committed a prospective ecosystem from early on. Finally, by implementing features that enhance trading efficiency and user experience to a level comparable to centralized services, both platforms have positioned themselves as leaders in their respective ecosystems.

For Bluefin, this trajectory suggests a promising future. Much like Jupiter's "grow the pie" narrative on Solana, Bluefin's critical role in the Sui ecosystem makes it a viable bet for both near and long-term adoption. As the Sui network attracts more users and trading volume, Bluefin is expected to see a proportional increase in its own user base and transaction volumes. The platform's ability to integrate various financial services into a seamless user experience, combined with the robust performance of the Sui blockchain, positions Bluefin as a formidable player in the DeFi space.

As mentioned earlier, the Bluefin team did not initially plan to build on the Sui platform. They began in the Polkadot ecosystem, moved through Arbitrum, and eventually transitioned to Sui, making them a rather unique case. Bluefin had numerous options and plenty of time. In some ways, the EVM ecosystem, where they originally built their services, might have been an easier and more efficient choice. Nonetheless, they made the adventurous decision to move to Sui. Why did they choose Sui?

“Bluefin’s vision was to create a decentralized exchange without technical tradeoffs. Early on, we heard Evan and other founders on a podcast discussing their goal of building a “blockchain with no tradeoffs” Surprisingly, our visions aligned perfectly. Once we confirmed their genuine commitment to this vision, building on Sui was the obvious choice(There may be some paraphrasing for the sake of clarity).”

Rabeel Jawaid, Co-Founder of Bluefin @ Logan’s Podcast (23:00)

Reading this article, one can realize that Bluefin is not merely another team attempting to create a decentralized exchange. They aim to build an exchange without the technical compromises that have plagued previous decentralized exchanges. However, achieving this vision is challenging for any team building an application, as they are inherently dependent on the performance of the underlying infrastructure. To build an exchange without technical compromises, the infrastructure they use must also overcome the inherent trade-offs of blockchain technology.

This is why they focused on Sui. From its inception, Sui has advocated being a “blockchain with no trade-offs” Of course, if this claim were merely rhetoric, Bluefin would not have chosen the Sui network. Therefore, it’s essential to examine the efforts Sui is making to create a “blockchain without tradeoffs.”

The distinguishing infrastructural features of the Sui network are its Object-Centric Data Storage Model and Horizontal Scaling in consensus. These two differentiators are expected to maintain the core values of blockchain while achieving the ideal scalability and latency envisioned by Bluefin. Let’s examine these two characteristics in order.

3.1.1 Sui’s Object-Centric Model

When we say that Sui is object-centric, we are referring to the structure of its storage. Unlike traditional blockchains, where the basic unit of storage is the account, Sui’s object model changes this basic unit to objects. In this context, “account” refers to blockchain user accounts and smart contract accounts, similar to account numbers in bank accounts. In traditional blockchains, NFTs and tokens are stored under accounts, whether user accounts or smart contract accounts. However, in Sui, each object is assigned a unique ID and can move independently of blockchain accounts. For instance, if there is an object called “CoolAsset,” it would have a unique ID like “AssetID123,” and this ID is stored in the global storage, referencing the object regardless of who owns it or which address it is associated with.

The reason this object structure is crucial for creating a “blockchain without tradeoffs,” as mentioned earlier, is due to the concept of Owned Objects. In Sui’s object-centric model, an Owned Object refers to an object that is owned by a single owner, and only the owner can read or write to it. Because of this structure, transactions related to Owned Objects can be processed without going through global consensus. This is because state changes involve only the state values related to the specific object. Thanks to these Owned Object transactions, Bluefin can process transactions instantly on the Sui blockchain and even process transactions in parallel if they are unrelated to each other.

Moreover, Sui’s consensus structure is also markedly different from other blockchains, so let’s delve into Sui’s consensus model as well.

