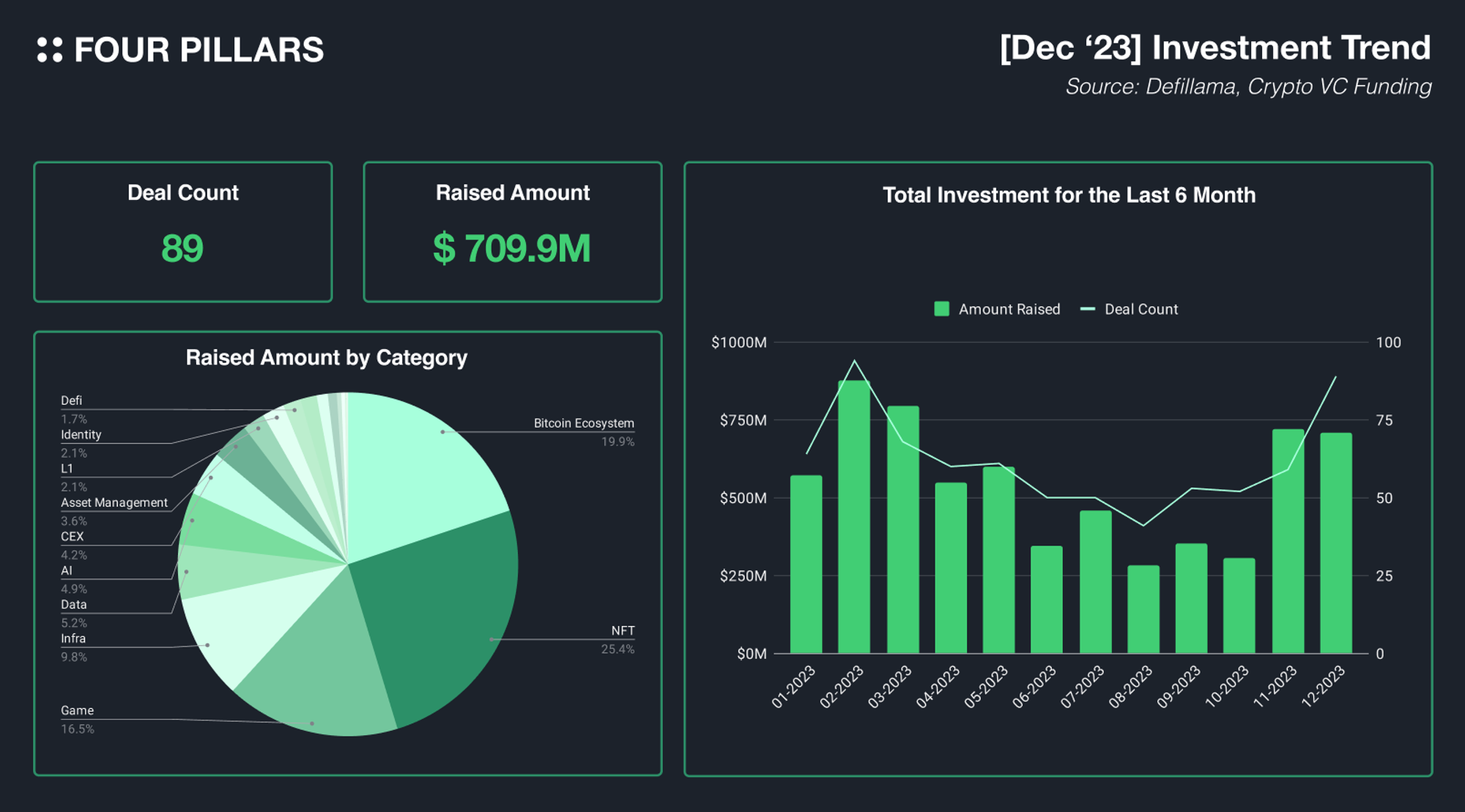

In December 2023, the crypto and Web3 sector witnessed a total investment of $709.9 million, slightly falling short of the previous month's figures. The number of investment deals reached 89, indicating a gradual increase following the lowest count recorded in the last quarter. Despite the investment in the crypto sector not significantly exceeding the levels of 2020, there has been a noticeable easing in overall investment sentiment and a gradual improvement in the crypto market's activity.

A closer look at specific areas reveals that the Bitcoin ecosystem, along with gaming and NFT sectors, attracted considerable investments. The Bitcoin ecosystem alone accounted for 10 investment deals, totaling $140 million, with notable funding secured by entities such as Arkon Energy and Babylon. The gaming and NFT segments are also preparing for the upcoming cycle, as evidenced by the efforts of companies and VCs. Notably, significant investments were made in projects based in South Korea. Crescendo, backed by Peter Thiel, invested a whopping $140 million in Line's Finschia, while Nexon allocated $100 million to support the launch of a new NFT game within the MapleStory Universe. Additionally, Medallion attracted $13.7 million in investments from Dragonfly, Coinbase Ventures, and others, highlighting the growing anticipation for IP or gaming services targeting actual users.

Investments in applications aimed at enhancing user experience are also on the rise. This includes Web3 marketing SaaS like Addressable, wallet solutions such as Rhinestone and Dynamic, and the accounting management solution Tres Finance. As investments in user-focused services continue, the demand for B2B SaaS products is expected to increase. However, compared to early and mid-year, investments in new L1 and L2 infrastructures have significantly decreased in frequency and scale. L1s like Telegram’s TON and QAN protocol did attract new investments, and Ethereum’s L2 focused on NFT, Frame, also secured funding, yet they seem to fall short in garnering market attention.

Although the market appears to be in a downturn, efforts to expand the crypto ecosystem are actively underway from both corporations and VCs. The dominant investment trend in the infrastructure sector earlier this year is gradually shifting towards applications. This shift indicates that the market is now looking forward to services targeting actual users, with commercialization expected in the not-too-distant future.

The Bitcoin network has maintained its position as the leader in market capitalization since its birth in 2008. The scale of its hash rate, essential for the security of the Bitcoin network, is immense. Babylon is a protocol that enables other Proof of Stake (PoS) blockchains to utilize the robust economic security of the Bitcoin network. Babylon offers two main services:

2.1.1 Bitcoin Timestamping

Babylon's first service, Bitcoin Timestamping, is now widely adopted by many projects within the Cosmos ecosystem (including Osmosis, Archway, Sei, Evmos, and others). Using a CosmosSDK-based intermediary layer, Babylon collects checkpoints from various Cosmos ecosystem networks, eventually recording them in the Bitcoin blockchain. This process involves using the OP_RETURN opcode for data storage on the Bitcoin network, ensuring that block hashes and signatures are logged. As a result, PoS networks employing Bitcoin Timestamping periodically have their block data secured on the Bitcoin network.

What advantages do PoS networks gain by storing block data on the Bitcoin network through Babylon? The most tangible benefit is fast unbonding. Most existing PoS networks have a several-day unbonding period when unstaking tokens. This period is crucial to prevent long-range attacks, where a malicious validator could unbond all staked tokens and create a harmful fork from a past block. Without the unbonding period, the protocol cannot penalize the malicious validator. However, if there's an unbonding period, it prevents immediate participation in attacks post-withdrawal and allows the community to reach a social consensus on the right canonical chain.

However, the unbonding period degrades user experience. In the volatile cryptocurrency market, this period poses significant risks to users, deterring them from staking. What if checkpoints could be recorded on the Bitcoin network? If PoS network checkpoints are periodically logged on the Bitcoin network, the most recently recorded block could be finalized by Bitcoin's security. This means the block is no longer vulnerable to long-range attacks, and users need only wait hours, not days, for unbonding. This enhances UX and incentivizes more users to stake.

2.1.2 Bitcoin Staking

Bitcoin Staking, Babylon's second service following Bitcoin Timestamping, can be likened to the Bitcoin version of EigenLayer. EigenLayer introduced the concept of restaking already staked ETH in other PoS protocols. Babylon's Bitcoin Staking allows BTC to be used as a token for maintaining security in other PoS protocols, leveraging the massive market capitalization of BTC.

BTC holders interested in staking create a staking transaction on the Bitcoin network and deposit BTC in a self-custody vault. Once BTC staking is confirmed, stakers can participate in validating other PoS networks and earn interest rewards in the form of the project's tokens. Previously, BTC holders had limited options to earn additional income from their BTC holdings. Babylon's Bitcoin Staking, by enabling native staking without bridging BTC to other networks, opens up a new pathway for additional income and is expected to unleash the vast liquidity of Bitcoin into the blockchain ecosystem.