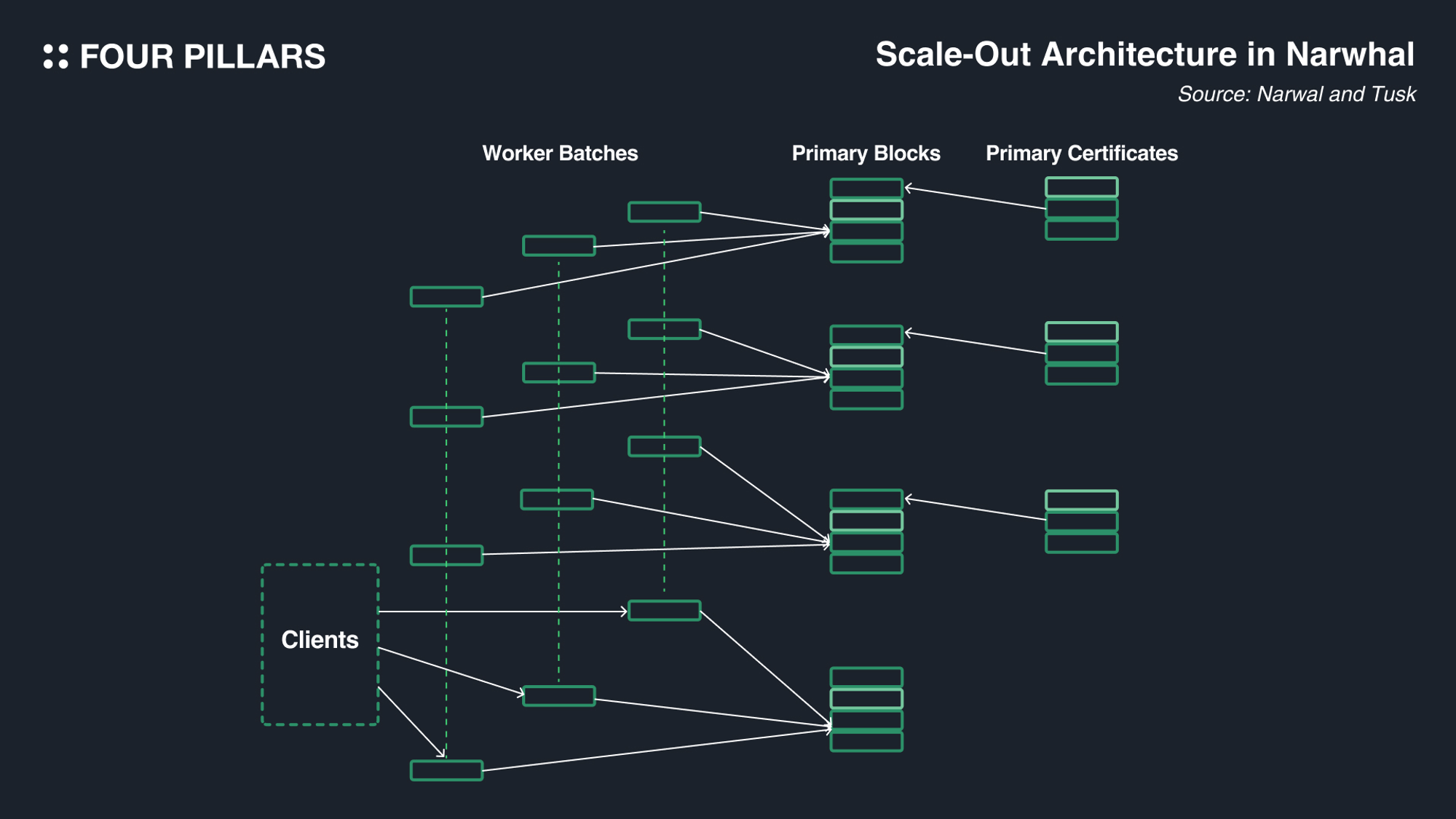

3.1.2 Horizontal Scalability

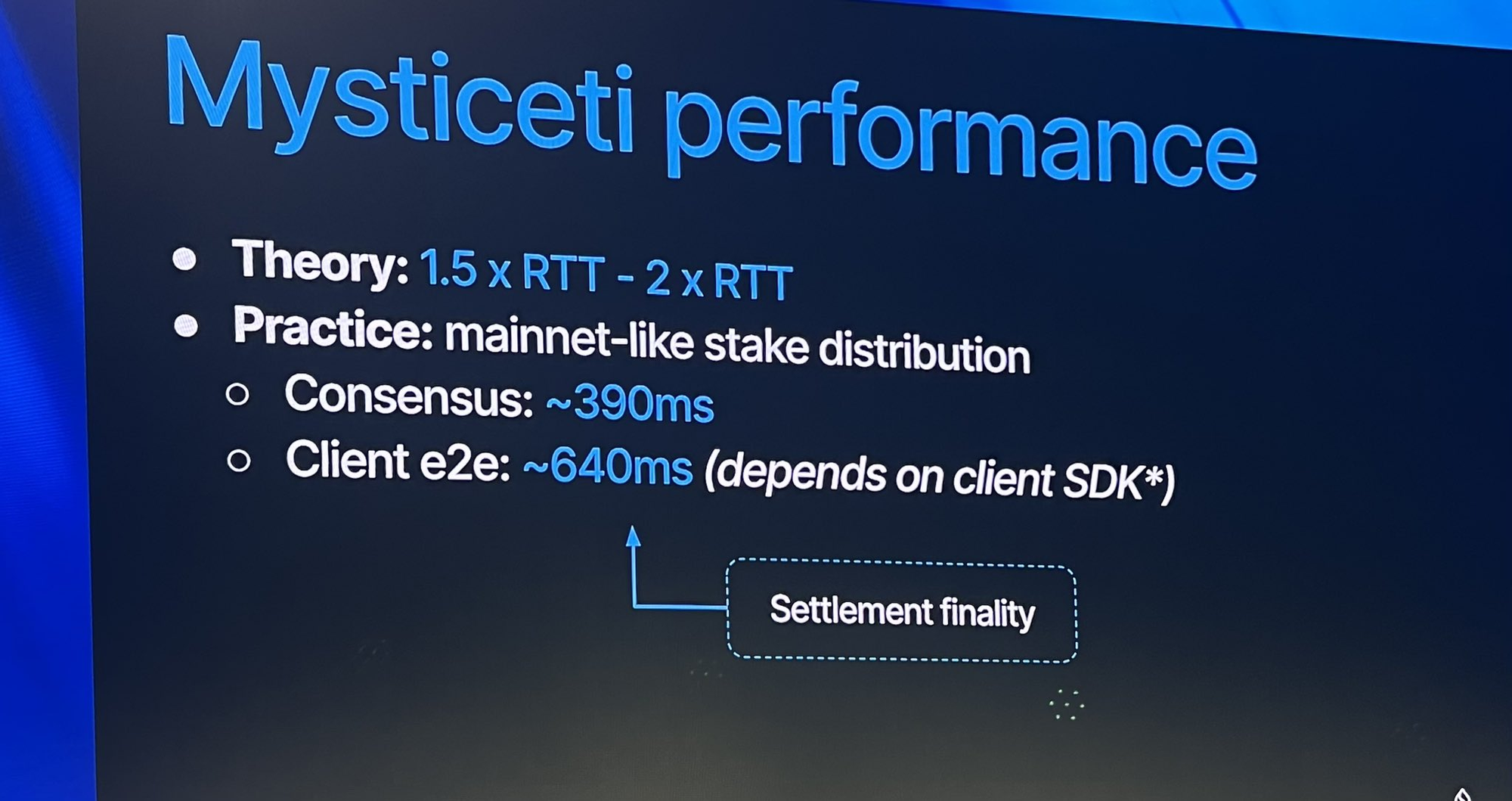

The term “scalability issue” is rarely used in the context of the Sui blockchain. This is because, if users generate a high volume of transactions that exceed the current capacity of validators, additional machines called “Workers” can be added to process transaction propagation in parallel. Currently, Sui does not have multiple Worker machines because there has not yet been a demand for transactions that would necessitate their addition. However, if Sui determines that the transaction demand has increased to the point where adding Worker machines is necessary, Sui’s validators can add these machines at the consensus level to handle the increased demand. Thus, when discussing speed in the Sui blockchain, it is more important to address the “latency” issue that arises as validators increase, rather than scalability problems. Therefore, the Sui team focuses extensively on researching consensus models that can effectively reduce latency, leading to the development of a new consensus engine called Mysticeti.

Source: X(@alonsodegortari)

With the introduction of Mysticeti, the consensus finality time is reduced to approximately 0.39 seconds, making it one of the fastest among existing blockchains. With the V3 launch coinciding with the upcoming Mysticeti upgrade of Sui, the platform aims to deliver superior technology while simplifying the user experience. Bluefin V3 will achieve several key improvements including:

Cross-Margin Support: Enables more efficient use of capital across multiple positions.

30ms Trade Confirmations: Users will experience rapid trade confirmations, with the system supporting up to 30,000 transactions per second.

400ms On-Chain Finality: Ensures the platform remains efficient and responsive, even during high-volume periods.

Low Gas Costs: Trade calls typically use 1,000 to 2,000 gas units, averaging around $0.01. The Bluefin Foundation will cover these gas expenses, further enhancing the user experience.

This demonstrates that Sui is continuously improving both scalability issues (by being able to add worker machines) and latency issues (through the development of a new consensus engine), which will greatly impact Bluefin’s performance enhancement. The development of Mysticeti is also evidence that Sui is continuously researching to create a more efficient consensus engine even after launching its mainnet. As they progress, Bluefin will have the potential to offer an even better user experience.

The Bluefin team recognized that Sui was not merely making claims about having no tradeoffs. They understood that Sui and Bluefin shared the same vision and appreciated the efforts the Sui team was putting into achieving this vision. This alignment of vision and dedication ultimately led Bluefin to choose the Sui blockchain.