Souce: A Borderless World: MapleStory Universe

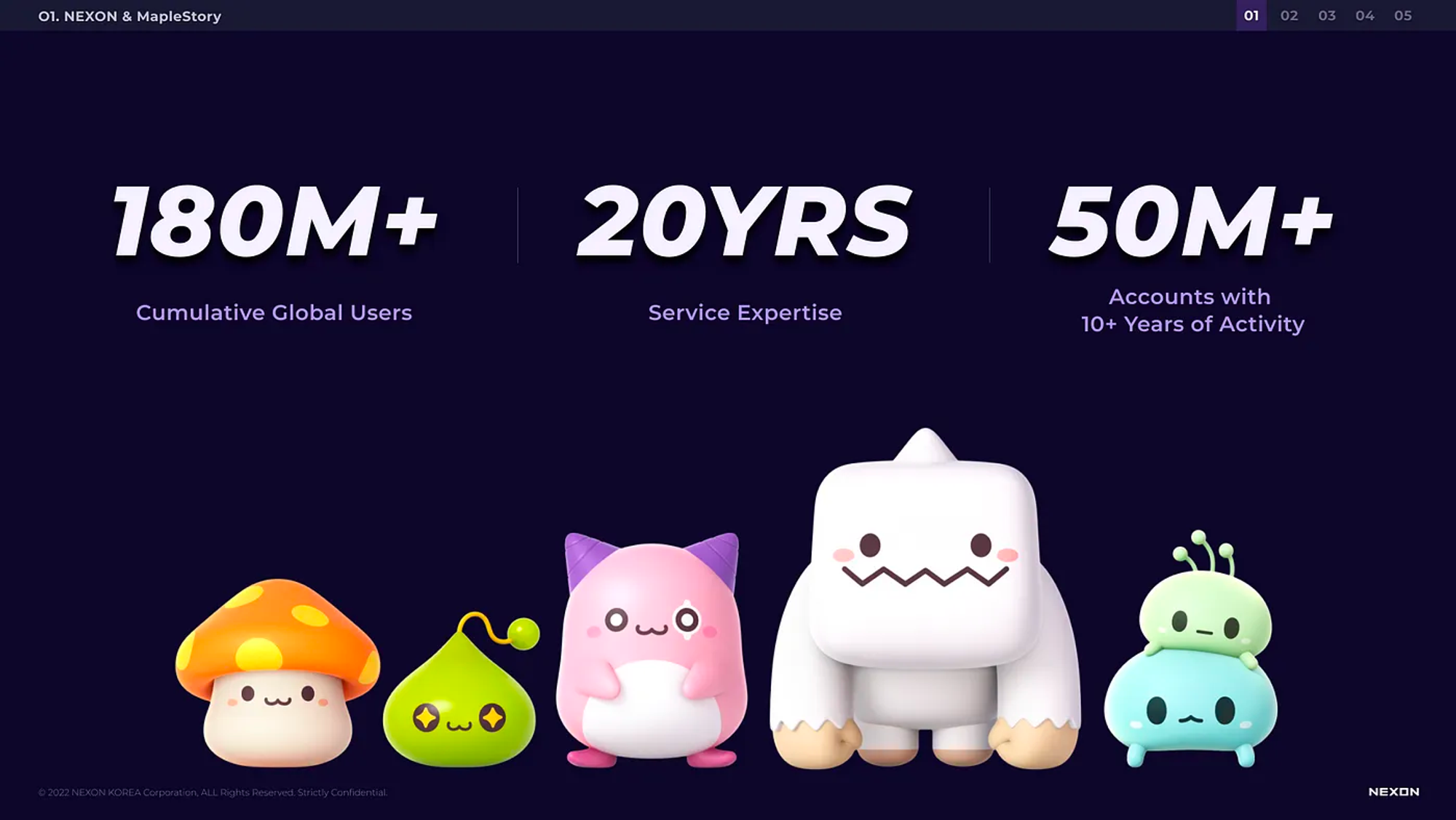

Maplestory is Nexon’s flagship IP, which was first released in 2003 as a 2D MMORPG and has been available on multiple platforms for nearly 20 years. Maplestory gained popularity by being an MMORPG with adorable graphics and casual gameplay. Now, Nexon is gearing up to revolutionize this beloved game by integrating blockchain and NFT technologies, creating what can only be described as the next level of MMORPG experience: the MapleStory Universe.

Nexon recognizes the importance of adapting to the evolving nature of games. Just as games evolved to cater to new audiences in the mobile era, Nexon is now adapting MapleStory for the blockchain era. The integration of blockchain features in MapleStory is part of Nexon’s broader vision to create innovative gaming experiences within an established design. The aim is to ensure that MapleStory not only provides utility and scalability but also thrives in the openness and scalability inherent to blockchain games. By making the game development and decision-making processes fully visible, Nexon increases player trust and immersion in the virtual world. This technology also allows for the free movement of in-game assets, enhancing the utility and scalability of the MapleStory Universe.

Nexon's vision for the MapleStory Universe goes beyond a simple game; it's an expansive blockchain ecosystem. Looking ahead, Nexon's decision to integrate MapleStory with blockchain is a strategic move to redefine gaming experiences. The company envisions a future where MapleStory NFTs are utilized in various blockchain projects worldwide, marking a significant shift from a beloved MMORPG to a revolutionary blockchain-based virtual world. This transformation reflects Nexon's commitment to innovation and its dedication to evolving alongside its players.

Souce: A Borderless World: MapleStory Universe

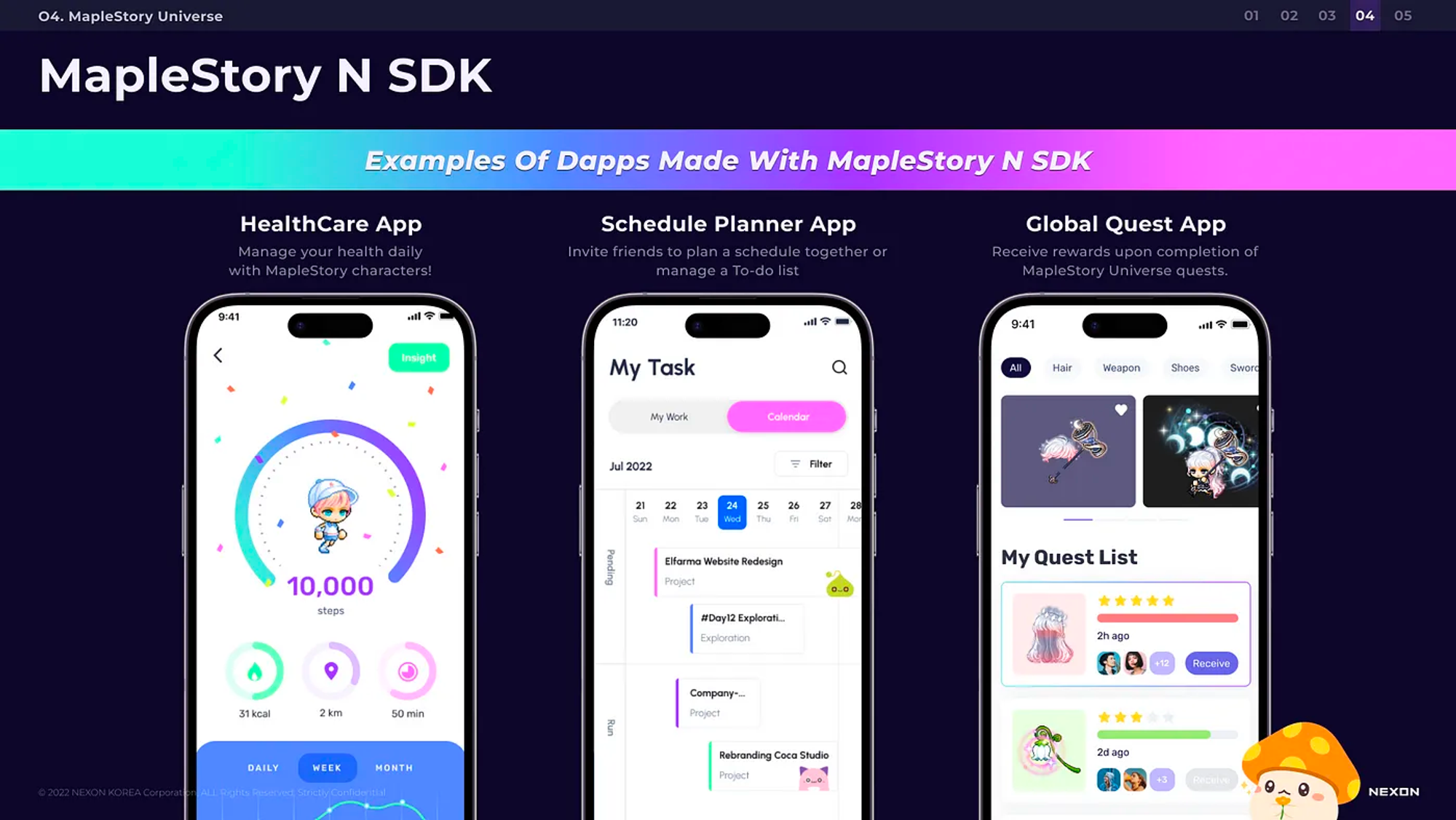

With the MapleStory N SDK, users can not only develop games but also any application they can imagine. It allows users to develop not only games but any application they can imagine within the MapleStory framework. Creators can develop products using resources and NFTs from the MapleStory IP. This initiative empowers users to be more than just players; they become architects of their own experiences within the MapleStory Universe.

Source: Introducing RX 2.0: the fun in Next Gen Games

Central to the MapleStory experience has always been the joy of item acquisition, termed as the Reward Experience (RX). Nexon is enhancing RX through blockchain technology, allowing items to be exchanged across various Dapps within the MapleStory blockchain ecosystem. This approach opens up an avenue for collaboration with various creators to generate abundant creative content.

Instead of solely relying on the development team to fulfill the demand for new content, a derivative ecosystem of creators could bring the fun of RX to the players. With the envision to RX 2.0, where the development team is a part of the ecosystem, collaborating with various creators to produce massive creative content.

Source: Mushvillage

The MapleStory Universe introduces a novel approach to managing in-game economies by implementing NFTs to control the production of currency, thereby tackling the prevalent challenge of asset inflation in traditional gaming systems. In this innovative setup, the quantity of items in the MapleStory Universe is capped across the entire server, independent of the number of players. These items are produced at predetermined intervals, ensuring a controlled release into the game environment.

This strategic limitation of item quantities heralds a significant shift in the player experience compared to conventional games. The usual focus on individual item farming gives way to a more competitive scenario where players vie for coveted items. This competition is expected to spur players to develop innovative strategies, enriching the gaming experience with an added strategic dimension. Moreover, this method of regulating total item quantities and preserving their rarity within a consistent range effectively addresses the longstanding issue of inflation, which has often plagued traditional gaming systems. By striking a balance between scarcity and accessibility, the MapleStory Universe aims to create a more engaging and sustainable in-game economy.