“Once the technical issues are largely resolved, the next crucial aspect is the people. One of the most convincing moments for us was when we had discussions with the Mysten team. Whenever we asked engineering-related questions, they never evaded answering. Moreover, the person providing those answers was not just any developer we didn’t know, but Sam Blackshear, the CTO of Mysten Labs and the creator of the Move language. During our conversations with him, we could truly sense his passion for Sui and its technology(There may be some paraphrasing for the sake of clarity).”

-Ahmad Jawaid, Co-Founder of Bluefin @ Logan’s Podcast (21:42)

While the advanced technology of Sui certainly played a significant role in onboarding the Bluefin team, the people involved were ultimately the most crucial factor. Bluefin values working with "great people" above all else, and this was a key reason they chose to onboard with Sui. Being builders familiar with the EVM (Solidity), the Move programming language was quite unfamiliar to them. As mentioned earlier, Sui's structure is fundamentally different from traditional blockchains, making it a very unfamiliar ecosystem for the Bluefin team. However, despite this unfamiliarity, Sam Blackshear, the CTO of Mysten Labs, provided invaluable support and feedback, essentially acting as part of their team. Given that Sam is one of the foremost experts on Sui’s architecture and its programming language, Move (which he created), his detailed responses and immediate feedback were instrumental. This demonstrated how much the Sui team wanted to onboard them into the Sui ecosystem.

Impressed by this level of dedication, the Bluefin team decided to choose the Sui network even before Sui launched its testnet (during the devnet phase). They opted to launch their product on the Sui network, even if it meant a delay in the mainnet launch. Their decision proved to be the right one. As mentioned in this article, Bluefin experienced remarkable growth in both transaction volume and user base after transitioning to Sui.

The story of Sui’s co-founders working closely with early projects is not unique to Bluefin. When I spoke with teams like Turbos Finance, they also recounted how much assistance they received from the Sui team. Ultimately, while technology is important, the proactive support in helping teams understand and adopt that technology is a key reason why projects have chosen Sui.

"Derivatives trading in DeFi requires high-performance blockchains and no decentralized protocol has yet matched the success of a leading centralized exchange because of the user experience challenges with onchain trading. We’re going to change that, and Sui enables us to do so.”

-Rabeel Jawaid, Co-Founder of Bluefin

Among the numerous new DeFi protocols emerging today, Bluefin stands out with a notable presence. Particularly in the Sui ecosystem, Bluefin alone accounts for over 70% of the market share, with weekly trading volumes exceeding 1 trillion KOW (1 billion USD), making these achievements highly noteworthy. In the context of the Layer 1 competition, with platforms like Aptos and Sei Network, there are currently no competitors offering services comparable to Bluefin’s. The user-friendly services provided by Bluefin are expected to continue to stand out significantly in the future. Additionally, the Bluefin team’s long-standing efforts to deliver an exceptional trading experience seem to be paying off, supported by Sui’s user-centric infrastructure features, such as zkLogin.

As I have already emphasized, Bluefin’s strengths will further improve as the underlying infrastructure it operates on continues to develop. Leveraging the advantages of the Sui network, Bluefin now aims to realize a vision beyond just being an exchange, aspiring to become a comprehensive financial network.

The journey of Bluefin, from its inception as Firefly Exchange to its evolution into a major player on the Sui network, illustrates a remarkable commitment to innovation and user-centric design in the DeFi space. By strategically navigating through various blockchain environments and continuously enhancing its platform, Bluefin has demonstrated its ability to adapt and thrive in a competitive market. Bluefin's success, marked by impressive trading volumes and a significant user base, underscores its potential to redefine standards in decentralized trading. The integration of advanced features like the zkLogin, stable pools, and a robust risk management system, further cements its position as a core player in the space.

Looking forward, Bluefin's vision extends beyond being a perpetual DEX. With plans to introduce a DEX aggregator and spot trading features, alongside a robust infrastructure layer, Bluefin aims to create a comprehensive decentralized financial ecosystem. This strategic expansion will likely drive increased user engagement and liquidity, solidifying its role as a cornerstone of the DeFi landscape.

The alignment of Bluefin’s vision with the technological advancements of the Sui network offers a promising future. Sui’s unique object-centric model and horizontal scalability provide the necessary infrastructure to support Bluefin's ambitious goals. As the Sui network continues to enhance its performance, Bluefin is well-positioned to leverage these advancements, offering users an unparalleled trading experience.

In conclusion, Bluefin's journey is a testament to the power of innovation and strategic alignment with cutting-edge technology. By focusing on user experience and leveraging the capabilities of the Sui network, Bluefin is poised to lead the next wave of decentralized trading solutions. The future holds immense potential, and with its solid foundation and forward-thinking approach, Bluefin is set to shape the landscape of decentralized finance for years to come.

Thanks to Kate for designing the graphics for this article.

Dive into 'Narratives' that will be important in the next year