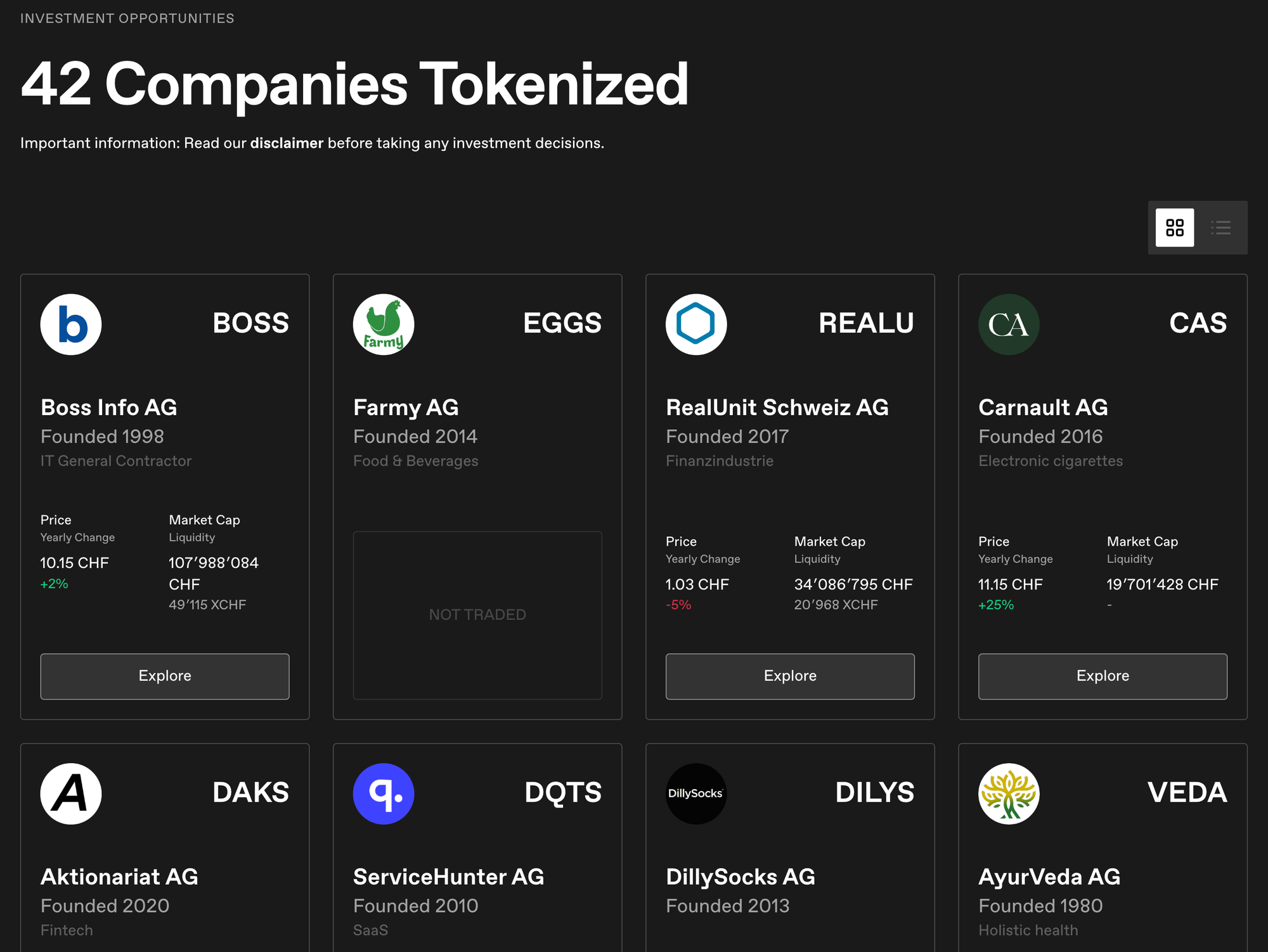

Source: Aktionariat

Aktionariat is a Swiss startup that provides blockchain-based solutions for securities tokenization and digital shareholder management. Their platform allows companies to tokenize their shares and set up a regulated private securities market on their own website.

Aktionariat's goal is to modernize capital raising and shareholder relations through blockchain technology. Their solutions handle all regulatory and technical aspects of tokenizing shares and operating a private securities market in Swiss. Over 40 companies have utilized their platform to raise funds directly from over 22,000 registered investors to date.

3.1.1 What Narrative is Aktionariat bringing?

Aktionariat's narrative focuses on using tokenization to improve the accessibility and liquidity of company shares for investors of all types in all regions. By making shares available to a broader investor base, companies can unlock increased liquidity and offer investors greater exposure to their assets. This accessibility not only benefits potential investors but also augments the marketability of the company's shares, potentially leading to enhanced market interest and activity.

In the current traditional finance landscape (TradFi), the process of accessing and trading company shares is often encumbered by complexity and limited to specific exchanges, posing challenges to both companies and investors.

However, through tokenization, Aktionariat seeks to address these limitations by enabling a more streamlined and accessible avenue for trading shares. This approach has the potential to democratize investment opportunities, foster a more dynamic market environment, and unlock previously untapped value for companies and investors alike.

Source: Aktionariat

The proposed solution involves the installation of a fully customizable platform on the company's website. This platform is designed to facilitate trading of shares, particularly the treasury shares of your company, against various currencies such as XCHF, Ether, or even CHF. The system operates based on a smart contract built on the Ethereum blockchain, and the shares are issued and managed as ERC-20 Security Tokens.

By leveraging blockchain technology and smart contracts, the platform ensures security, transparency, and efficiency in the trading process. Furthermore, the flexibility to trade shares against multiple currencies expands the potential market and offers diversification opportunities.

However, the risks associated with middlemen and regulatory issues in other countries should be addressed.

3.1.2 Dive into Aktionariat

The platform consists of two digital tools: a portfolio app for users and a corporate dashboard for issuers. It is designed to cater to asset management and corporate functionalities within a financial or investment contex

Source: Aktionariat Deck

The Portfolio App is designed for personal asset management. It enables users to trade tokenized shares by connecting with a Brokerbot, manage Ethereum-based assets in a self-custody wallet alongside traditional shares, request the tokenization of traditional shares, and transfer Ethereum-based assets.

The Corporate Dashboard targets businesses by offering scalable shareholder relations. It encompasses a digital share registry for tokenizing new or existing shares, management of digital corporate events and votings, distribution of dividend payments, and configuration of market settings.

With this platform, the following benefits are enabled:

Continuous fundraising - Companies can sell tokenized shares to new investors at any time online.

Secondary market trading - Existing shareholders can trade shares via an integrated broker bot powered by smart contracts.

Employee incentivization - Employees can be rewarded with real equity stakes in the form of security tokens with less procedure.

Strategic independence - Companies gain liquidity without the pressure of exits by staying privately owned.

Particle Trade is a derivative application that allows building leverage positions on tokens listed on a DEX (currently on Uniswap V3). What makes Particle interesting is that, until now, to build leverage positions, a separate lending protocol had to exist, and it had to support assets (allow them to be borrowed) for leverage positions to be built. However, Particle enables the construction of leverage positions on tokens without a separate lending protocol, through its own trading mechanism called LAMM (Leverage AMM).

3.2.1 What Narrative is Particle Trade bringing?

Many people would point to finance as the most widely used field for blockchain and crypto assets, especially investment in finance. The reason why blockchain and crypto assets have become more widely known is because Uniswap invented and applied the AMM (Automated Market Maker) protocol to decentralized exchanges, and as this technology became more widely used, more investors and traders were able to actively invest using blockchain directly. This means that 1) financial applications using blockchain have already proven their Product-Market Fit (PMF), and 2) when efficient and widely adoptable standards like AMM are introduced, the demand for direct blockchain usage can increase. From this perspective, the new AMM framework proposed by Particle is worth paying attention to. Leverage is the essence of finance. Although leverage can be a very risky tool, it is considered extremely important as an innovation that enhances capital efficiency.

Particle is attempting to bring such leverage to decentralized exchanges, and further, onto the blockchain. For those interested in decentralized finance, this is a project worth watching. Additionally, whether it's Particle or not, observing how the new LAMM framework is utilized in the market is also an important point of interest.

3.2.2 Dive into Particle Trade

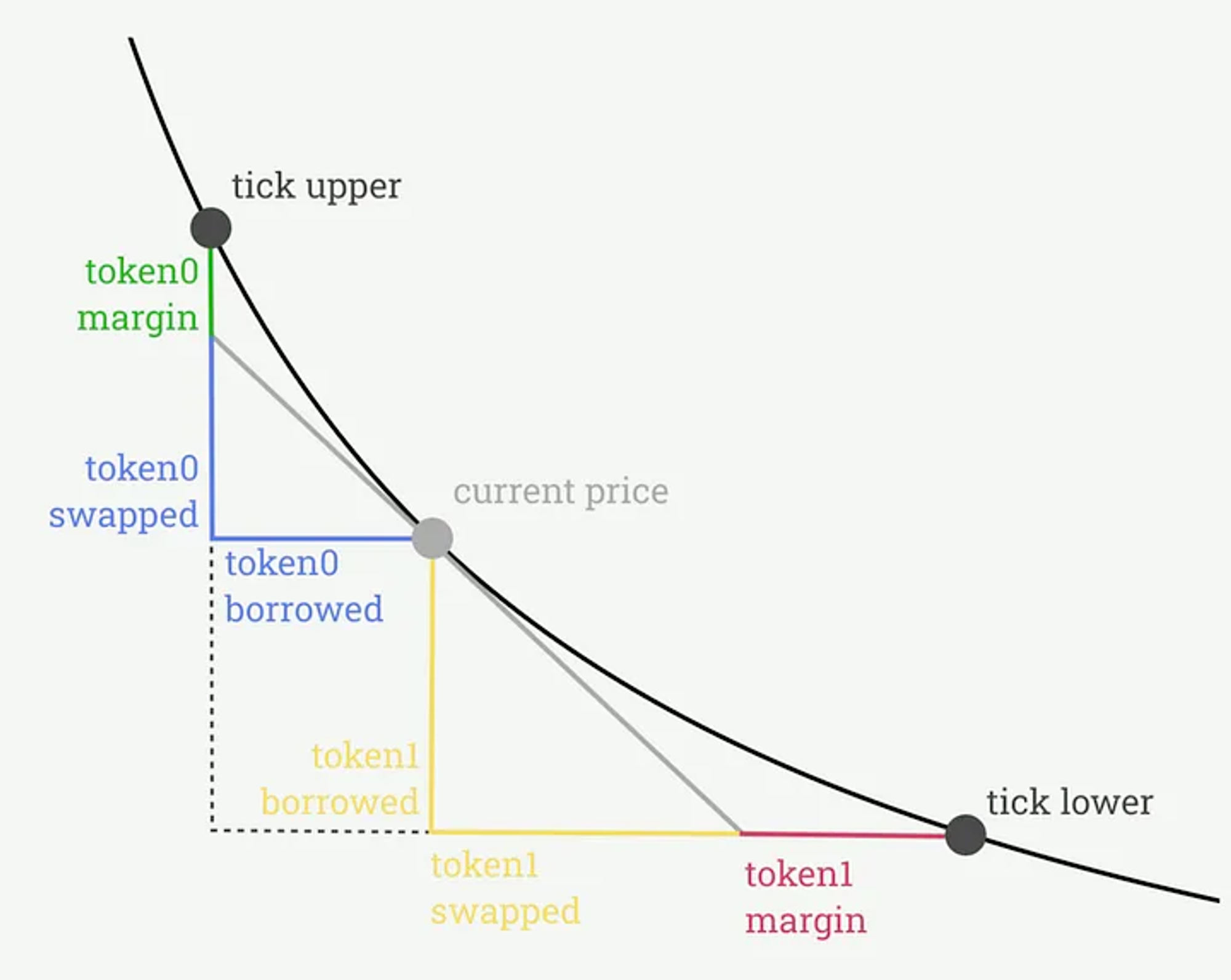

Particle is attractive because it enables the construction of leverage positions without the need for a separate lending protocol. This is technically possible due to their unique trading mechanism, LAMM (Leverage AMM). Simply put, LAMM allows building leverage positions using LP tokens (Liquidity Provider tokens, which were already present in traditional AMM). It sets price boundaries for the LP tokens, concentrates liquidity within that range, and ensures that tokens can always be converted within these boundaries. However, if the price of the LP token falls below the predefined lower boundary, Particle automatically converts all assets into one of the two tokens (since LP tokens are always pairs of two different tokens) based on a preset formula and liquidates them. This process effectively allows borrowing LP tokens to build leverage positions.

Let's take a practical example for better understanding.

Suppose there's an ETH/USDC pair, and its liquidity is concentrated within the $1,800 to $2,000 range. Assume the current price of Ethereum is 2,000 USDC. A user borrows liquidity in this range to build a long position on Ethereum (say, borrowing 1.04 ETH and 2294.95 USDC). What happens if Ethereum's price drops to the bottom of the range ($1,800)? As mentioned, Particle converts the borrowed liquidity into one token (let's assume Ethereum in this case), using a predetermined formula. In this example, the borrowed liquidity is converted into 2.25 ETH. So, how much does the user need to build this position?

2.25 - 1.04 (Ethereum from the borrowed liquidity) - 1.15 (value of 2294.95 USDC converted to Ethereum) = 0.06 ETH. Thus, the user has leveraged 2.19 ETH worth of liquidity with just 0.06 ETH.

In simple terms, this is approximately 36.5 times leverage. Through this mechanism, leverage can be provided for tokens listed on Uniswap V3, enabling leverage trades without the support of separate lending protocols or derivative exchanges. Of course, the assumption that the price remains constant when converting borrowed liquidity into a single token is a bit naive, but this is a suitable example to introduce how LAMM works.

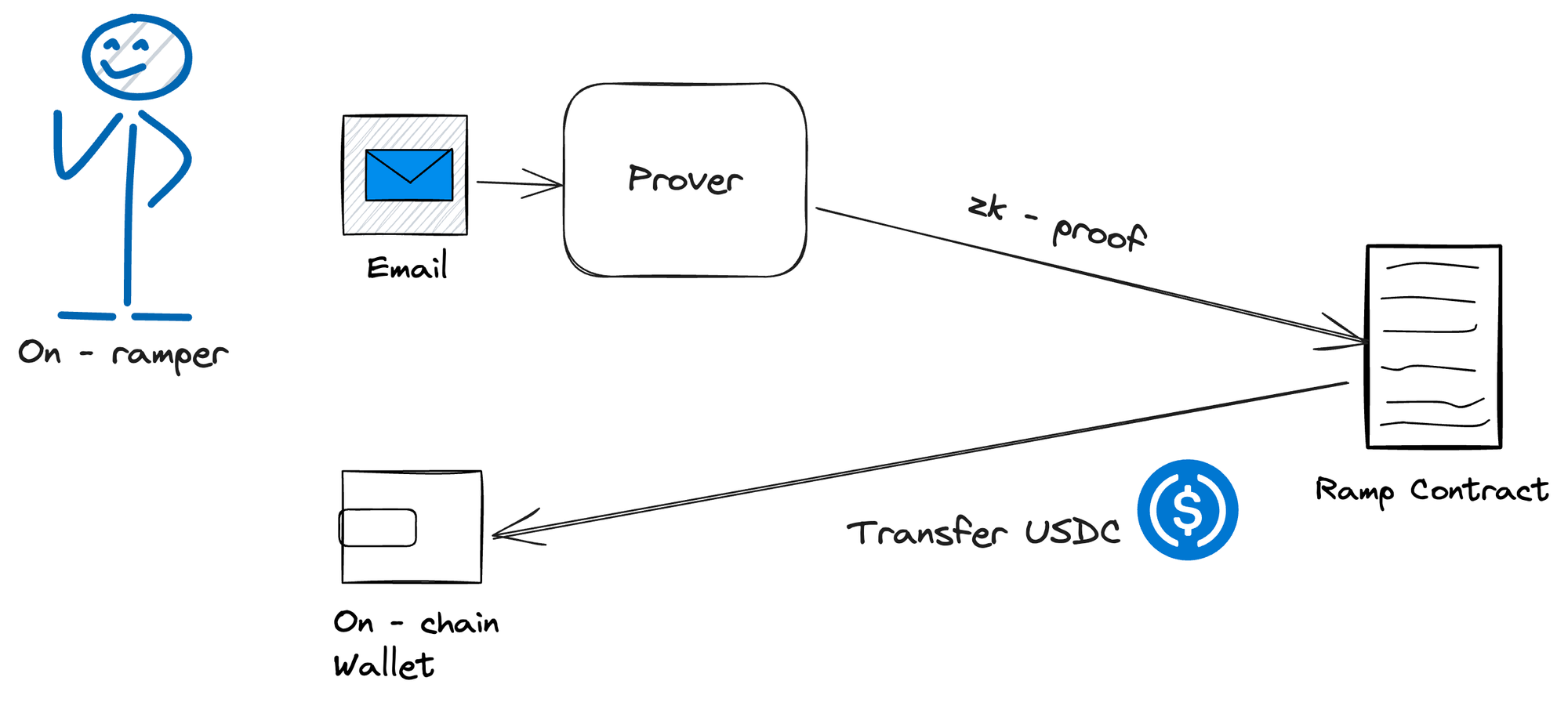

Source: zkP2P

3.3.1 What Narrative is zkP2P bringing?

Core value of blockchain technology lies on decentralization and permissionless. However, there are plenty of centralized components involved in operating the ecosystem. Without passing through all the centralized exchange or banking infrastructure for on/off-ramp, you cannot even safely land or escape from onchain. Otherwise, you need some kind of off-chain component, a brokerage, oracle or exchange, to facilitate the transaction (of course, with a fee). This is a daunting process.

zkP2P is a project aiming to revolutionize mainstream access to cryptocurrencies by letting people convert funds from popular payment apps into crypto simply and privately. They recently launched an alpha version focused specifically on enabling Venmo users to convert money into USDC stablecoin held in an Ethereum wallet. Although the process is simple yet powerful. You can convert USD to USDC in 90 seconds at the minimal transition fee.

Source: zkP2P Docs

The key innovation here is zkP2P's use of zero-knowledge proof (ZKP) technology to facilitate these Venmo to crypto conversions without requiring invasive KYC identity checks or relying on custodial accounts with multi-day holding periods before withdrawals. This greatly improves the user experience.

Besides the simplicity and seamlessness, zkP2P is likely to offer the best price for the fiat-to-crypto conversion. Currently, user only need to send 100.07 USD using Venmo to receive USDC onchain. By eliminating intermediaries and leveraging ZK proofs of payment, zkP2P aims to significantly reduce the fees for the middleman

zkP2P plans to incrementally add support for other popular payment apps beyond Venmo. The protocol is designed to be interoperable with popular web2 payment rails, thus bridging the traditional and decentralized financial systems. If successful, this model could finally enable truly mainstream crypto adoption by resolving the friction points around privacy and custody that have hindered onboarding in the past. The potential impact over the entire industry is highly anticipating.

3.3.2 Dive into zkP2P

Source: zkP2P Docs

The underlying technology leverages ZK proofs to ensure the privacy and trustlessness of transactions without a centralized intermediary or custodian. Payment solutions such as Venmo send emails when a transaction takes place. These emails contain a DKIM signature, a RSA signature from private key used for email verification, thus proving that the transfer has taken place. ZKP2P uses ZK proofs, specifically zkSNARK, to verify DKIM signatures in payment confirmation emails while preserving sensitive information private.

The process is quite simple (while implementation is not). zkP2P implements a one-time registration that associates a Venmo ID with an Ethereum wallet address while keeping the actual ID encrypted. When a user initiates a Venmo transfer to zkP2P to purchase USDC, the payment details including the user's hashed Venmo ID, transfer amount, and timestamp get fed into a ZK circuit. The proof gets published onto the Ethereum blockchain and it essentially unlocks access to the corresponding USDC amount, automatically depositing those funds into the user's connected Ethereum wallet.

zkp2p is built upon the zkemail package, which is a general library for validating emails via DKIM signatures. They provide ZK Email SDKs to verify email authenticity without implementing from scratch. With the broad adoption of mail in verification, payment and delivery, possible space for exploration is widely opened. Hopefully, in the future, more and more payment service providers be supported, making the crypto ecosystem even more seamless while keep permissionless.

Dive into 'Narratives' that will be important in the next year